Meaning pronunciation translations and examples. The IRS provides example copies of W-2 forms for employers to see.

Wage Tax Statement Form W 2 What Is It Do You Need It

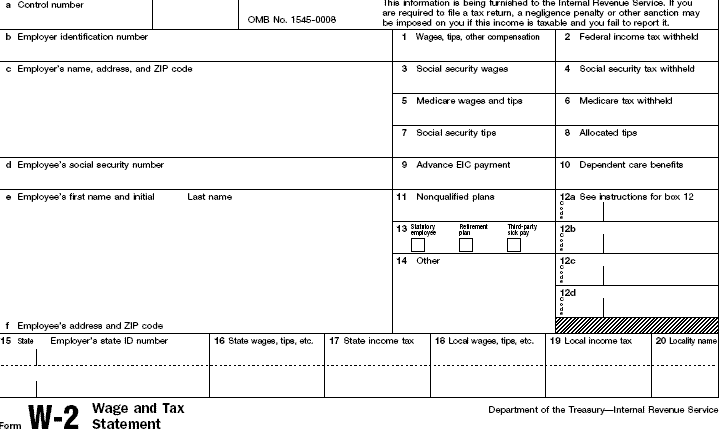

The IRS requires all employers to report the wage and salary information for their employees by means of Form W-2.

W2 form definition. Employees then use information on the W-2 form to fill out their income tax forms. In other words its an annual payroll report than an employer gives to each employee listing the details of his. Working under a W2 contract is a comparable setup to that of a full-time employee except on a temporary contract basis.

