Use Fill to complete blank online IRS pdf forms for free. The main goal of our team is to provide recommendations on the choice of safe reliable and trusted online casinos welcome Casino W9 Form bonuses and gambling for players Casino W9 Form from the United States.

Irs Form W 9 Get W 9 Tax Form For 2021 Printable Pdf Fill Out Instructions Fillable W9 Online

When the first reportable win occurs you may be asked to complete IRS Form W-9.

W9 form gambling. Online gambling is illegal in some states jurisdictions. I think as states legalize they will start to see federal tax on gambling as directly affecting their income streams. Any document notice or letter either issued by the IRS or stamped by the IRS that states the.

Form W-2G Certain Gambling Winnings 2019. If you are not filing a joint return then you need to have the W9 corrected first so the income is not reported as your wifes gambling winnings. The W9 by itself is harmless but casinos need w9 to do their jobs.

Playing casino games involves risk and should be considered a fun recreational activity not a way to earn an income. Whether the earning are derived from contracted work gambling or investments they are all forms of income and are required to be reported to the IRS. Table Games Slot Machine Free Spins.

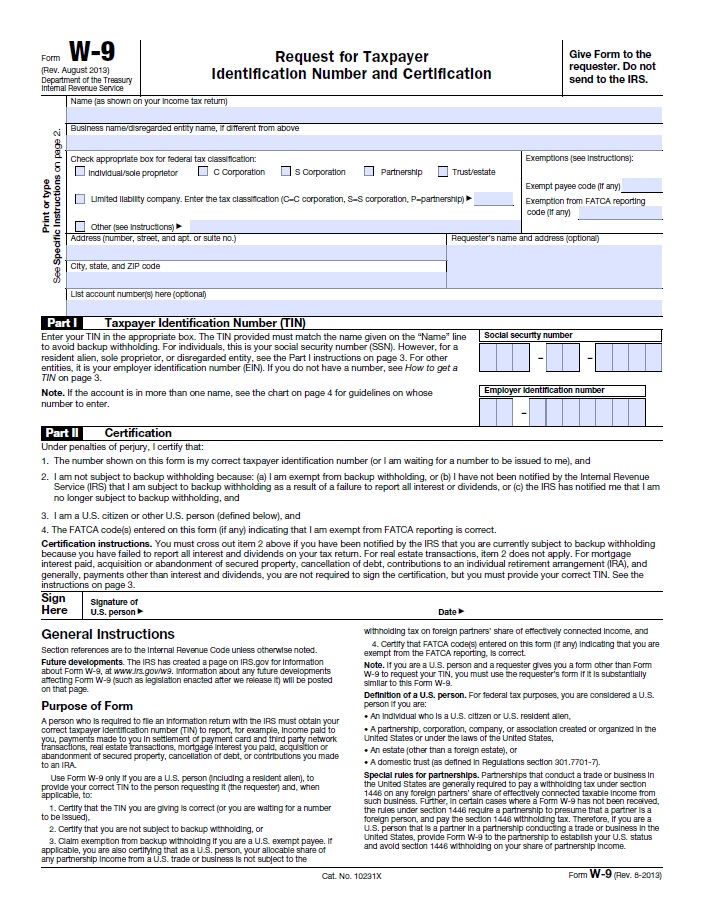

A W-9 form is an Internal Revenue Service IRS tax form that is used to confirm a persons name address and taxpayer identification number TIN for employment or other income-generating purposes. The corrected W9 is still required though for reportingpurposes. We do not provide the opportunity to play for money on our.

More states come online more pressure should build up. Instead for identity verification of organizations Google will accept the following forms. How Does W 9 Form Work IRS Form W-9 Request For Taxpayer Identification Number And Certification is a one-page IRS tax form that businesses or individuals use to deliver the correct taxpayer ID number to customers individuals banks or financial institutions.

Selling real estate receiving profit from bonds and so forth. Unlike a W8 form it plays no role in applying for tax exemption or rate reduction status. I went to the casino and played blackjack and baccarat and throughout my winning session I cashed out around 2500 3000.

All forms are printable and downloadable. Certain Gambling Winnings 0121 12162020 Form W-2G. On average this form takes 37 minutes to complete.

