Physical Address 3512 Bush Street Raleigh NC 27609 Map It. However you may not need to wait on the mail.

Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

Form NC-3 is an Annual Withholding Reconciliation for reporting the total tax amount withheld from an.

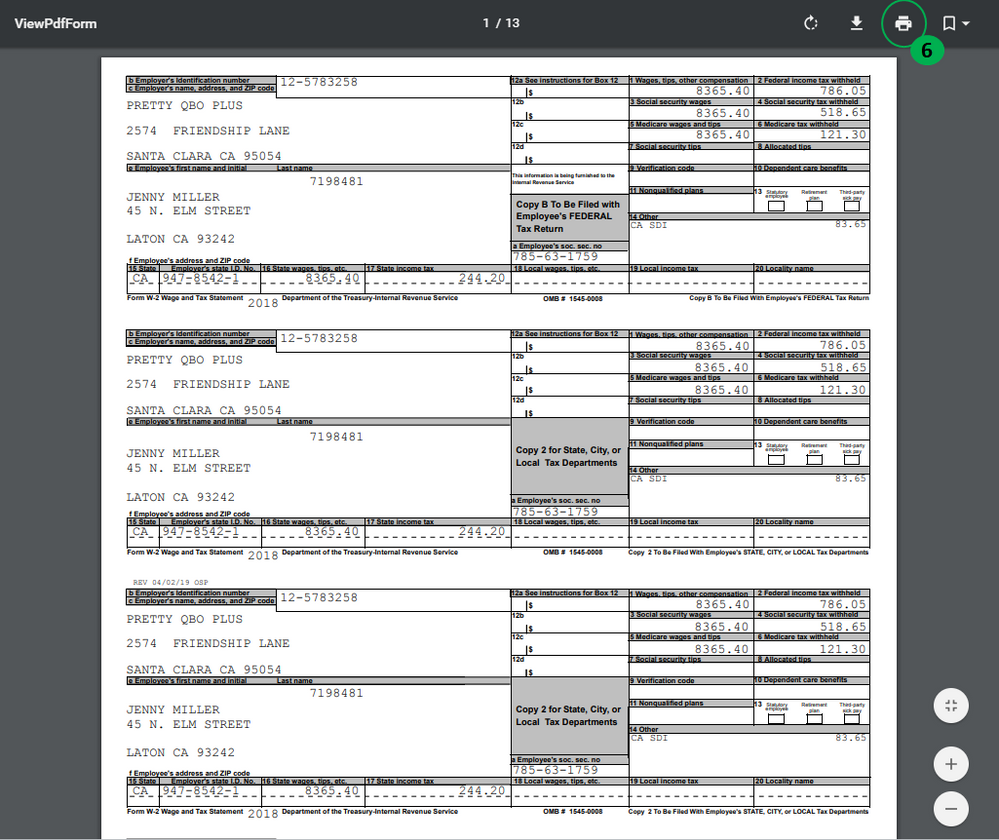

W2 form nc. HR Blocks free W-2 Early AccessSM service lets an electronic copy be sent to us so you can get an early start on your taxes. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in. This option has been enhanced to help payroll providers and other large businesses meet the electronic filing requirement.

Form NC-4 Employees Withholding Allowance Certificate. Just one-page long this form is uncomplicated at first blush. The North Carolina W2 forms electronic filing format follows the specifications outlined in eNC3 Specifications for W-2 Reporting and follows the layout of the SSA EFW2 fields with the RS records included.

Ad signNow Allows You to Edit Fill and Sign any Documents on any Device. Remitter Authorization Form Authorization form to allow a remitter to be linked to an employer account. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is.

The W2 Form is also known as the IRS Wage and Tax Statement. RC-1 Employers Election to Cover Multi-State Workers Under the Employment Security Law of North Carolina. PDF 48848 KB - December 17 2021 Taxes Forms.

About Form W-2 VI US. Electronic Signature Solutions by SignNow. Individual income tax refund inquiries.

