See Specific Instructions on page 3. In fact all nonprofits must submit this form in order to be eligible for the tax-exempt status.

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

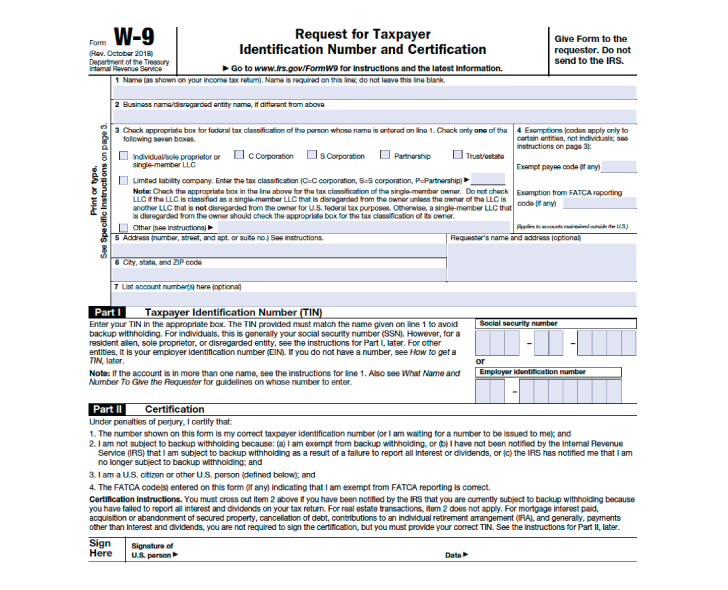

It requests the name address and taxpayer identification information of a taxpayer.

/w-9_147044986-5bfc3441c9e77c00519c4986.jpg)