Generally the ratio of the winnings to the wager. Join today for free. USA Casino Expert is an independent community of gambling industry professionals founded in 2017.

If a wager is subject to IRS reporting requirements DraftKings will issue IRS Form W-2G Certain Gambling Winnings which is used to report gambling winnings and any federal income tax withheld on those winnings. Please call 1-800-Gambler if you have problems gambling. Payments of gambling winnings to a nonresident alien individual.

Once completed you can sign your fillable form or send for signing. I ask to see my transactions so I can verify I went over the 10k threshold. W 9 Form Casino - 100 Safe Secure.

In January 2022 Google will update its Advertiser Identity Verification policy to clarify that for US verification Google no longer will accept W9 forms for identity verification. Gamble USA takes no responsibility for your actions. The end result of submitting a W-9 is receiving a form 1099.

So if youre wondering whether you should complete and file a W8 or W9 form it simply comes down to your residency status. Form W-9 Request for Taxpayer Identification Number and Certification to request the TIN of the recipient. Casino W9 Form Super Hot Fruits Slots Toy Slot Machines Online Gambling South America Voluntary Self-Exclusion If youre experiencing difficulties associated with gambling Voluntary Self-exclusion VSE might be a great way to help regain control.

Gambling and lottery dont qualify though. The type of gambling the amount of the gambling winnings and. All the information provided to a business on a W-9 helps that business in completing the 1099 earnings reporting form.

Casino withholding winnings because I wont sign w9 form. All content is intended for audiences ages 21 years and older. Instructions for Forms W-2G and 5754 Certain Gambling Winnings and Statement by Persons Receiving Gambling Winnings 0121 02182021 Form W-2G.

W9 forms are a common form generally sent out to independent contractors freelancers versus employees and many other situations where you have earned income. File this form to report gambling winnings and any federal income tax withheld on those winnings. First youll need to get tax form W9 downloadable if only your annual revenue from freelance work is at least 600.

2 In your case Form w9 info is needed by a casino to rat you out to IRS thru the filing of SARC Form 102. The requirements for reporting and withholding depend on. Popular with US Players.

If you are filing a joint returnwith your wife then you need to add that incomeon the returnas Gambling. Besides sometimes free W-9 tax form is requested to record other income-generating sources. 1 There is no benchmark nor dollar amount for the use of W9.

Never risk money that you cannot afford to lose. Casino W9 Form Corona Casino Resort Phu Quoc Poker Para Nokia C1 3rd Trimester Casino. Individualsole proprietor C Corp S Corp etc address.

How much are gambling winnings taxed. It is your responsibility to check your local regulations before playing online. It is your own Casino W9 Form responsibility to determine if gambling online from your current location is Casino W9 Form legal.

A W9 form is provided to employees from an employer to verify the identity of the employee for tax purposes. They will then be able to send you Form. When you fill out the DraftKings or FanDuel W9 form you will be required to submit your full name or business name tax classification ie.

See the following instructions for each type of gambling for detailed rules on backup withholding. Fill Online Printable Fillable Blank Form W-2G Certain Gambling Winnings 2019 Form. If you are self-employed you can send the form to someone.

Certain Gambling Winnings 2020 12192020 Form W-2C. Ie cashing out 11000 in chips in several times in order to evade the CTR. On the last cash out they told me I needed to file.

How Is It That I Go To The Casino With 15k Gamble For Hours Cash Out With 12k And The Cashier Makes Me Fill Out A W 2 Even Though I Lost Money

W 9 Tax Form Empire City Casino

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Irs Form W 2g Certain Gambling Winning Blank Lies With Pen And Many Hundred Dollar Bills On Calendar Page Stock Image Image Of Bills Paper 161094055

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Filing Out Of State W 2g Form H R Block

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Us Taxes On Gambling Winnings Special Rules For Canadians

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

How To Fill Out A Form W 9 For A Single Member Llc

Irs Form W 2g Certain Gambling Winning Blank Lies With Pen And Many Hundred Dollar Bills On Calendar Page Editorial Photo Image Of Jackpot Filling 171622156

W 9 William Hill Us The Home Of Betting

Irs Form W2g Irs Form For Gambling Winnings

Post a Comment

Post a Comment