Could the contractor be considered an independent. Yes if a withdrawal was taken prior to the date of death a 1099-R will be issued under the deceased owners taxpayer identification number.

Fast Answers About 1099 Forms For Independent Workers Updated For 2018 Fillable Forms Independent Worker 1099 Tax Form

Its a way of telling the contractor AND the IRS how much the contractor got paid for the year for a service.

1099 form questions. Ad Find Edit Sign Save or Send via E-mail any Form. Experts on JustAnswer have answered all types of questions about 1099 Form for people in situations like yours. Each type of 1099 form is an informational return meant to notify the IRS of any income outside of W-2 earnings.

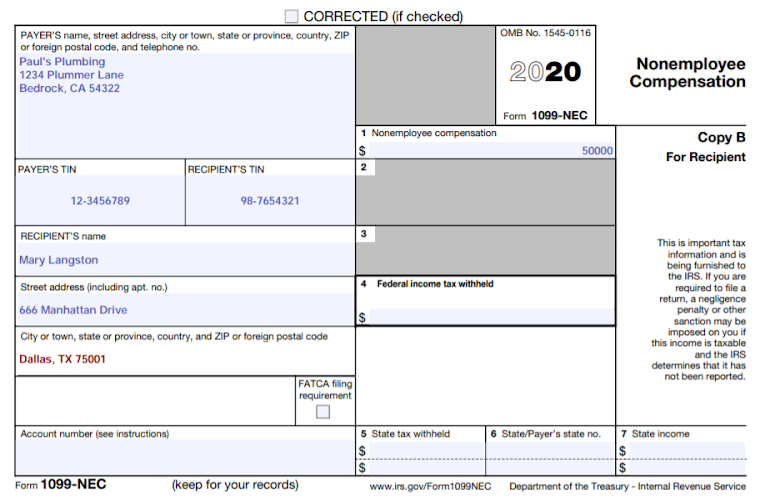

Receiving a 1099-C should always mean the debt is canceled and no longer subject to collection. A 1099 form is given to a self-employed contractor or business owner at the end of the year to report to the IRS how much money was received. The second section of form 1099-NEC lists the recipients the contactor or vendor information such as the name street address.

For Form 1099-R the taxable amount box 2a is blank box 2b is checked box 4 has an amount withheld not blank. If youre a Dasher youll need this form to file your taxes. It is then the responsibility of the individual to file and pay the appropriate taxes.

Why did I get this 1099. The 1099 is being furnished to all participants by the IRS deadline of January 31 2022. But it may be up to you to make sure.

Shows who the recipient is. What if a 1099-R has not been received or has been misplaced. The IRS has strict guidelines to qualify for this form.

If youre member of a co-op who received at least 10 in patronage dividends expect a 1099-PATR. Medical and health care payments. 1099-INT forms are not required to be issued for amounts less then 1000.

File Form 1099-MISC for each person to whom you have paid during the year. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Will a 1099-R be issued to a person who passed away during the tax year.

The amount we earn in December does that. Does the 1099-C form mean my debt is canceled and can no longer be collected upon. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. When a person is paid on the form 1099-misc all money earned by the individual is paid on an untaxed basis. 1099 NEC To report non-employee compensation.

Which 1099 Form Do I Use. A 1099-K form summarizes your sales activity as a Merchant. So I reached out them via their chat and they told me that I will have to manually reach out to them after 1312022 and then they will send it to me.

Interest payments are reported on a form named 1099-INT. It depends on the amount of interest you received in a calendar year. Form 1099 MISC- To report miscellaneous income.

Report payment information to the IRS and the person or business that received the payment. Do I receive a 1099 INT every tax year. Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of 600 or more made in the course of a trade or business in rents or for other specified purposes Form 1099-MISC.

Anytime you make withdrawals to pay for school youll likely get one of these. Is there a different 1099 form to report interest paid. The 1099-Q form reports money that you your child or your childs school received from a qualified tuition plan like 529 plan or Coverdell ESA.

Yes amount in box 2a was used as the taxable amount or No a different amount was taxable. Below are some answers to frequently asked questions about the 1099. IRS 1099 K- To report third-party network transactions.

Ad Find Edit Sign Save or Send via E-mail any Form. Ticketmaster will generally provide you a copy of the Form 1099-K. A 1099 form is a classification that differentiates a contractor over an employee.

What is a form 1099. A form 1099 is similar to a W-2 but its for an independent contractor as opposed to an employee. When it comes to Tax and 1099 Form you can take your pick from hundreds of Tax professionals all over the world who frequently answer questions about 1099 Form.

At least 600 in. As per the IRS instructions the 1099 INT Form is issued only when the interest income paid in a tax year exceeds 600. This is the equivalent of.

Is the nonemployee compensation the sum of all the earnings you see in your Google Adsense in a year. The first section of form 1099-NEC lists the payers the entity reporting income to the IRS information such as the name address phone number and tax identification number such as SSN and EIN. Getting ready for tax time and only one of my banks has not shared how they will send the 1099-INT form.

Its provided to you and the IRS as well as some. JustAnswer is the largest online question and Expert answer site online. I have two questions on the 1099 tax form.

What is a 1099 tax form. Regularly Asked Frequently Asked Questions on IRS 1099 INT. What Are 1099 Forms.

Until 2016 IRS rules allowed creditors to file a 1099-C if no payments had been made on a debt for 36 months. Ticketmaster is generally required to file a Form 1099-K report with the IRS if the gross amount of your transactions on our marketplaces is 600 or more in a calendar year. The IRS then compares the form 1099 they get to what the contractor puts on their taxes.

All Plan participants get a 1099 because the IRS considers the legal services benefit you receive to be a taxable fringe benefit. Shows who the filer is. The laws for filing 1099 forms are complicated and are coming under increased IRS scrutiny.

These questions are intended to help you prepare your individual income tax return if you received a Form 1099-G because a state or local tax refund was reported to the Internal Revenue Service IRS or a Form 1099-INT was reported to the IRS for interest paid on a. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. Can Las Vegas CPA Professionals help file my 1099 forms.

Since payments reported on a 1099 form do not encompass employee compensation they typically do not include tax withholding. 1099 INT To report interest income. So there is no 1099 INT required for the interest paid below 600.

An individual that is an independent contractor fills the following roles. After completing the entry per the 1099-R the question is asked to Describe the Taxable Amount.

Irs Form 1099 Reporting For Small Business Owners In 2020

Form 1099 Nec For Nonemployee Compensation H R Block

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Do Llcs Get 1099 S During Tax Time Fundsnet

What Is A 1099 Form What Freelancers Need To Know

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Misc Form Reporting Requirements Chicago Accounting Company

Understanding 1099 Form Samples

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 G Tax Form Why It S Important

Post a Comment

Post a Comment