On the 2021 W-4 form you can still claim an exemption from withholding. Form W4 allowances is still one of the most searched topics about the form although its no longer found on the W4 Form 2021 and the.

How To Fill Out My 2020 W4 So That I Get More Money In My Paychecks R Personalfinance

Or maybe you recently got married or had a baby.

W4 form reddit. Big changes were made to the 2020 W4 so it should be more accurate now. Yes there is a new Form W-4 for the 2021 tax year. 2 allowances would withhold 357 per twice-monthly paycheck and leave you owing 650.

Enter 8600 into Step 4 a on the 2021 Form W-4. Enter 4300 into Step 4b on the 2021 Form W-4. If your financial health is good this is the number of tax allowances I recommend that you claim.

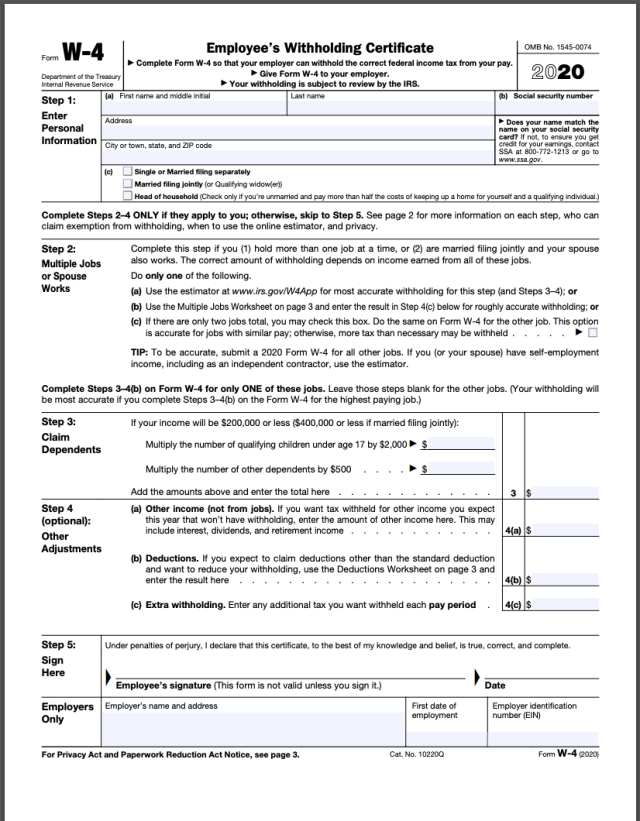

Forms W-4 filed for all other jobs. Im taking on a second job as an independent contractor and I have to fill out a W4. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

W4 form for 2nd full time job. My current job is around 115k total with bonuses and the one I am about start 12422 will be about 70k total with bonuses. If you get paid bi-weekly youd add 25.

Form W-4 is perhaps the most commonly used tax form right after the 1040Every worker regardless of how much theyre earning files Form W-4 to allow their employers to withhold tax accurately when processing payroll. Form W-4 tells your employer how much tax to withhold from your paycheck. Use our W-4 calculator see how to fill out a 2022 Form W-4 to change withholdings.

Im just confused if I am except for you can claim 2020 retention waiver if you meet both of the following conditions. Since the most amount of tax withholding you can have is your entire paycheck minus all high-priority deductions 401k pretax benefits FICA taxes etc just go to Step 4c Extra withholding and enter your paycheck in dollars. Im filing a W4 for the first time since Im finally getting my first job.

December 2020 Department of the Treasury Internal Revenue Service. You can also submit a new W-4 to your HR or payroll department when you have a life event that affects your taxes eg getting married or divorced or having a baby or if you paid too little or too much in taxes. Do I select Multiple Jobs on both W4s and not mess with withholdings at all on my.

The employees filing status on the 2021 Form W-4 would be Single Enter 8600 into Step 4a on the 2021 Form W-4. Every so often the IRS changes the documents to make them more accessible for people to understand and to correspond with changes in tax rules and exemption guidelines. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck.

The employees filing status on the 2021 Form W-4 would be Single. Employee about 120k before taxes Job B. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

If you do nothing your 2019 W4 remains in effect. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. Amount considered not taxed 3700 4150 allowances.

