See the instructions for your tax return. Form 1099-R is an IRS tax form used to report distributions from annuities profit-sharing plans retirement plans or insurance contracts.

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

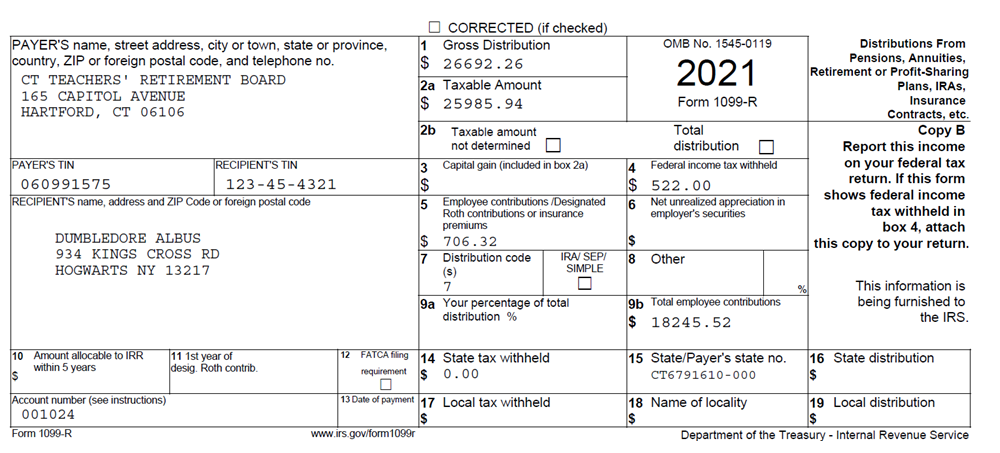

Gross Distribution includes all payments for monthly Benefits DROP Leave and Initial Benefit Option funds disbursed directly to you contributions refunded upon leaving state service and funds transferred to another non-qualified plan.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

1099 r form meaning. The form is used to report. The following chart provides the distribution. On the 1099R block 7 what is code 7.

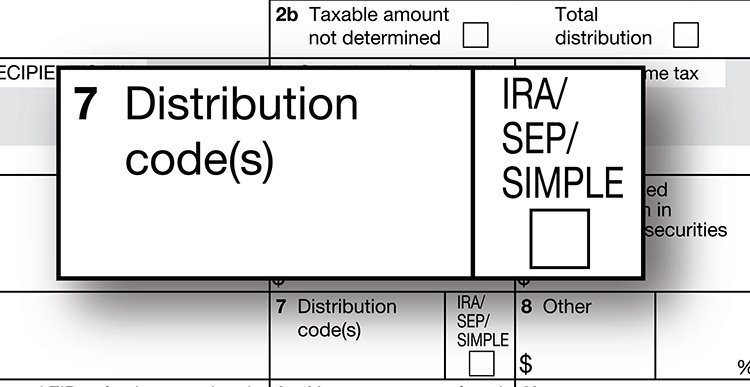

Individual retirement arrangements IRAs. The image below highlights the 1099-R boxes most frequently usedand their explanationsfor defined contribution plan distributions. Form 1099-R must be sent no later than January 31 following the calendar year of the distribution.

IRS 1099-R Form is the version of Form 1099 that is used to report distributions from pensions annuities retirement or profit-sharing plans IRAs charitable gift annuities and insurance contracts. Qualified plans and section 403b plans. You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan.

The payer enters Code 2 in box 7 if your are under age 59 12 and the payer knows that you qualify for an exception. Generally do not report payments subject to withholding of social security and Medicare taxes on this form. These codes descriptions are taken directly from the back of form 1099-R.

The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue. Reportable disability payments made from a retirement plan must be reported on Form 1099-R. If youre staring down a 1099-R and are unsure how to complete it read on for a crash course.

2 Early distribution except Roth exception. It needs to be used anytime you receive over 10 from these accounts in a tax year. Rollover activity is also reported.

Youll generally receive one for distributions of 10 or more. Ask The Taxgirl. Since the 1099 also includes the taxpayers social security number SSN the IRS is able to check to see if an income has been reported.

IRS Form 1099-R is used to declare a distribution the receiving of an amount over 10 from any of the following sources. The 1099-R form is an informational return which means youll use it to report income on your federal tax return. Form 1099-R Distribution Codes for Defined Contribution Plans.

What is a 1099-R. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. Early distribution exception applies under age 59½.

The code s in Box 7 of your 1099-R helps identify the type of distribution you received. Death regardless of the age of the employeetaxpayer to indicate to a decedent. The normal distribution is for individuals who are older than 59-12 and the distribution does not have a penalty.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Purchase of Service both principal a FORM 1099-R Explanation of Boxes amounts.

Use Code R for a recharacterization of an IRA contribution made for 2018 and recharacterized in 2019 to another type of IRA by a trustee-to-trustee transfer or with the same trustee. There is no special reporting for qualified charitable. IRS Form 1099-R is related to tax filing.

The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns. 2 Early distribution exception applies. Heres a handy list of codes.

1 Early distribution except Roth no known exception. Code 7 on Box 7 of the 1099-R tax form means Normal Distribution states TurboTax. What is IRS Form 1099-R.

Internal Revenue Service Form 1099-R is the form the administrator of your retirement plan uses to report distributions. The report will include the financial information so you can include it on your state and federal tax returns. What is a 1099-R.

The 1099 is another form that is connected to the tax return and serves as evidence that income is paid to a specific taxpayer. Taxable Amount Gross distribution. Report such payments on Form W-2 Wage and Tax Statement.

Form 1099-R is filed for anyone who has received a distribution of 10 or more from the mentioned items. It is used to show any distributions from pensions IRAs profit-sharing plans and annuities. LASERS refer Box 1.

If your annuity starting date is after 1997 you must use the simplified method to figure your taxable amount if your payer didnt show the taxable amount in box 2a. Box 7 of 1099-R identifies the type of distribution received. Form 1099-R is one of twenty information returns the Internal Revenue Service IRS uses to report different kinds of non-employment income that taxpayers might receive outside of their salary.

1 Early distribution no known exception. What is IRS 1099-R Form. Early distribution no known exception in most cases under age 59½.

This helps to prevent them from underreporting their taxable income. Profit-sharing or retirement plans. What does code 2 on a 1099-R mean.

Early distribution from a SIMPLE IRA in first 2 years no known exception. Reported on Form 1099-R. What is a 1099 R.

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages salaries and tips. Code 7 in box 7 on Form 1099-R means normal distribution for a retirement account. Insurance contracts etc are reported to recipients on Form 1099-R.

Recharacterized IRA contribution made for 2018.

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

What Does Fatca Mean And Where Is It On My 1099r F

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Irs Form 1099 R Box 7 Distribution Codes Ascensus

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Post a Comment

Post a Comment