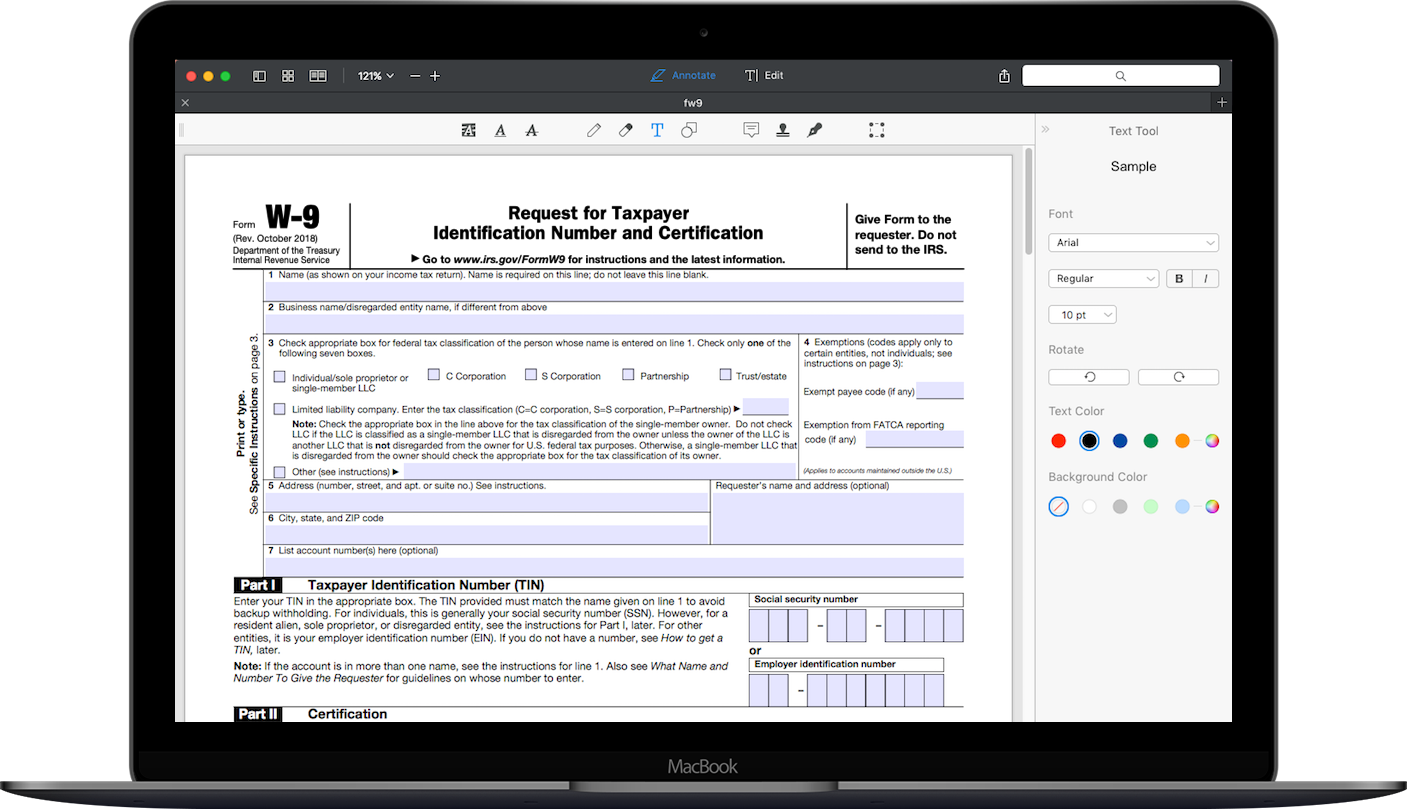

W-9 form #3. If you are requested to complete a Form W9 pay particular attention to these. Form W-9 is an IRS form that is filled out by self-employed workers for companies they are providing services for. HEAD to HEAD PAPER.

By signing it you attest that. Do not send to the IRS. A W-9 is an Internal Revenue Service form that businesses use to obtain Social Security and taxpayer identification numbers from the people and organizations that they pay for services.

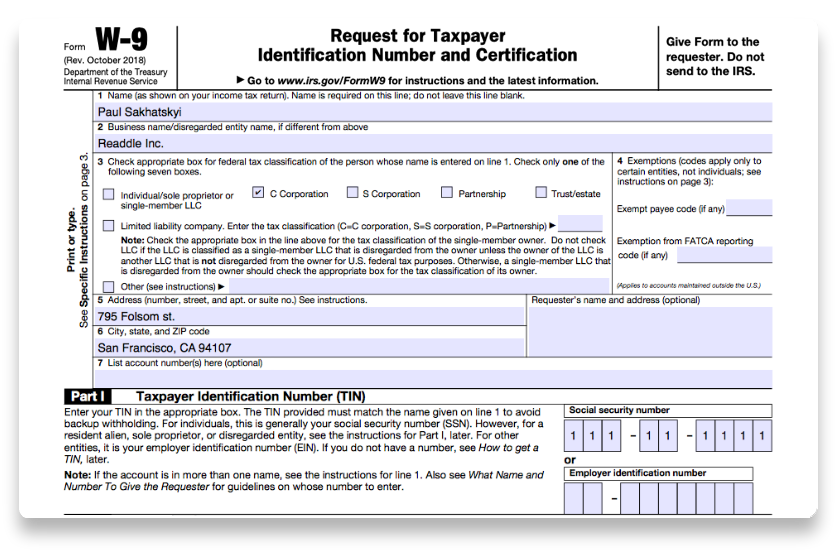

Form W-9 establishes the identity of your organization as being independent and free. Business name if this is different from line 1 On line 3 you should check the bow to indicate if you are an individual sole proprietor or single-member LLC. Form W-9 is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service.

The individualsole proprietor or single-member LLC box is the appropriate box to check for. IRS Form W-9 Request for Taxpayer Identification Number and Certification is a one-page IRS tax document that individuals and businesses use to send the correct taxpayer identification number to other individuals clients banks and financial institutions. Page 3 and the Instructions for the Requester of Form W-9 for more information.

Sign and date your form. The UW requires the form W-9 for all tax reportable transactions as of January 1 2010. Companies use W-9s to file Form 1099-NEC or Form 1099-MISC both of which notify the IRS how much theyve paid to non-employees during a tax year.

TOP 13mm 1 2 CENTER SIDES. Employers use this form to get the Taxpayer Identification Number TIN from contractors freelancers and vendors. The Purpose of Issuing W-9 Forms.

Part II Certification. 216mm 81 2 3 279mm 11 PERFORATE. Implementation of the W-9 reporting process January 1 2010.

