Claimants have until Jan. It shows gross unemployment income you earned and how much if any was withheld for taxes.

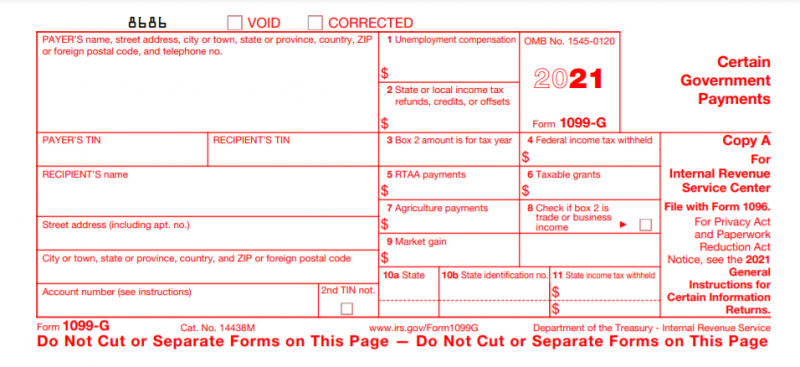

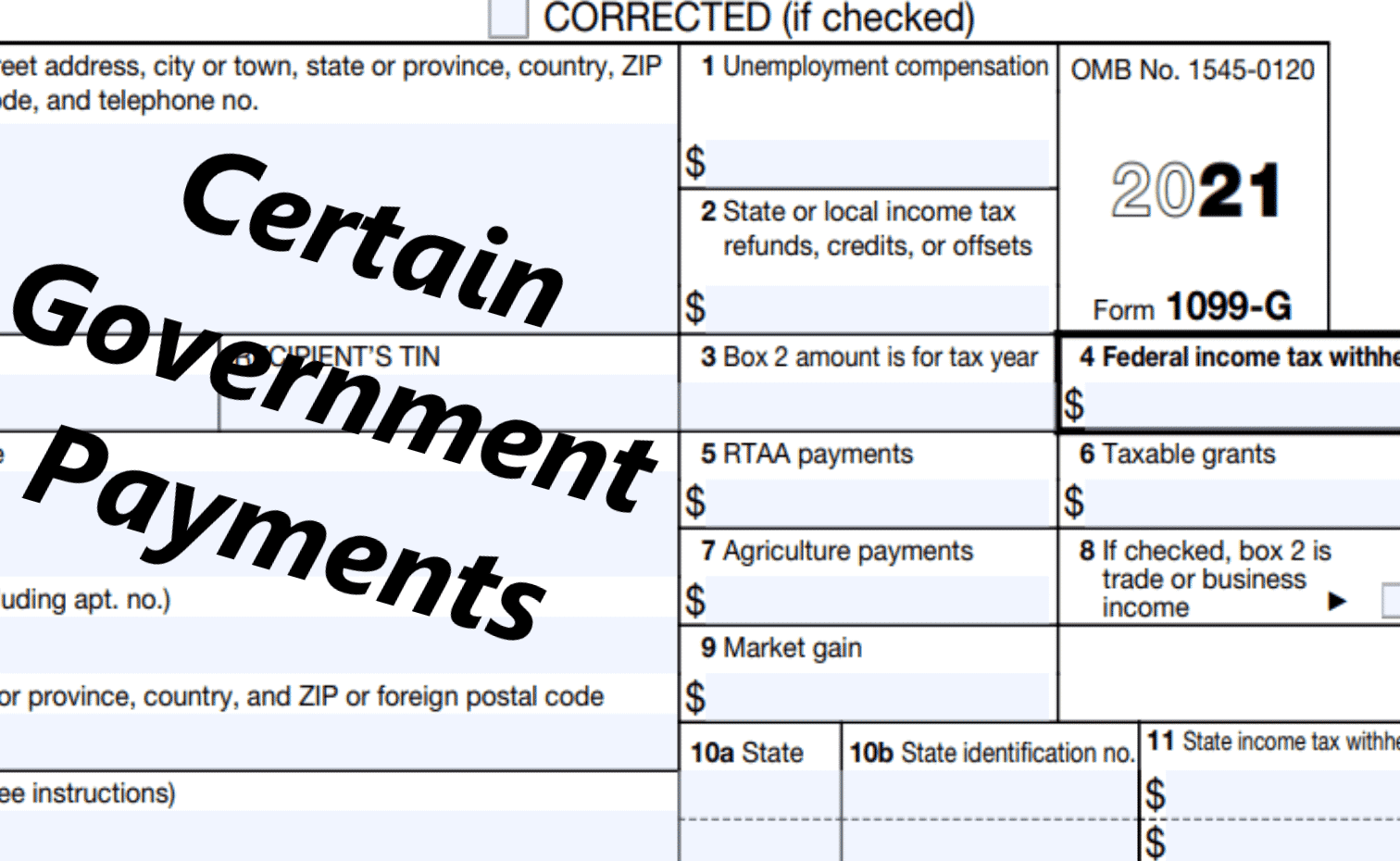

1099 G Unemployment Compensation 1099g

Q - What should I do if I am a victim of identity theft and received a 1099-G notice.

1099 form 2021 unemployment. A - If you have received a Form 1099-G and you have not filed for or collected unemployment benefits in 2021 you may be a victim of identity theft. If you received any unemployment benefits in 2021 you will need the 1099-G tax form to complete your federal and state tax returns. If you have more than one 1099-G form add all the amounts from Box 1 on each form and enter the total amount on Line 19 of your 1040 form.

FORM C-42 TENNESSEE DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Division of Workers Compensation 220 French Landing Dr. To access this form please follow these instructions. How To Enroll In Unemployment.

Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account. The 1099-G form is available as of January 2021.

T he Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. March 08 2021 0100 PM. Log in to Benefit Programs Online.

How To Enroll In Unemployment. Taxpayers who receive unemployment compensation are encouraged to watch their mailboxes during the tax season for the 1099G tax form that is required to file your federal tax returns. Unemployment benefits are taxable so any unemployment compensation received this year must be reported on tax returns.

To access a copy or request a paper copy online. Form 1099G tax information is available for up to five years. The 2021 General Instructions for Certain Information Returns and The 2021 Instructions for Form 1099-S.

ODJFS issued approximately 17 million 1099-G forms in 2021 and 200000 forms in 2020-30- The Ohio Department of Job and Family Services manages vital programs that strengthen Ohio families. Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes. First Quarter 2021 Form 1099G for Unemployment Compensation The California Employment Development Department EDD released information and resources to help individuals who received a Form 1099G for unemployment compensation as these payments must be reported on the individuals state and federal tax returns.