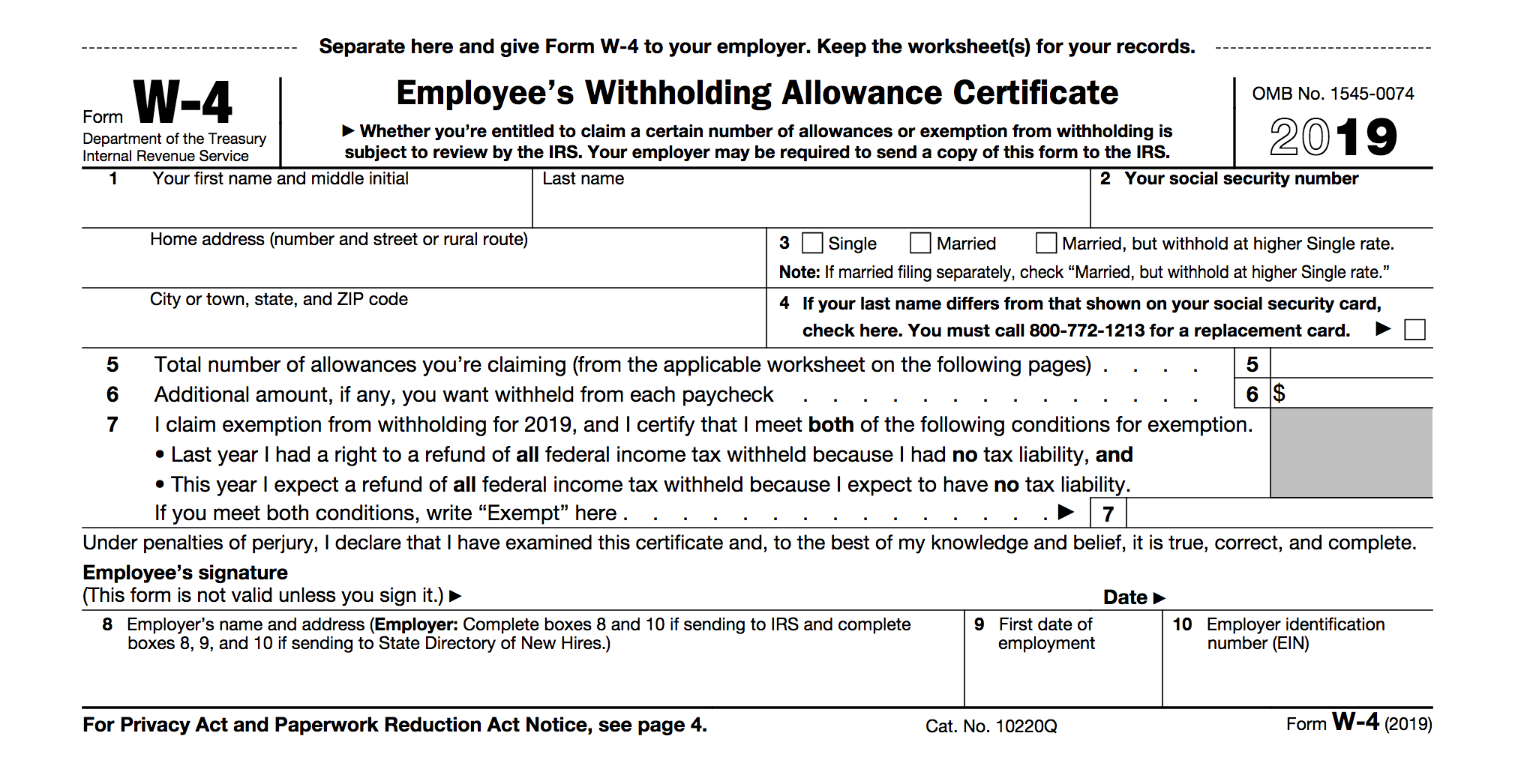

When it comes to filing taxes your employer will withhold income taxes on your behalf along with withholding and paying Social Security and Medicare. A standard tax form showing the total wages paid to an employee and the taxes withheld. A W-2 reports.

W-2 definition a standard tax form showing the total wages paid to an employee and the taxes withheld during the calendar year. Form W-2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes. IRS Tax Form W-2 Wage and Tax Statement.

A form that an employer provides an employee each year indicating the employees wages salary andor tips and the amount of tax withheld over the course of the year. Form W-2 is an annual report required by the IRS that an employer summaries the total wages income tax withholdings FICA tax withholdings and state income taxes that were paid to an employee during the year. This helps the employee calculate hisher income tax liability.

Medical work A form given to an employee at the end of a year which reports to the US federal government the employees total earnings and any earnings withheld for various purposes including federal state local and FICA taxes. Any W-2 Form that under the Internal Revenue Code and regulations promulgated thereunder is required to be submitted to the Internal Revenue. The W-2 is also used to report the amount of taxes that have been withheld from each paycheck.

W2 is actually a tax form required by the IRS when a person is employed by a company as an employee. This helps the employee calculate hisher income tax liability. Form W-2 provides important tax information from your employer related to earnings tax withholding benefits and more.

If you have several W-2 forms add up the Box. The information on the W-2 is extremely important when preparing your tax return especially for. The W2 form definition is used by employers to report employees wages to the Internal Revenue Service IRS.

The definition set by the IRS is that employers must have a W-2 form in their hand by the beginning of February. Medical work A form given to an employee at the end of a year which reports to the US federal government the employees total earnings and any earnings withheld for various purposes including federal state local and FICA taxes. The purpose of this form is to provide the employee with information that must be included in their income tax form.

Prepared by an employer for each employee. Employee means an individual whose labor or service is engaged by the Insured Agency and who is on the Insured Agencys regular payroll with federal andor state taxes withheld and required to be reported on a W-2 Form. But the W-2 form also reports the amount of state or federal taxes withheld from your paycheck.

Answer 1 of 11. Form W-2 also known as the Wage and Tax Statement is the document an employer is required to send to each employee and the Internal Revenue Service IRS at the end of the year. But these days its easier than ever before to get your W2 form online because employers can send these forms electronically.

A form that an employerprovides an employeeeach year indicating the employees wages salary andor tipsand the amount of tax withheld over the course of the year. The amount from Box 2 is reported on Line 62 of Form 1040 on Line 36 of Form 1040A or on Line 7 of Form 1040EZ. This is to be contrasted with the 1099 tax form where an independent consultant or independent contract getting service fees will be issued a 1099 form.

The IRS uses W-2s to track employment income youve earned during the prior year. Form W-2 is a required tax form that employers send to employees and the Social Security Administration SSA after the year ends. This represents the amount of federal taxes you have paid in throughout the year.

Information about Form W-2 Wage and Tax Statement including recent updates related forms and instructions on how to file. Your Form W-2 should be sent by January 31st of each year and be used to prepare your tax return. A W-2 form is a statement that you must prepare as an employer each year for employees showing the employees total gross earnings Social Security earnings Medicare earnings and federal and state taxes withheld from the employee.

Form 1040 U S Individual Tax Return Irs Tax Forms Tax Forms Tax Return

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

W 2 And W 4 A Simple Breakdown Bench Accounting

Pin On Wedding Planner Business Tips

W2 Vs W4 What S The Difference Valuepenguin

Forms W 2 And 1099 Explained For International Students Other Nonresidents

What Is The Difference Between A W 2 And 1099 Aps Payroll

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

The Irs Refund Schedule 2021 Tax Return Deadline Tax Refund Tax Return

Excel Payroll Template 2019 Lovely Payslip Template Australia Peterainsworth Payroll Template Payroll Calendar Payroll

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

What Is A W 2 Form Definition And Purpose Of Form W 2

What Is The Difference Between A W 2 And 1099 Aps Payroll

Post a Comment

Post a Comment