Learn about IRS e-File options including Free File to electronically file your individual tax returns. Four electronic filing options for individual taxpayers are listed below.

Irs Form 1040 Es Fill Out Printable Pdf Forms Online

Can I electronically file Form 1040-ES separately from the tax return.

E-file form 1040-es. Keep in mind that the IRS doesnt allow electronic funds withdrawal of estimated tax payments to be sent with Form 4868. The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. Select the option for calculation you wish to use.

The IRS accepts EFW payment information only when submitted with an electronically filed tax return or extension. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. Go to Screen 7 20YY EstimatesW-4 W-4P.

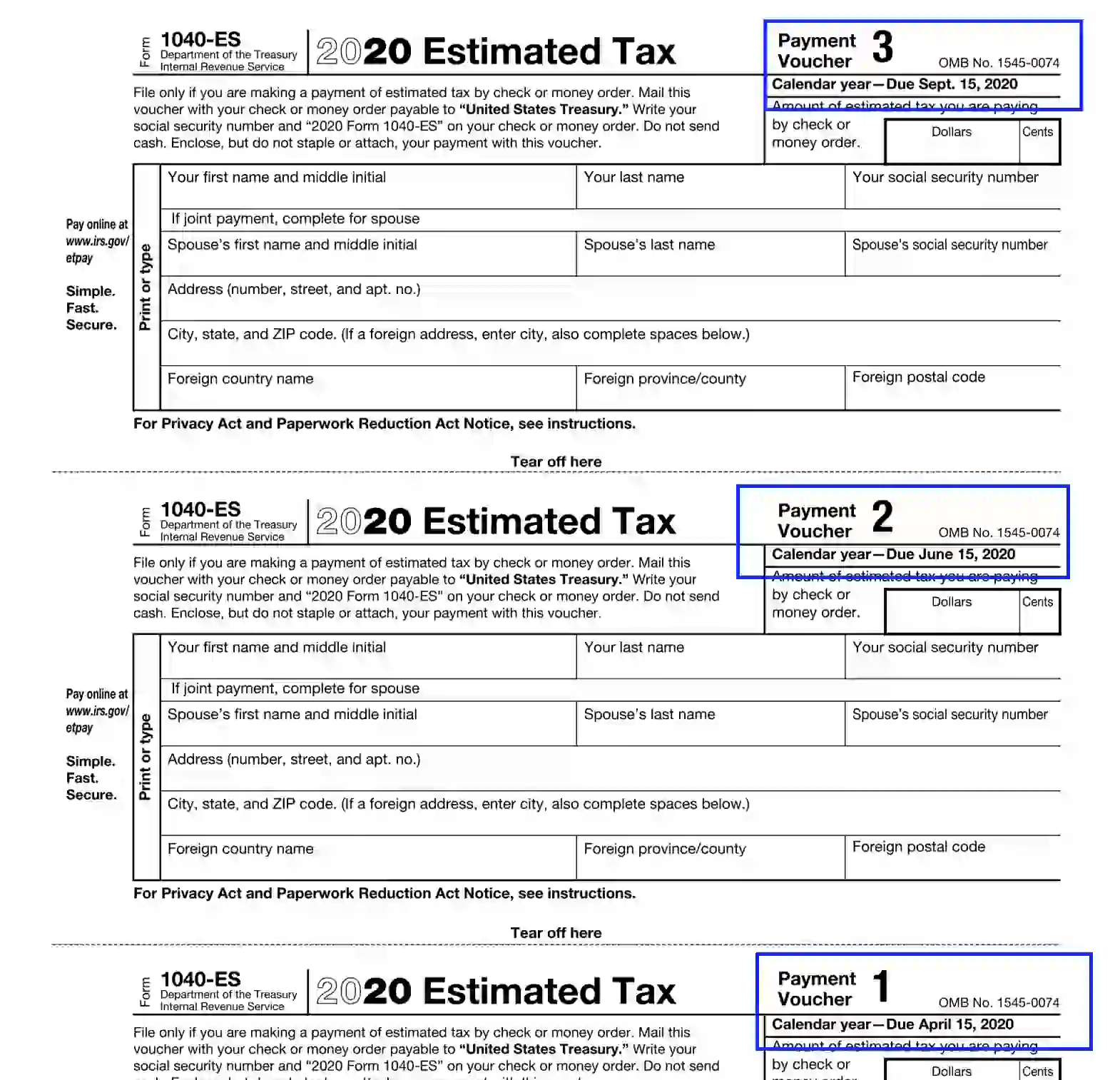

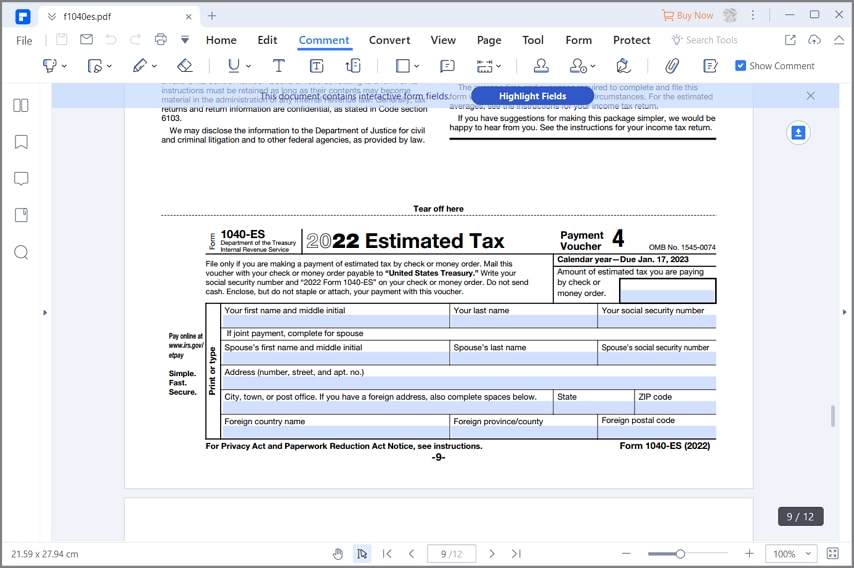

How to generate Form 1040-ES estimate vouchers. Send in your payment by check or money order with the corresponding payment voucher from Form 1040-ES. The IRS does receive a copy of these forms when a tax return is filed.

The 1040 form changes by tax year. And can all four estimates be designated for withdrawal with the electronically filed return. When you file Form 1040 electronically you may schedule up to 4 installments of estimated tax to be paid by electronic funds withdrawal in ProSeries.

IA 1040-ES is an Iowa Individual Income Tax form. Locate the General Information section. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Enroll online at wwweftpsgov. Click on the Estimate Options CtrlT O drop down menu. If you had taxable income but taxes were not withheld this income will also need.

Can I electronically file Form 1040-ES separately from the tax return. The latest update on 02182021 removed the Do Not File watermark. Other Federal Individual Income Tax Forms.

