The IRS has introduced a draft of a new W-4 form that plans to eliminate allowances and changes are planned to take effect in 2020. You can claim one allowance for yourself one for your spouse and one for each of your dependents.

Youre probably wondering why your employer or anyone would want to do this at all.

W4 form zero allowances. Claiming zero allowances or taking certain steps on the 2020 Form W-4 will decrease your take-home pay regardless of whether you file as married or single. Your withholding is subject to review by the IRS. Answer 1 of 4.

Youll most likely get a refund back at tax time. Generally the more allowances you claim the less tax will be withheld from each paycheck. This ensures the maximum amount of taxes are withheld from each paycheck.

If you put 0 then more will be withheld from your pay for taxes than if you put 1. You can not make changes to a previously filed W-4. Anyone can claim 0 allowances.

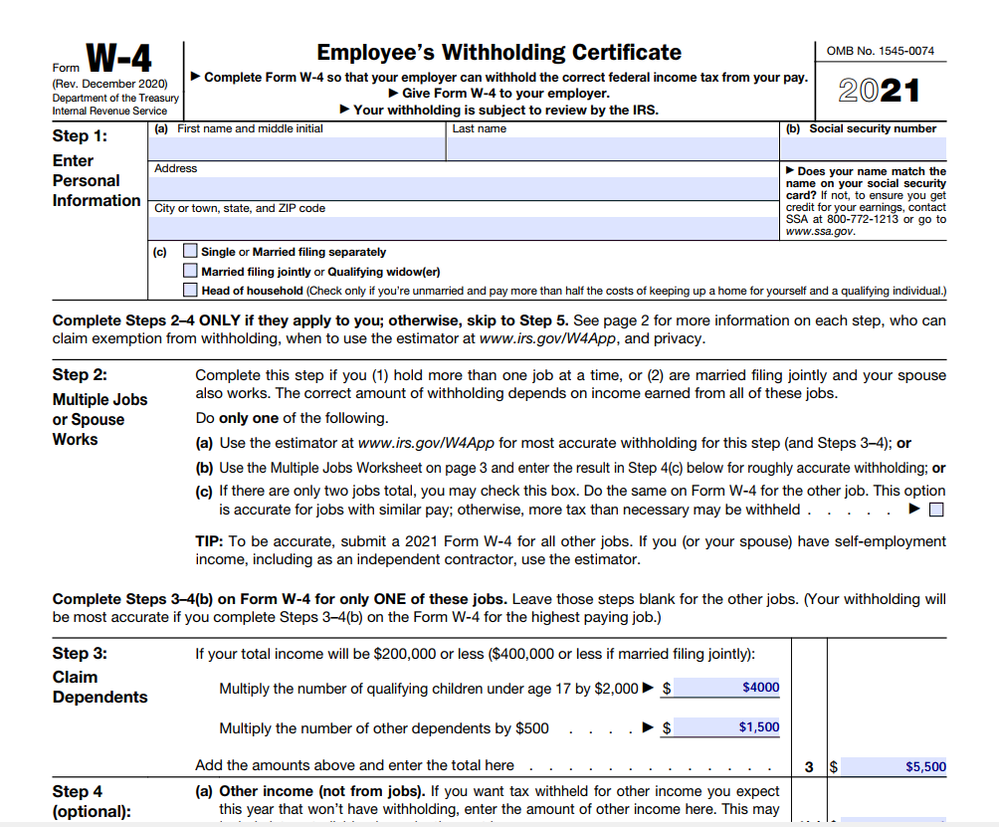

Take the few extra minutes to really assess your situation and fill in the W-4 accordingly. The W4 W-4 form also called the Employees Withholding Allowance Certificate is a form that your employer uses to make sure that they are withholding the correct amount of taxes from your paycheck. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for.

For example youre a college student and your parents claim you. You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. Claiming zero allowances means that the maximum amount of taxes will be withheld from your paycheck.

For example youre a college student and your parents claim you. Give Form W-4 to your employer. Form W-4 is adjustable if you happen to.