Form W-9 is officially titled Request for Taxpayer Identification Number and Certification. If you are asked to complete Form W-9 but do not have a TIN write Applied For in the space for the TIN sign and date the form and give it to the requester. Name as it appears on your income tax return Line 2.

Status and avoid section 1446 withholding on your share of partnership income. You can get Forms W-7 and SS-4 from the IRS by visiting IRSgov or by calling 1-800-TAX-FORM 1-800-829-3676. Status and avoiding withholding on its allocable share of net income from the partnership.

Form W-9 is sent to the company that requested it not to the IRS. If your nonprofit corporation provides services to another business you may be asked to fill out a W-9 form Request for Taxpayer Identification Number and Certification. Give Form to the requester.

Internal Revenue Service Form W-9 Request for Taxpayer Identification Number and Certification Rev. The W-9 form is an informational reporting tax form meaning that it provides information to the IRS about taxable entities. Dont waste time on manual W-91099 processing.

Then write nonprofit corporation exempt under IRS Code Section 501c3 However you need to provide the actual code this particular church is exempt under which could differ. The taxpayer you the payee isnt subject to backup withholding. Even though nonprofits are exempt from income tax and not subject to withholding taxes you must fill out and issue Form W-9 to the requesting business entities.

Line 3 Check the appropriate box in line 3 for the US. This can be a Social Security number or the employer identification number EIN for a business. The form is never actually sent to the IRS but is maintained by the individual who files the information return for verification purposes.

Certify that you are not subject to backup withholding or 3. Federal tax classification of the person or business whose name is entered on line 1. Person including a resident alien to provide your correct TIN to the person requesting it the requester and when applicable to.

See Purpose of Form on Form W-9 Withholding agents may require signed Forms W-9 from US. The UW needed to have a signed legal document on file to support and document the tax information when it makes a tax reportable payment. Automate your entire IRS W-91099 compliance process.

Use Form W-9 only if you are a US. W-9 Form Defined. Name of the organization Line 3.

The required document is the IRS W-9 form. Certify that the TIN you are giving is correct or you are waiting for a number to be issued 2. Form W-9 is also used to report.

Forth Step Sign your W-9 Form. An individual A sole proprietorship or. October 2018 Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification a Go to wwwirsgovFormW9 for instructions and the latest information.

The TIN you gave is correct. NONE Give form to the requester. The employer must include the appropriate taxpayer identification number on each payment to the non-employee and the total of all payments for the year must be included on the Form 1099-NEC thats provided to the worker and to the IRS.

The form also provides other personally identifying information like your name and address. In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. Most often when youre a self-employed contractor you send it to someone so that.

Those who should fill out a W 9 are those who are working as independent contractors or freelancers because the W-9 is the form used by the IRS to help gather information about such workers. Person including a resident alien and to request certain certifications and claims for exemption. Sync your vendors Use our csv import or directly integrate with QuickBooks and Xero.

On line 3 of your W-9 form check the other box. United States provide Form W-9 to the partnership to establish your US. Exempt recipients to overcome a presumption of foreign status.

Use Form W-9 to request the taxpayer identification number TIN of a US. A W-9 form is a formal written request for information only and is used solely for the purpose of confirming a persons taxpayer identification number. For example you may need to.

Do not send to the IRS. FORM W-9 PAGE 1 of 4 MARGINS. The title of Form W-9 is officially Request for Taxpayer Identification Number and Certification.

If this is the case your name should be. Updating Your Information You must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. Select OTHER and then write in nonprofit corporation.

W 9 Form What Is It And How Do You Fill It Out Smartasset

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

Learn How To Fill Out A W 9 Form Correctly And Completely

How To Complete An Irs W 9 Form Youtube

How To Fill Out A W 9 For A Nonprofit Corporation Legalzoom Com

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

The Extraordinary Fire Incident Report Form Doc Samples Format Sample Word For Office Incident Report Temp Incident Report Form Security Report Incident Report

/w-9_147044986-5bfc3441c9e77c00519c4986.jpg)

Filling Out Form W 9 Request For Taxpayer Identification Number Tin And Certification

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

How To Fill Out A W 9 For Nonprofits Step By Step Guide

W 9 Form What Is It And How Do You Fill It Out Smartasset

Learn How To Fill Out A W 9 Form Correctly And Completely

Post a Comment

Post a Comment