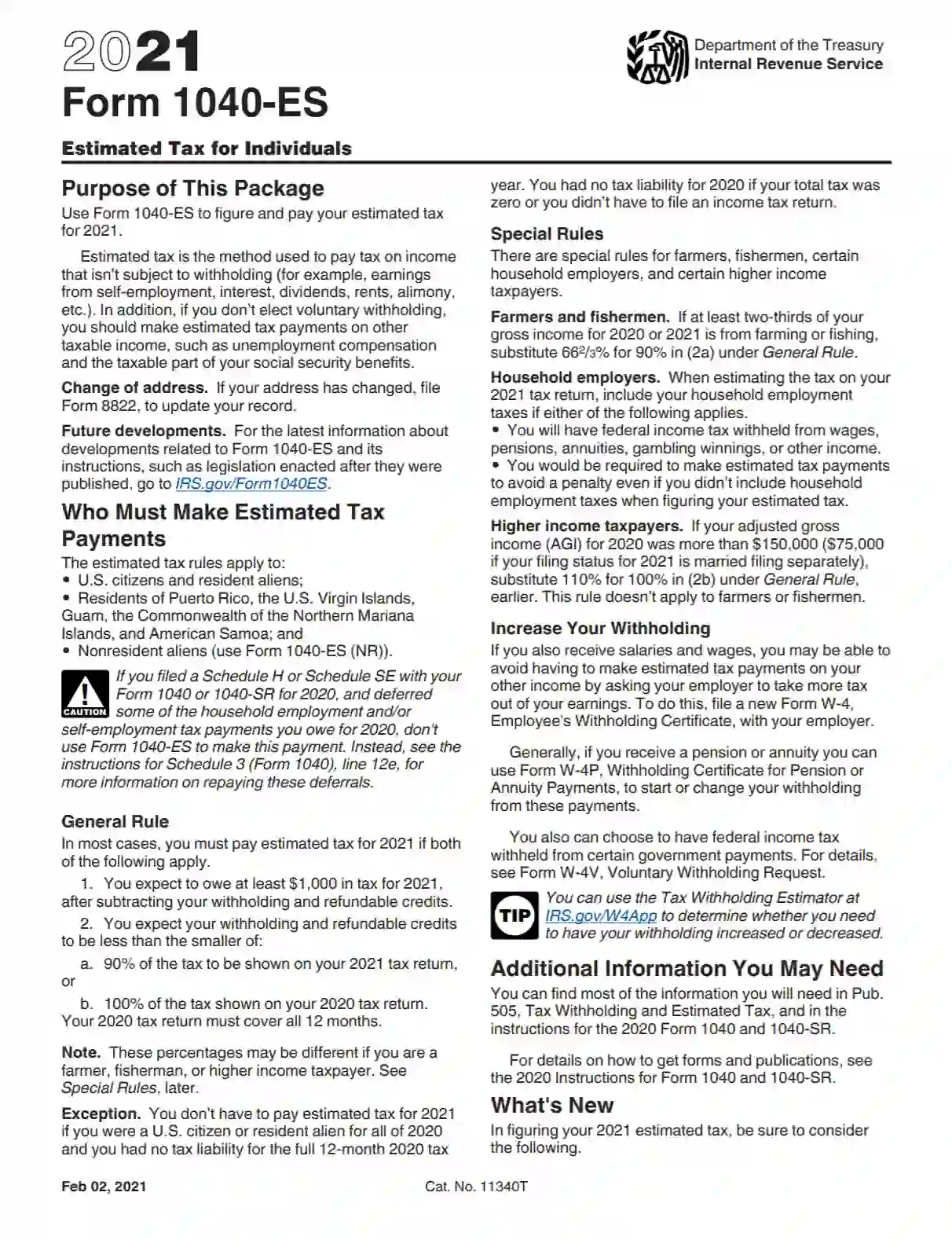

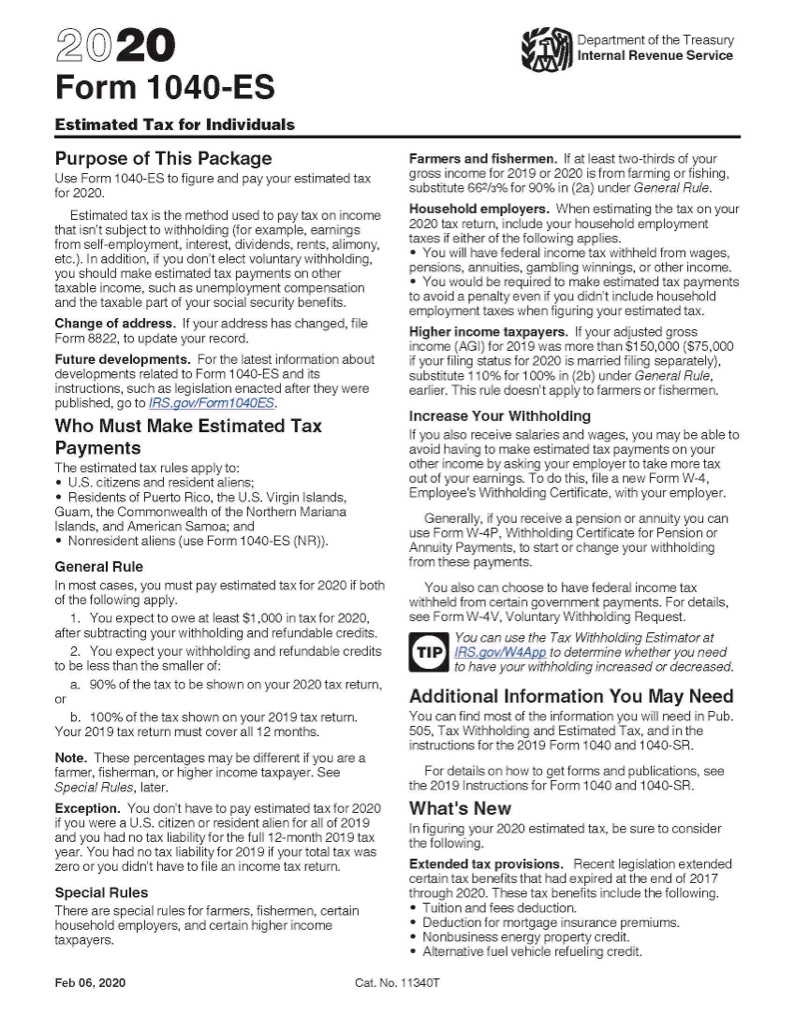

Get an extension until October 15 in just 5 minutes. Use Form 1040-ES to figure and pay your estimated tax for 2021. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed.

An income tax return is filed or e-Filed annually usually by April 15 of the following year of. For businesses and other taxpayer audiences see the links to the left. Pay electronically using the Electronic Federal Tax Payment System EFTPS.