Generally the more allowances you claim the less tax will be withheld from each paycheck. When your personal or financial situation changes for example you get married take out a mortgage or get a second job you should recalculate your withholding allowance and submit a new form W-4 to your employer. But doing this gives the IRS interest-free use of your money until you get your refund.

You might be wondering what it means to claim a 0 or 1 on a W-4 but its important to note that in 2021 you dont use the W-4 form to claim withholding allowances. This ensures the maximum amount of taxes are withheld from each paycheck. Your family and claim zero allowances on Forms W-4 filed for all other jobs.

This means that come tax season youll most likely get more money back. That means if youve completed a new W-4 for any. Claiming a zero tells your employer that you do not anticipate any allowances on your income taxes and instructs the business to withhold the maximum amount each pay period.

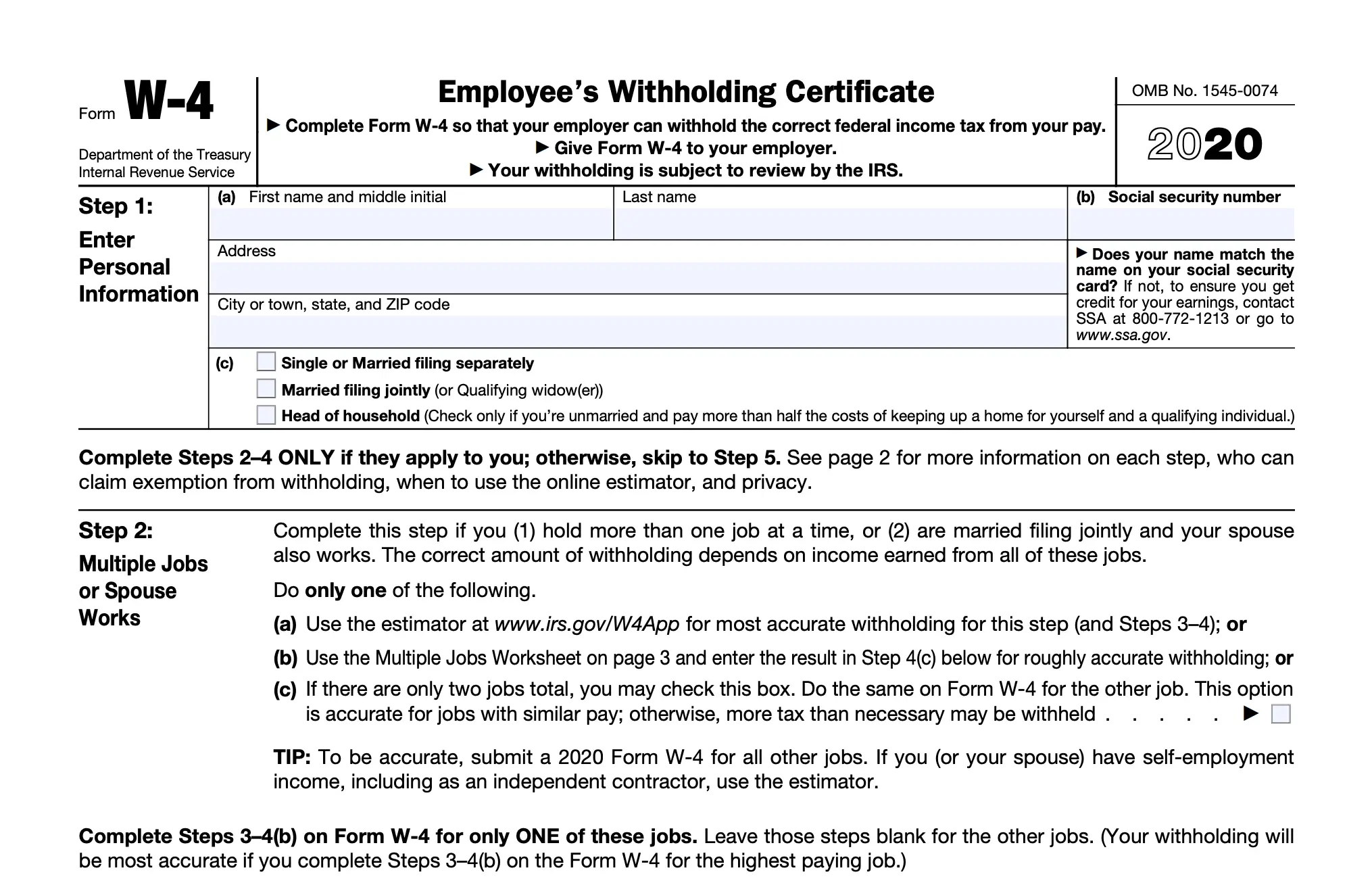

The new version of the form does not have withholding allowances. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for. More of what you earn will be sent to the IRS.

From 2020 and on allowances have been removed from Form W-4. Who Can Claim 0 Allowances. Claiming zero allowances means less take home pay but a bigger tax refund during tax season.

