To file on paper use Form TC-941R Utah Annual Withholding Reconciliation. Form and the Utah withholding schedules or tables in this publication.

2009 Form Ut Ustc Tc 941 Fill Online Printable Fillable Blank Pdffiller

The completed W-4 form to Payroll.

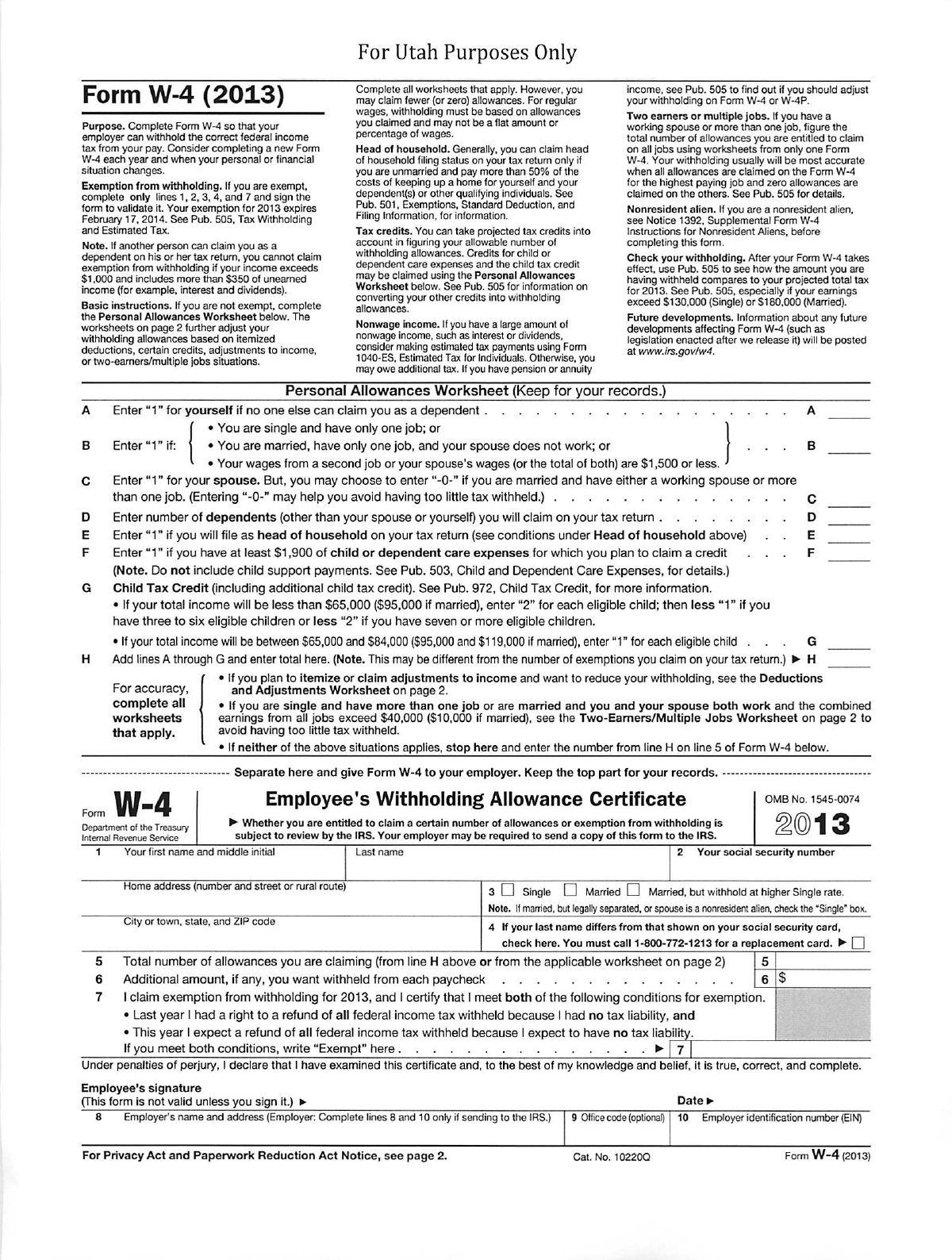

W4 form utah. Use our W-4 calculator see how to fill out a 2022 Form W-4 to change withholdings. The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. The primary similarity between the W2 tax form and the W4 tax form is that they are tax papers used by workers and employers.

While a W4 tax form tells the employer how much money should be set aside for local state and federal taxes the W2 form tells employees how much money they earned taxes to be paid and where other deductions went health insurance union dues Medicaid etc. Accurately completing your W-4 can help you prevent having a big balance due at tax time. C Mark the box found in substep C of step.

The following tips will help you complete For Utah Purposes Only Form W4 2011 Purpose quickly and easily. Your withholding is subject to review by the IRS. The second option is to complete a paper W4 and fax it directly to State Finance at 801-538-3244.