When filing the form youll need to access the state website and upload the form afterward. Ask for it from the Employment Security Commission of North Carolina which processes unemployment benefits. NC Department Of Revenue PO.

Electronic Signature Solutions by SignNow. The State of North Carolina requires you to file annual withholding reconciliation Form NC-3 along with the Form W2. Mail your Form W2 along with Form NC-3 to the following address.

NC-3 also known as the Annual Withholding Reconciliation form is used to withhold and pay tax withheld in a calendar year. Deadline to File Form NC-3 with North Carolina -January 31 2022. Create your W-2 Form.

Step 1 Company Information Step 2 Employee Information Step 3 More Information Step 4 Preview Your Stub. PO Box 25000 Raleigh NC 27640-0640. If you previously used CDs to file W-2s and 1099s switching to Web File Upload is simple.

Step 1 - Company Information Step 2 - Employee Information Step 3 - More Information Step 4 - Preview Your Stub. Business Recovery Grant Program Businesses that suffered economic loss during the pandemic may be eligible for a one-time payment from the Business Recovery Grant Program. Know that you can also file the annual reconciliation Form NC-3 electronically.

Employers will need to provide personal information like their address and Account ID as well as the total tax withheld as reported for each period. Ad signNow Allows You to Edit Fill and Sign any Documents on any Device. What is an NC 5.

Just make sure that youre going to upload it as a txt file since this is the accepted file type. Its a federal tax document designed and processed by the Internal Revenue Service to let the employers report their employees for performing particular services during the year if the total of payments for these services exceeds 600 during the tax year. Employers are required to send W-2 forms by January 31 each year or the next business day if the date falls on a weekend or holiday.

TaxBandits supports the filing of Form W-2 with both the Federal and State of North Carolina. The North Carolina Department of Revenue requires W2 filing even if there is no state withholding. You should receive Form 1099-G by mail if you have been granted unemployment compensation but you can also request it.

ENC3 Specifications for W2 Reporting NCDOR. Apply now through 13122. Employers and submitters are required to upload W-2 Wage Data text files through the NC eNC3system.

Attach your payment to the completed form and mail them to DES to ensure proper credit to your account. ENC3 is the online filing option for businesses to electronically file Form NC-3 and related W-2s and 1099s required to be filed with NC. Yes you can e-file your North Carolina state W-2 using an open office.

Form NC-5 is used to file and pay withholding tax on a monthly or quarterly basis based on your filing frequency. Individual Income Tax. Use this filing option to upload flat files txt only containing your NC-3 W2 and 1099 information.

Box 25000 Raleigh NC 27640-0001. Does North Carolina mandate W2 filing. North Carolina Form W-2 Filing Deadline.

Income Tax Withholding Tables Instructions for. Virgin Islands Wage and Tax Statement About Form W-3 C Transmittal of Corrected Wage and Tax Statements Page Last Reviewed or Updated. Mailing Address 1410 Mail Service Center Raleigh NC 27699-1410.

North Carolina requires Form NC-3 along with the Form W-2. North Carolina Department of Revenue. How to find your W2.

This is to provide an annual statement that includes wages paid to your employees taxes withheld. The deadline for filing Form W-2 and the Annual Withholding Reconciliation Form NC-3 with the North Carolina state is. About Form W-2 Wage and Tax Statement.

The 1099-G form is a federal tax form used to report unemployment compensation paid by the state of North Carolina.