These were linked to a taxpayers personal exemption amount and are no longer used to make the form simpler and more accurate. Youll get it back in the form of a refund if it turns out that you dont owe that much when you complete your tax return. It may seem counterintuitive but claiming a zero on your W-4 form will actually increase the amount of your income withheld each pay period.

You can see it more clearly without the allowances. That withholds most taxes from your pay which could result in a refund. First a little background.

The more allowances you claim on your W-4 the more you get in your take-home pay. The number of W-4 allowances you claim can vary depending on multiple factors including your marital status how many jobs you have and what tax credits or deductions you can claim. The US taxing system is pay as you go.

The answer is YES. For 2021 you do not use the W-4 form to claim withholding allowances any longer. Many taxpayers opt to claim zero allowances in hopes of receiving a refund at the end of the year.

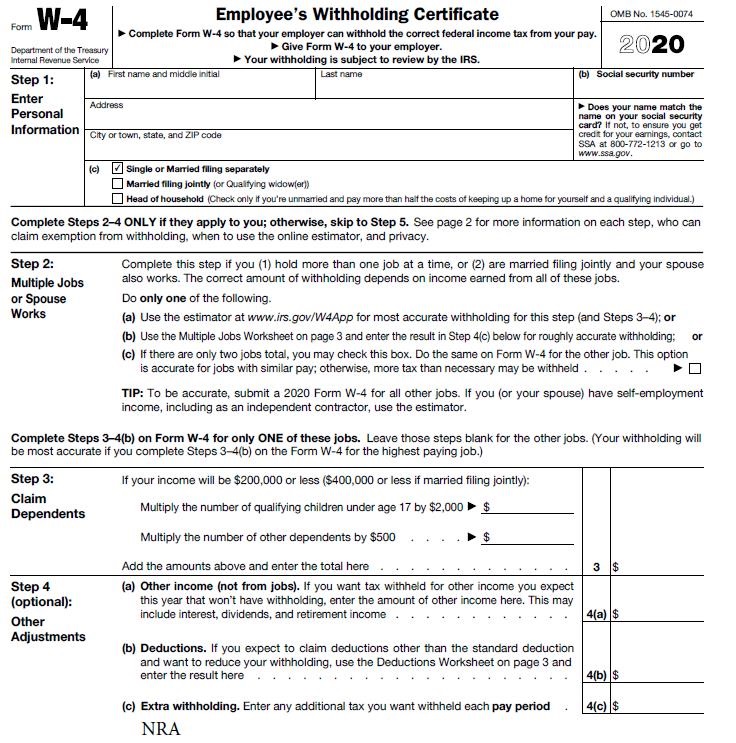

The fewer allowances claimed the larger withholding amount which may result in a. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Enter Personal Information a.

The W-4 form was updated to comply with the tax code changes contained in the Tax Cuts and Jobs Act. However if someone claims you as a dependent on hisher tax returns you are limited to zero allowances. However you can file a new W4.

