Use Form W-9 only if you are a US. The landlord moving in or a family member of theirs.

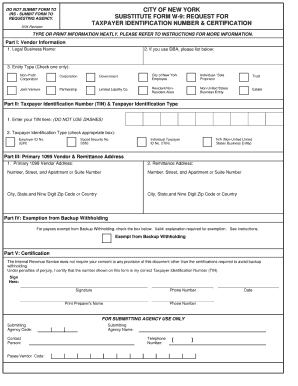

Nys W9 Form Fill Online Printable Fillable Blank Pdffiller

That doesnt mean that you cant let the house to three different people but it does mean that they should all be named as joint tenants on one tenancy agreement.

W9 form lease. This permits you to report specific information for example income paid IRA contributions and your capital gains with the IRS. These payments are typically reported to the IRS on Form 1096 and to the vendor or independent contractor on Form 1099. Income paid to you.

W9 Form Rental Assistance A W9 form can allow you to provide an individual or financial institution with taxpayer Identification TIN TIN. A Letter of Intent to Lease Residential Property is a formal letter used by a landlord to provide a preliminary agreement with a potential tenant before signing the official lease contract. The W-9 simply tells the payer your entity type and identifying number.

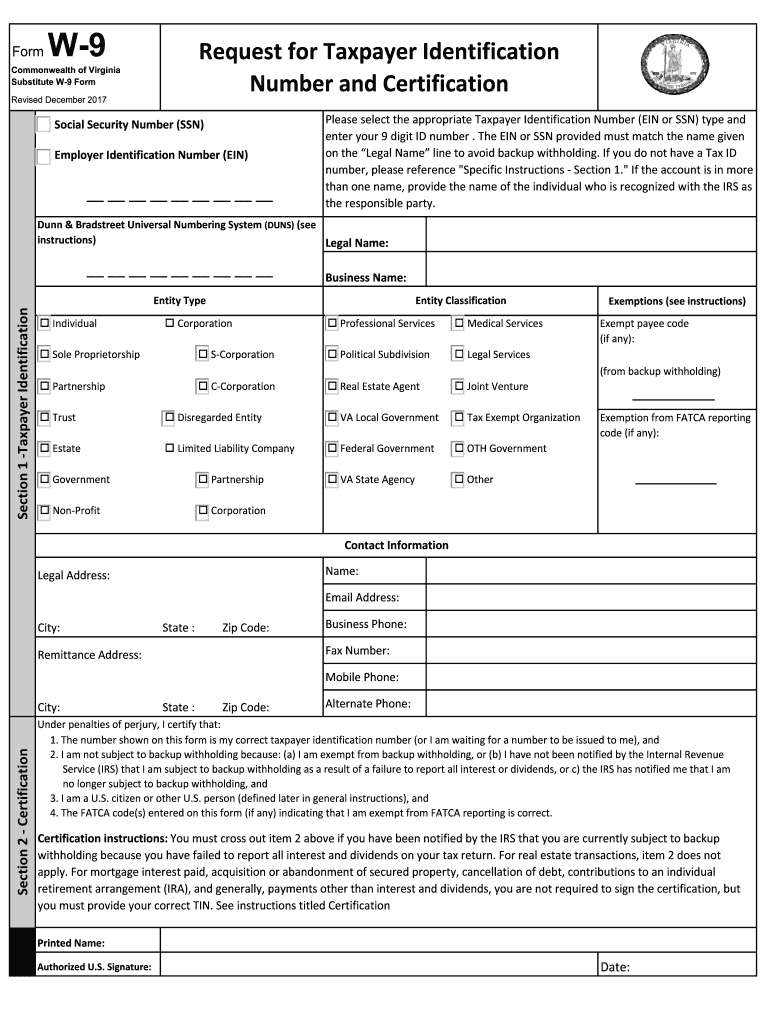

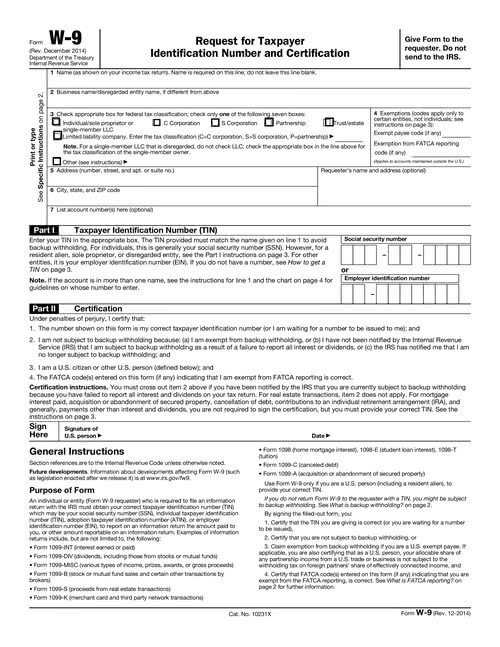

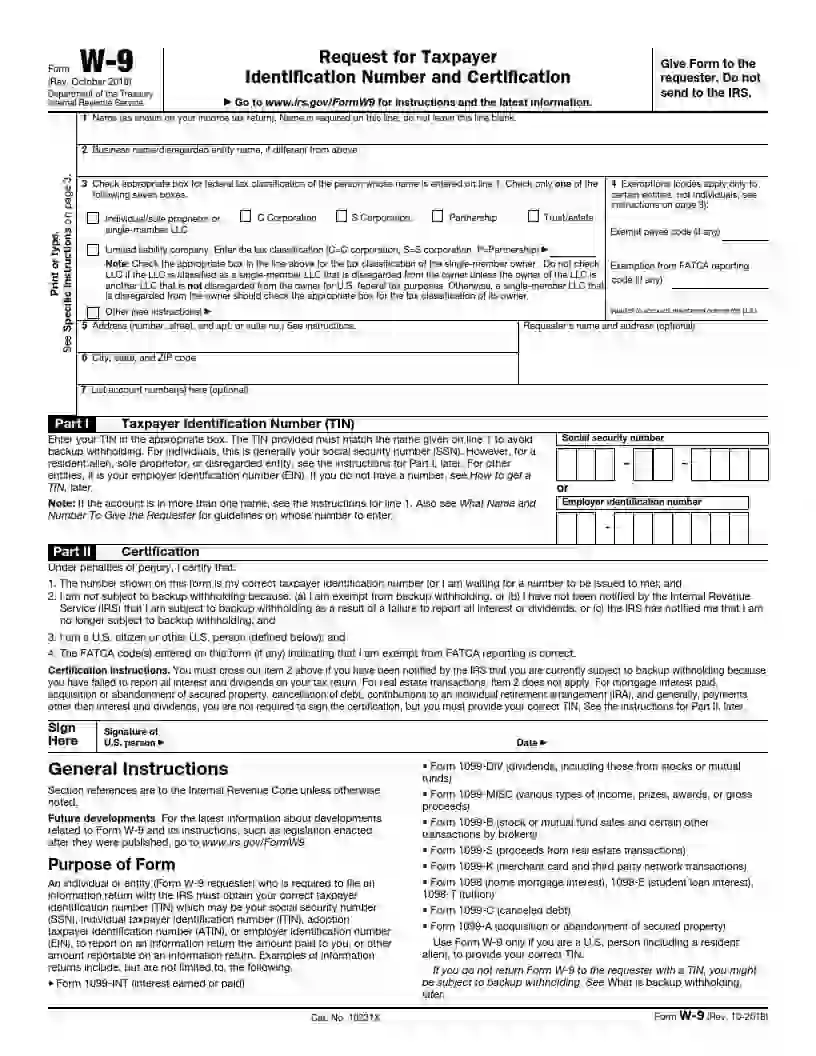

Person including a resident alien to provide your correct TIN to the person requesting it the requester and when applicable to. Form 1099-A acquisition or abandonment of secured property Use Form W-9 only if you are a US. Companies use W-9s to file Form 1099-NEC or Form 1099-MISC both of which notify the IRS how much theyve paid to non-employees during a tax year.

