The 1099 tax rate consists of two parts. Generally if a debt you owe is canceled or forgiven other than as a gift or.

1099 Form 2020 Get 1099 Misc Printable Form Instructions Requirements What Is 1099 Tax Form

Enter Box 1 1099-A in Box 1 1099-C Generally enter Box 2 1099-A in Box 2 1099-C.

1099 c form calculator. Enter any accrued interest that was canceled in Box 3 1099-C. Hence you can still receive a 1099-C form for debts you have gotten ages ago. Put an electronic signature on your 1099 c form printable while using the help of Sign Tool.

Form 1099-C - Cancellation of Debt. Enter total income marked on Form 1099 to calculate what taxes you owe Calculate. Lenders must issue Form 1099-C when they forgive debts of more than 600.

This form must be filed in certain circumstances where more than 600 in debt is cancelled or goes unpaid for a certain period of time. PDF editor makes it possible for you to make improvements in your 1099 c form Fill Online from any internet linked gadget. If your lender agreed to accept less than you owe for a debt you might get a Form 1099-C in the mail.

Receiving A 1099-C Form For An Old Debt. First calculate your adjusted gross income from self-employment for the year. Many 1099-C forms contain errors and experts say its one of the more confusing tax forms.

If a Federal Government agency financial institution or credit union cancels or forgives a debt you owe of 600 or more you will receive a Form 1099-C Cancellation of Debt. File 1099-C for canceled debt of 600 or more if you are an applicable financial entity and an identifiable event has occurred. Thats where a 1099-C form comes in.

A 1099-C is a tax form that the IRS requires lenders use to report cancellation of indebtedness income. IRS tax follows canceled debt But there are some rules including an important one on timing. Its money you received that you are no longer expected to repay and since its not a gift it counts as income.

Note that 1099-C forms dont fall under the statute of limitations. Your lender can tell you this amount. The IRS takes the position that canceled debt is taxable income to you and must be reported on your tax return.

Fill out sign and edit your papers in a few clicks Form C 2022. The biggest reason why filing a 1099-MISC can catch people off guard is because of the 153 self-employment tax. IRS authorized e-File service provider for form 1099-C.

Alternatively your lender might automatically discharge the debt and send you a Form 1099-C if its decided to stop trying to collect the debt from you. While lenders are only required to send 1099-Cs if a canceled debt is worth 600 or. Make use of a electronic solution to generate edit and sign documents in PDF or Word format on the web.

Save Time and Frustration with the Insolvency Calculator for 1099-C Income from Canceled Debts. The reason you get Form 1099-C is because the IRS treats canceled debt as taxable income. Do the job from any device and share docs by email or fax.

Data put and request legally-binding digital signatures. 124 Social Security Tax. Gives you total taxable income if any and total reduction of tax attributes.

Download them to your computer tablet or mobile Windows iOS Android Linux. Calculate your self-employment 1099 taxes for free with this online calculator from Bonsai. Losing your 1099-C Form.

Turn them into templates for numerous use include fillable fields to collect recipients. Information about Form 1099-C Cancellation of Debt Info Copy Only including recent updates related forms and instructions on how to file. 1099c Form Calculator Visit our site to get electronic PDF samples.

Distribute the prepared blank by using electronic mail or fax print it out or save on your device. Once blank is done click Done. So when a lender or creditor cancels 600 or.

Youll receive a Form 1099-C Cancellation of Debt from the lender that forgave the debt. Form 1099-C call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. Lenders that file a 1099 form with the IRS are required to send you a 1099-C form by Jan.

Save your time and efforts. Thats where a 1099-C form comes in. The self-employment tax applies evenly to everyone regardless of your income bracket.

The amount of the canceled debt is shown in Box 2. What is a Schedule C. According to the IRS nearly any debt you owe that is canceled forgiven or discharged becomes taxable income to you.

Common examples of when you might receive a Form 1099-C include repossession foreclosure return of property to a lender. Form 1099-C entitled Cancellation of Debt is one of a series of 1099 forms used by the Internal Revenue Service IRS to report various payments and transactions excluding employee wages. Use the income calculated on this form to calculate the amount of Social Security and Medicare taxes you should have paid during the year.

File 1099-C Online with Tax1099 for easy and secure e-File 1099-C form 2021. Filing quarterly taxes. IRS Form 1099-C reports a canceled debt to you and to the IRS when a lender forgives an outstanding loan you owe and no longer holds you responsible for paying it.

Schedule C is an IRS form that accompanies Form 1040 to determine business net income or loss. How to file 1099-C instructions due date. In most cases you have to report canceled debt as ordinary income on your federal tax return.

However if the amount of debt canceled is different from the amount reported in Box 2 of your 1099-A enter the amount of debt actually canceled. Updated for the 2020 - 2021 tax season to ensure accurate results. You can simply contact your creditor and request another copy of your 1099-C form.

Youll file a 1040 or 1040 SR to report your Social Security and Medicare taxes. Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free. The lender files this form with the IRS and a copy is supposed to be sent to the taxpayer as well.

Fill in tax Form 982 quickly and easily with help from this amazing calculator. A complete solution you can calculate insolvency full or partial. 124 for social security tax and 29 for Medicare.

All You Need To Know About The 1099 Form 2021 2022

/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Tax Forms

How A Form 1099 C Affects Taxes Innovative Tax Relief

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemble The Actu Irs Forms Fillable Forms Tax Forms

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

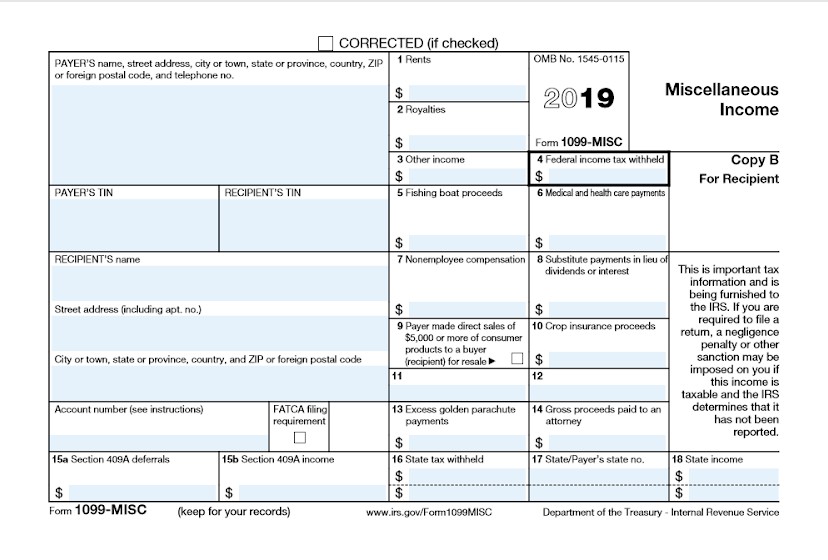

Form 1099 Misc Miscellaneous Income Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service Meeting Agenda Template Irs Forms 1099 Tax Form

Instant Form 1099 Generator Create 1099 Easily Form Pros

Schedule C Also Known As Form 1040 Profit And Loss Is A Year End Tax Form Used To Report Income Or Loss From A Sole Llc Taxes Tax Consulting Hobbies Quote

Post a Comment

Post a Comment