Then fill out steps 2 through 4 b only for the highest paying job you have. Save or instantly send your ready documents. If youre filling out a Form W-4 you probably just started a new job.

You may be exempt from withholding if you do business in Utah for 60 days or less during a calendar year. Open the document in our full-fledged online editing tool by clicking Get form. It can also help you avoid overpaying on your taxes so you can put more money in your pocket during the year.

Pay wages to Utah resident employees for work done outside Utah you may reduce the Utah tax by any tax withheld by the other state Make payments reported on forms 1099 or as required under Utah Code 59-10-405. Additionally the state-specific W4 form for Oregon Arkansas AR4EC California DE4 Delaware Vermont W-4VT and Iowa has been updated and is now available for use in the system. Employees have to fill the form out by themselves each year and let the employer know when the financial situation changes and a new W 4 blank form has to be filled.

Utah decided to retain existing pre-2020 Federal Forms W-4 for employees employed prior to January 1 2020 who do not wish to change their withholding deductions. To find it go to the AppStore and type signNow in the search field. Colorado New Mexico North Dakota and Utah decided to use the 2020 Federal Form W-4 in lieu of a state-specific Withholding Certificate for employees who commence.

Print out the official W-4 form from irsgav 3. Give Form W-4 to your employer. Form W-4 tells your employer how much tax to withhold from your paycheck.

Enter 2 if you are both 65 or over AND blind. While both the W4 and W2 are concerned with payroll their roles are completely different. Annual reconciliations filed by mail are due by.

Update this form and certify changes 2. Enter 1 for your Spouse 2 if 60 years old or older if no one else claims your spouse as a dependent Enter number of dependents other than your spouse that you will claim Enter 1 for you are 65 or over OR blind. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck.

If filing on paper you should attach copies of the federal W-2s sent to all of your employees working in Utah to the reconciliation form and submit by mail. After completing printed W-4 form please write at the top of the paper State Only along with your 4. Fill in the requested fields that are colored in yellow.

Consider completing a new Form W-4 each year and when your personal or financial situation changes. How to File Returns You must fi le returns electronically and pay all amounts with-held to the Tax Commission by the due dates. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

How to create an eSignature for the W2 Form Utah on iOS devices. This change may also be done electronically in the Employee Self Serve System. Or maybe you recently got married or had a baby.

See Utah Rules R865-9I-14 and 15. For instance if an employee has a child during the current. Employers must request the federal tax form W4 from their employees every year or at the time of hiring a new employee.

Annual reconciliations filed electronically are due by March 31. If you have further questions about either process please contact the Employee Resource Information Center ERIC by calling 801 957-9390. The information found in step 2 of the W4 form helps you know how to calculate the right amount of withholdings for your household if you have a multi-income household.

Easily fill out PDF blank edit and sign them. Report this number of allowances to your employer on Delaware Form W-4. Complete W4 Form Utah 2020-2022 online with US Legal Forms.

Request for Federal Income Tax Withholding from Sick Pay. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. For security reasons never e-mail a completed W-4 form - indicates a required field.

Both documents have to do with workers employers income and taxes. If you own an iOS device like an iPhone or iPad easily create electronic signatures for signing a w4 form utah in PDF format. The 2020 Federal W4 Form is now also available for use as the state withholding form for Colorado Nebraska South Carolina New Mexico North Dakota and Utah.

Complete Form W-4 so your employer can withhold the correct federal income tax from your pay. Withholding Certificate for Pension or Annuity Payments. You will need to submit a W4 form for each job you do.

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. The form was redesigned for 2020 which is why it looks different if youve filled one out before then. Click the green arrow with the inscription Next to move from field to field.

SignNow has paid close attention to iOS users and developed an application just for them. They also both have to do with the workers taxes like how much tax to withhold from an employees paycheck and filing your taxes for a tax return. Enter Personal Information a.

Pin On Vintage Audio Loudspeakers

Red Beryl On Matrix Thomas Range Juab Co Utah Usa Not For Sale Red Beryl Chocolate Cookie Mineral Specimen

Tax Services Payroll Accounting Financial Business Services

Website Design Trends Web Inspiration Web Design Inspiration

State W 4 Form Detailed Withholding Forms By State Chart

Utah W4 Form Fill Online Printable Fillable Blank Pdffiller

Free Utah Form W 4 2013 Pdf 543kb 1 Page S

Free Downloadable Tech Backgrounds For September 2019 Free Background Pictures Fall Background Background

Utah W4 Form Fill Online Printable Fillable Blank Pdffiller

Gefallt 172 Mal 4 Kommentare Ryan Winter Ryanwinter Auf Instagram Another Poste Graphic Design Photography Typographic Poster Graphic Design Typography

Post a Comment

Post a Comment