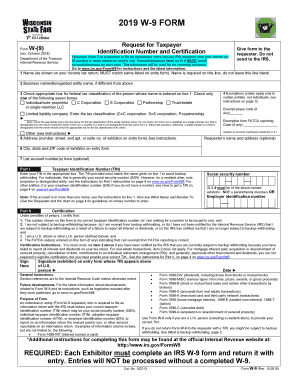

W9 Tax Form How to fill out a Form W9 Tax Form W-9 and the 1099. The combination of your tax classification for example individual corporation or LLC and the type of payment made for example payments for services attorneys fees or rent determines what must be reported to the IRS. Yes W9 is a standard form.

It depends on the amount of the gratuity and the context in which it is receivedFirst a W9 form is used when a business pays for services to vendors that it reasonably expects the payments will total more than 600 during a calendar year. The reason they are requesting this is because the organization plans to report the rent payment to the IRS. A Form W-9 sometimes miswritten as a Form W9 is a document issued by the United States Internal Revenue Service IRS for certain taxation purposes.

Acquisition or abandonment of secured property. The Letter of Intent to Lease Residential Property may include the following information negotiated by a tenant and a landlord. A Landlord Lease Termination Letter or Landlords Notice of Termination is a rental document that includes termination of lease clause that permits the landlord to end the lease under certain conditions such as when.

If the form W-9 is for a legitimate purpose like the reporting of interest paid to you for your security deposit then I wouldnt worry about your tax information being shared it wont. Form W-9 is sent to the company that requested it not to the IRS. Mortgage interest you paid.