Can you on your w4 claim 0. You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. According to a question Intuit Turbo Real Talk Community when the question was posed of Should I claim 1 or 0 on my W-4 The answer to this question is.

The number you report on a W-4 will ultimately determine your take home pay and your tax refund. As you earn your salary your employer will withhold meaning deposit money from your check for your anticipated income tax. Claiming zero on Form W-4 also increases your chances of receiving a larger tax refund than if you had claimed the maximum number of allowances.

When should you claim 0 allowances. Just keep in mind that by choosing 0 allowances more money will be withheld from your paycheck. You will file your tax return as of the end of.

Dont write down any number. If you dont submit IRS form W-4 to your employer. What is the max number of allowances you can claim on W4.

Every piece of information you enter on Form W-4 has a direct impact on the federal income tax withholding amount. Can I Make Changes to the W-4. Because of this Form W-4 is now a lot simpler and easier to understand.

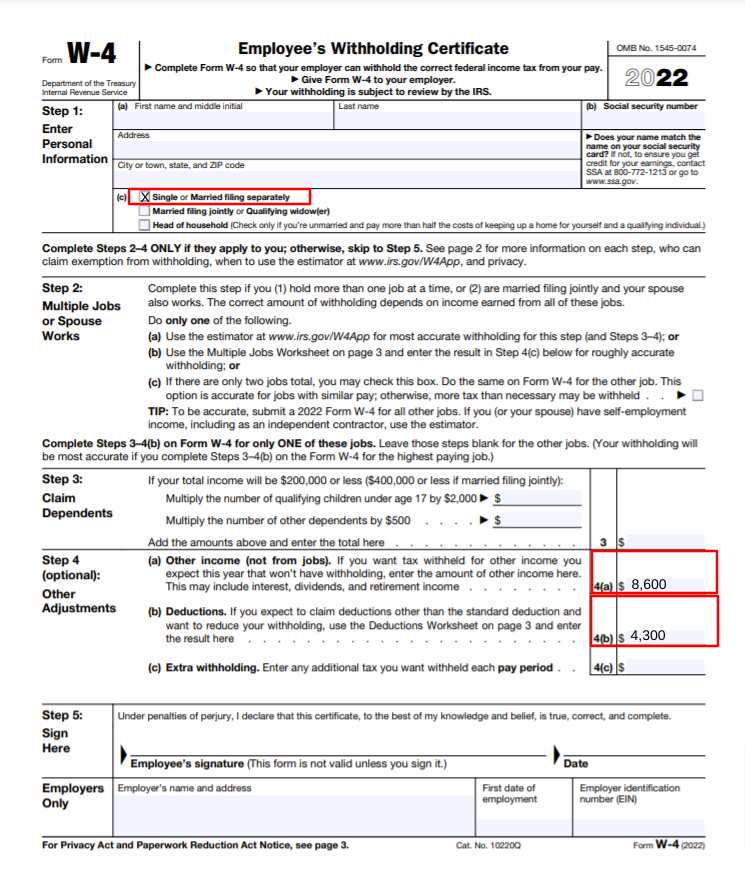

For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W-4 and your spouse should enter zero -0- on lines 5 and 6 of his or her Form W-4. Changing Your W-4 Allowances. There are only a few situations where I would recommend you claim zero allowances on your W-4 form.

The fewer allowances claimed the larger withholding amount which may result in a refund.

How To Fill Out The New W 4 Form Correctly 2020

Pin By Connor Quigley On Connor S Tax Board Tax Forms Employee Tax Forms Irs Forms