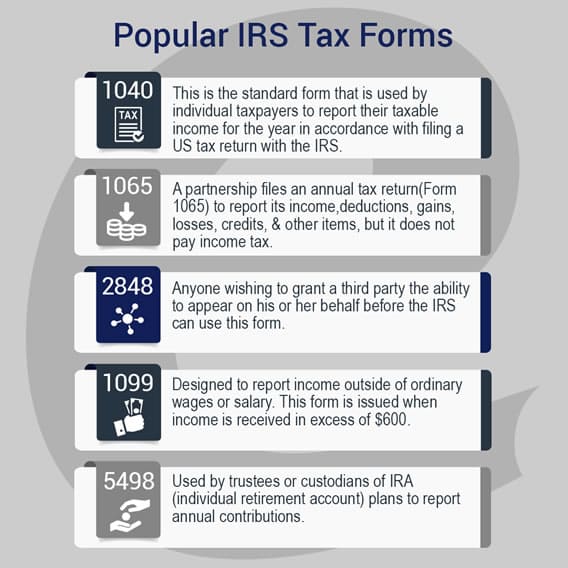

Form 8879 is used to authorize the electronic filing e-file of original and amended returns. To use them or not is your choice. Purpose of Form Form 8879 is the declaration document and signature authorization for an e-filed return.

While the 1040 relates to the previous year the estimated. January 2021 to authorize e-file of your Form 1040 1040-SR 1040-NR 1040-SS or 1040-X for tax years beginning with 2019. How do I designate estimated tax payments from Form 1040-ES for next year to be automatically debited from a clients bank account on their electronically filed income tax return.

Use this Form 8879 Rev. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government. Form 1040-ES and Payment Methods You can make 1040-ES estimated tax payments online at the IRS thus there is no need to e-File Form 1040-ES for the any of the quarters.

For example the 2020 and 2021 Form 1040 added line item 30 for the Recovery Rebate Credit. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. Employee Business Expenses 2 max per taxpayer.

The Form 1040-ES Estimated Tax form for paying 2021 estimated taxes are for your use only. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. Nonresident Alien Individuals can complete and sign Form 1040.

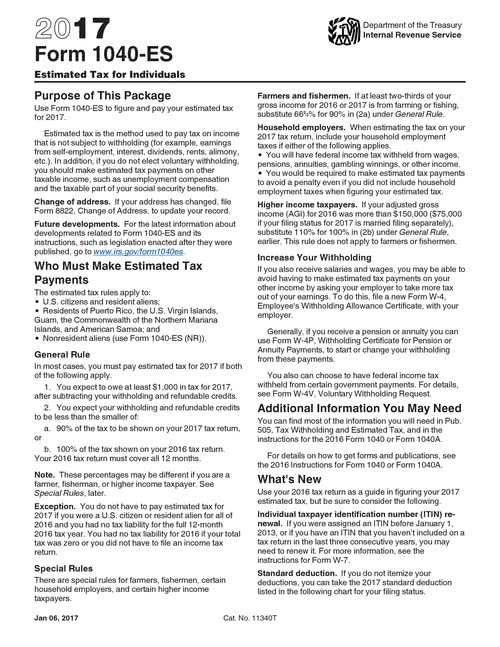

We last updated Federal Form 1040-ES in January 2022 from the Federal Internal Revenue Service. Foreign Tax Credit Unlimited number per return Form 1310. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc.

Form 1040ES is the only form for figuring out estimated tax payments. In addition if you dont elect voluntary withholding you should make estimated tax payments on other. The Form 1040 is the base IRS income tax form - and first page - of a Federal or IRS income tax return for a given tax year.

You need to apply for this service in order to use it and you can set up one-time or recurring payments up to a year in advance. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis. FormSchedule E-file E-file Notes 2020 1040 Federal and State E-filed Forms Form 1116.

Statement of Person Claiming Refund Due a Deceased Taxpayer 1 max per taxpayer Form 14039. Identity Theft Affidavit Does not e-file Form 2106.

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Form 1040 Es Paying Estimated Taxes

1040 Es 2020 First Quarter Estimated Tax Voucher

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Fillable Form 1040 Es 2021 Printable Form 1040 Es 2021 Blank Sign Forms Online Pdfliner

2021 1040 Es Form And Instructions 1040es

Irs Tax Forms 1040ez 1040a More E File Com

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Form 1040 Es Paying Estimated Taxes

Irs Form 1040 Es Fill Out Printable Pdf Forms Online

Irs Form 1040 Es Create And Fill Online

Post a Comment

Post a Comment