Q - I did not file for or collect unemployment benefits. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic. Get Tennessee 1099 Unemployment.

Denise Caldwell is a finance writer who has been writing on taxation and finance since 2006. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. Copy A appears in red similar to the official IRS form.

Your 1099-G form will be available in late January 2022. To order these instructions and additional forms go to. If you received unemployment benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income.

ILogin is required to view your 1099-G form online. To complete Form 1099-S use. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. The 1099-G tax form includes the amount of benefits paid to you for any the following programs. Copy A of this form is provided for informational purposes only.

This shows the amount you were paid and any federal income tax you chose to. To request a copy by phone call 1-866-333-4606 My 1099G form is incorrect. The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not.

1099-G forms are delivered by email or mail and are also available through a claimants DES online account. If you received jobless benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. 1099-G Info for Identity Theft Victims.

These instructions apply for claimants across all programs eg. Applicants have until January 2 2022 to request an electronic version of their 1099-G through. 2 2022 to request an electronic version of their 1099-G through the Michigan Web Account.

You must include this form with your tax filing for the 2021 calendar year. How To Get Your 1099 Form. Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes.

If you received unemployment compensation you should receive Form 1099-G from your state. This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment Compensation in 2021 as well as any adjustments or tax withholding. Regular UI and PUA.

For all unemployment claimants that received benefits in 2020 the 1099-G form is now available to download on the DLT website. Why did I receive a Form 1099-G from UIA. This will also be mailed to claimants.