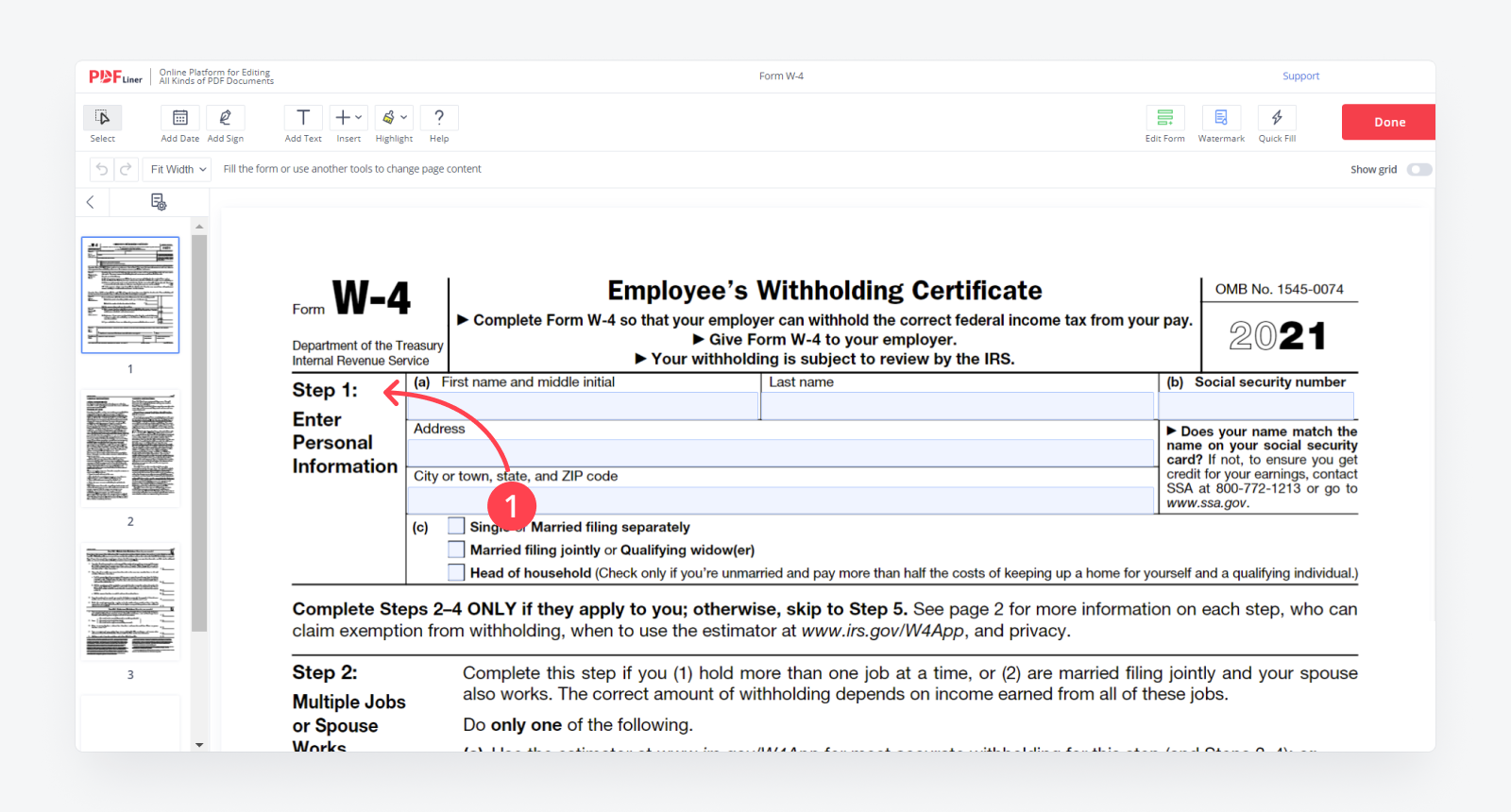

How To Fill Out A W 4 Complete Form W 4 Instructions For 2021

Tax Withholding The New Form W 4 Bhgp S

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Understanding Your W 4 Mission Money

How To Complete The W 4 Tax Form The Georgia Way

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

W 4 Form Basics Changes How To Fill One Out

Taxes How Many Allowances Should You Claim Financial Motivation Tax Help Income Tax Preparation

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

2022 New W 4 Form No Allowances Plus Computational Bridge

Post a Comment

Post a Comment