Formsandchecks Help Page State List W 2 And 1099 Forms

4up Condensed W2 Forms 4up V2 Copy 1 D Employer Discount Tax Forms

Fillable Online Giving Wfu Form Nc 4 Web 11 01 Fax Email Print Pdffiller

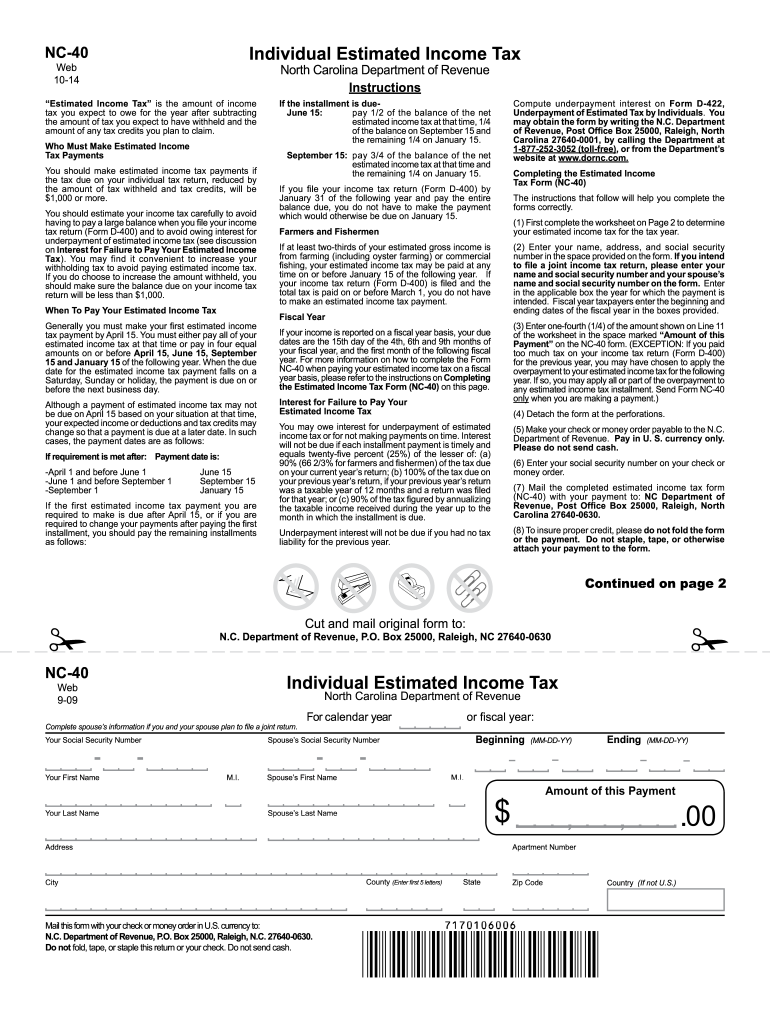

Printable Nc 40 Tax Form Fill Online Printable Fillable Blank Pdffiller

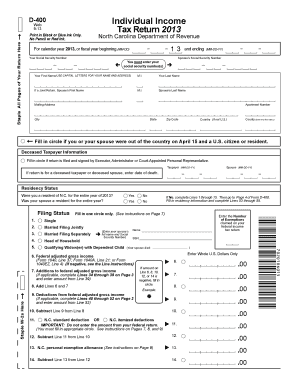

2015 Nc State Tax Forms And Instructions

W2 Forms Copies 1 D Employer Discount Tax Forms

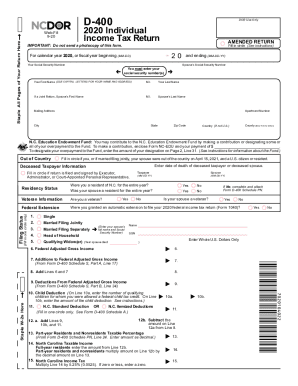

Fillable Online Prepare And File A North Carolina Tax Return Amendment Form North Carolina Income 2020 2021 Tax Return Nc Forms North Carolina Tax Forms 2020 Printable State Nc Form D Prepare

W2 Forms Copy B Employee Federal Discount Tax Forms

Intro To The W 2 Video Tax Forms Khan Academy

2018 2022 Form Nc Nc 3 Fill Online Printable Fillable Blank Pdffiller

W2 1099 Nec Printing And E Filing Software Free Trial

How To Create Our W2 File To Submit Electronically On State Web Site

Get Educated Learn How To Read Your W 2

2009 Tax Information Form W 2 Wage And Tax Statement

Post a Comment

Post a Comment