If you received unemployment benefits in 2021 you should receive Form 1099-G by the end of January. These Are The States That Will Not Mail You Form 1099. Because paper forms are scanned during processing you cannot file Forms 1096 1097 1098.

31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. The form will show the amount of unemployment compensation you received during 2020 and any federal and state income tax withheld. The form includes the amount of benefits paid and other information to meet Federal State and personal.

Any unemployment benefits you collected box 2 Any unemployment benefits you repaid in calendar year 2021 box 3 If you received a 1099G form and you did not file for or collect unemployment benefits please report this to us immediatelyThis. Form 1099g for calendar year 2021 will be mailed on or before January 31 2022 to all individuals who received unemployment insurance regular EB PEUC FPUC LWA and pandemic unemployment assistance PUA benefits in calendar year 2021. Nashville Tennessee 37243-1002 AGREEMENT BETWEEN EMPLOYEREMPLOYEE CHOICE.

Select Form 1099G View next to the desired year Print or Request Paper Copy. How to Get Your 1099-G online.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

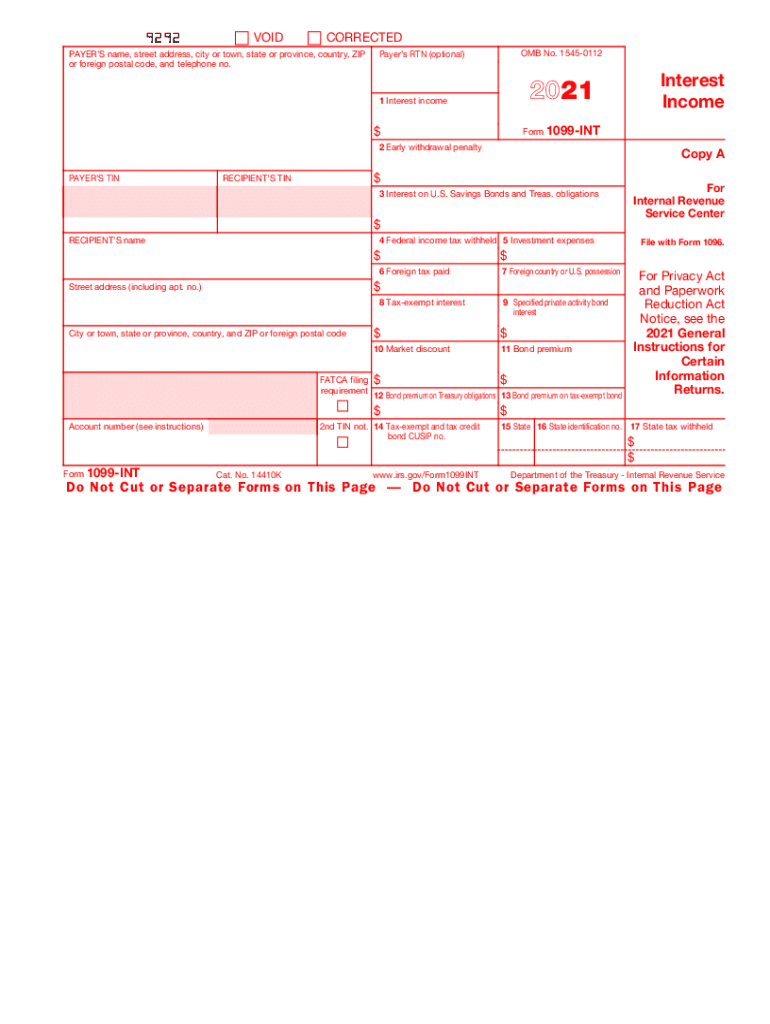

Form 1099 Misc Miscellaneous Income Definition

Tax Form Arriving Soon For Unemployment Program Claimants Lower Bucks Times

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 Form Fileunemployment Org

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Illinois Ides 1099 G Form For 2020 Unemployment What You Need To Know The Dancing Accountant

1099 G Tax Form Why It S Important

1099 G Form 2021 Irs Forms Zrivo

1099 G Tax Information Ri Department Of Labor Training

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Post a Comment

Post a Comment