Independent contractor about 40k before taxes. IRS Form W-4 tells your employer how much federal income tax to withhold from your paycheck. If you use 2 as your allowances number youre telling the system to consider 3700 4150 2 12000 of your income to not be taxable.

I havent found a solid Reddit post for W4 help on 2 full time jobs. Multiply the employees claimed withholding allowance 1 by 4300 to get 4300. Heres how the computational bridge would look in action.

You can claim 1 allowance on each form W-4 OR you can claim 2 allowances on one W-4 and 0 on the other. So for step 2 Im doing the multiple jobs worksheet because the IRS estimator is down for maintenance until late January. The Internal Revenue Service renews Form W-4 every year for changes to the tax law and to point out which year the tax form is for.

Fill out the latest W-4 form which is the 2021 Form W-4. Your withholding is subject to review by the IRS. The old Form W-4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked.

Step 2 of the redesigned Form W-4 lists three different options you should choose from to make the necessary withholding adjustments. You should not have federal income tax liability in 2019You hope not to have any federal income tax liability in 2020am are doing. The form was redesigned for 2020 which is why it looks different if youve filled one out before then.

If youre filling out a Form W-4 you probably just started a new job. So 78 x 8600 670. Note that to be accurate you should furnish a 2020 Form W-4 for all of these jobs.

Give Form W-4 to your employer. Sorry if this is repetitive. So if you get paid twice a month ideally you would have around 360 withheld per paycheck.

To answer your question. If youre married with no kids. So if you want the equivalent to the old single 0 multiple 8600 times your average tax rate.

Youll be asked to fill one out when you start a new job. Form W-4 also known as the Employees Withholding Certificate is a document you must fill out for your employer when undertaking part-time and full-time employment not contract work that receives income on Form 1099The W-4 reveals how much federal income tax your employer must withhold from your paycheck meaning filling out it correctly is critical to. Please explain my W4 like Im 5.

Given employers keep the W-4s filed by employees on their records it makes it a lot easier for employers to figure out whether or not they withheld tax inaccurately. The W-4 form has been changed for 2021 and looks different than the W-4 forms from previous years. W 4 withholding form.

So just do as it says and you can run the calculator again in a month or 2 and make sure everything still looks good. Thats because the W-4 form lets you tell the system a certain amount of your income should not be taxed. For example a 40000 W2 wage earner filing single pays 3114 in tax which is a 78 avg rate.

1 allowance would withhold 396 per twice-monthly paycheck and leave you with a refund of 92950. Multiply the employees claimed withholding allowance 1 by 4300 to get 4300. If you have a second job and your filing status is single youll end up filling out a W-4 for each job.

For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W-4 and your spouse should enter zero -0- on lines 5 and 6 of his or her Form W-4.

Roblox Toy Codes Roblox Toys Kids Toys For Boys

New W 4 Adjusting Your Tax Withholdings Just Changed

My 1966 2 Litre Triumph Vitesse With Overdrive Check More At Https Www Evmore Net Car Pictu Autos Und Motorrader Autos Motorrad

The Necrotic Soul A Necromancy Subclass For The Sorcerer Unearthedarcana Dnd Sorcerer Sorcerer Dungeons And Dragons Homebrew

The Aviator A Dexterity Heavy Artificer Focused On Conquering The Skies U D D Dungeons And Dragons Dungeons And Dragons Classes Dungeons And Dragons Rules

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Paying Taxes Income Income Tax Return

Circle Of Vines V1 0 A Plant Based Druid Who Uses Their Wildshape To Gr Dungeons And Dragons Classes Dungeons And Dragons Rules Dungeons And Dragons Homebrew

Triangulos Notables In 2022 Mathematician Math

Confused On How To Fill The New W 4 Form R Personalfinance

Pin By Geoffrey Spencer On Quality Pixel Art Pixel Art Games Pixel Art Design Cool Pixel Art

What Does The New Checkbox For Two Total Jobs On The 2020 W4 Form Do Calculation Wise R Personalfinance

Laserllama S Alternate Artificer A Streamlined And Satisfying Take On The Masters Of Arcane In Dungeons And Dragons Homebrew Dnd Classes Blinded By The Light

Post a Comment

Post a Comment