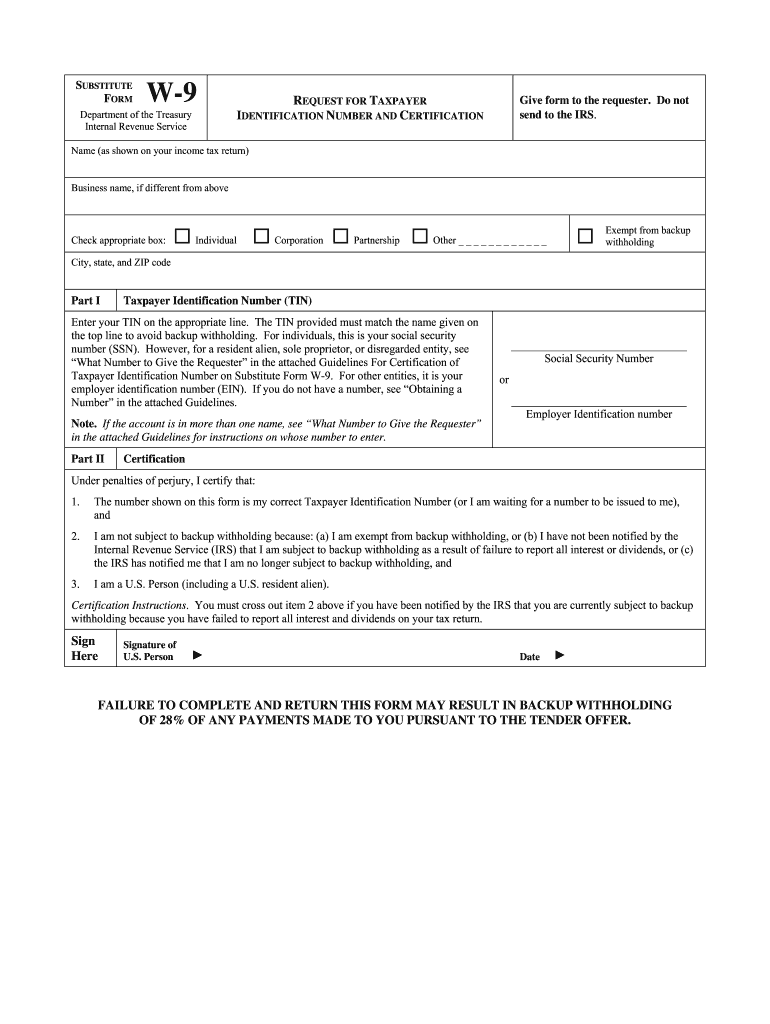

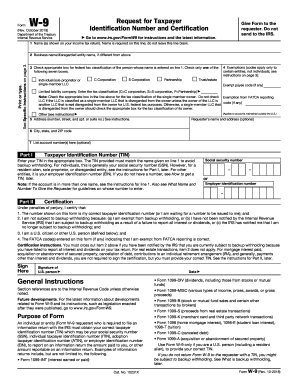

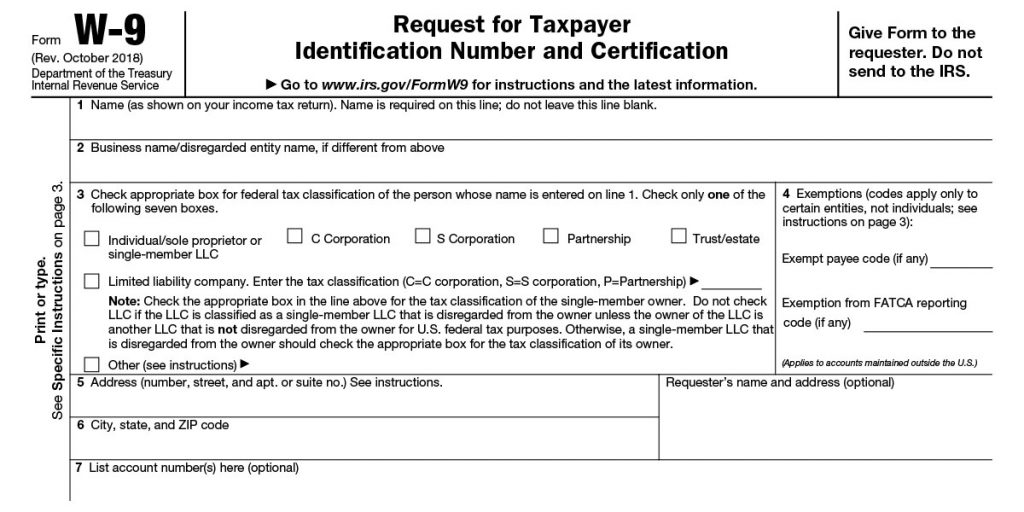

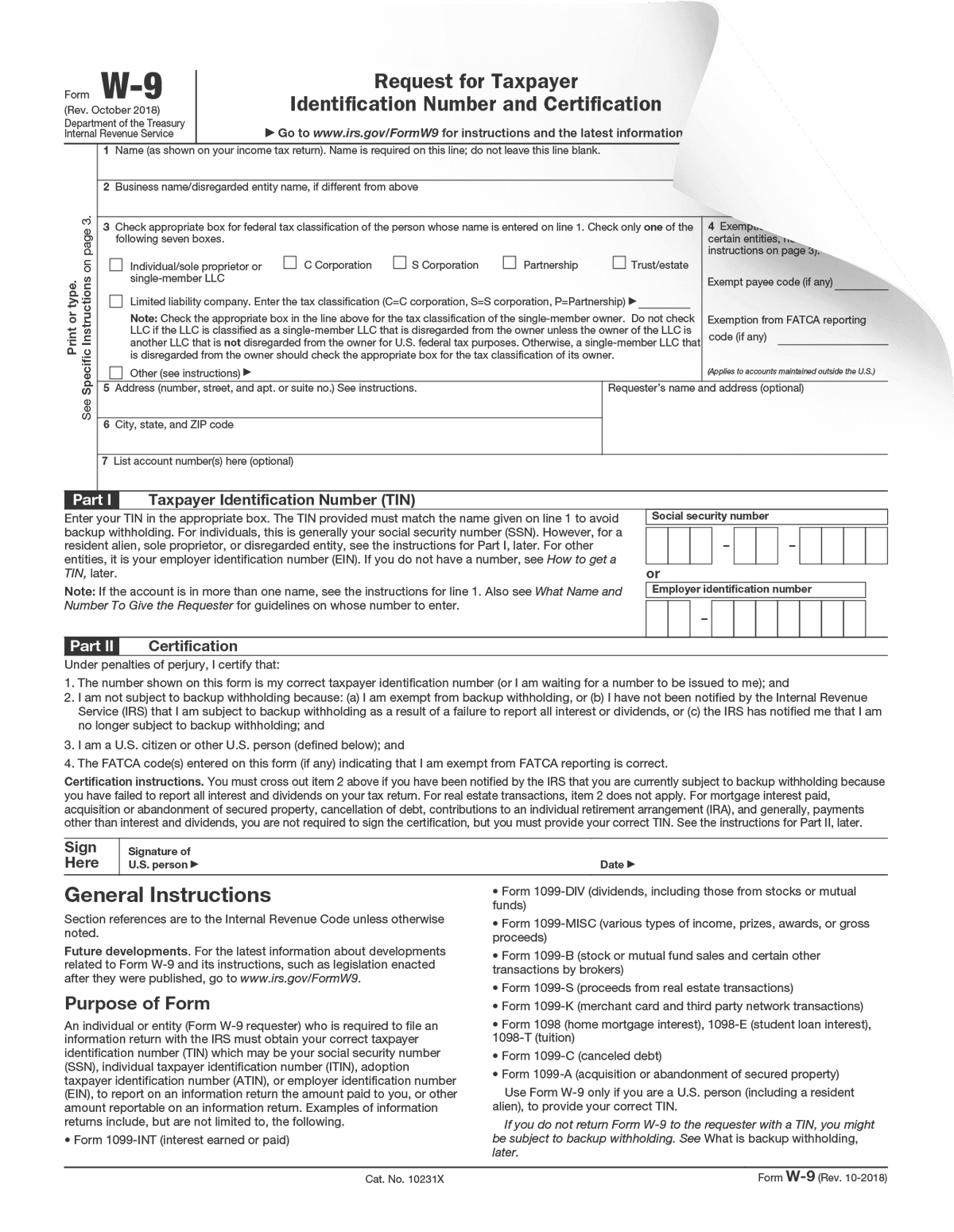

Form W9 W-9 Tax Form Explained. Certify that the TIN you are giving is correct or you are waiting for a number to be issued 2. IRS Form W-9 Request for Taxpayer Identification Number and Certification is a one-page IRS tax document that individuals and businesses use to send the correct taxpayer identification number to other individuals clients banks and financial institutions.

Form W-9 asks for the independent contractors name business name if different business entity sole proprietorship partnership C corporation S corporation. Rent and Utility Assistance - Landlord Application IRS form W9 Tax bill or Mortgage statement demonstrating proof of ownership Provide a copy of your lease or rental agreement. Landlord W9 For Rent Assistance Pdf RentalsRentals Details.

If youre personally paying rent there should be no need for a form 1099 if this is for your company then its a different matter. Property managers must do the same for all contractors not taxed as corporations that were hired and. What is form W-9.

Information Needed on Form W-9. Form W-9 is an IRS form that is filled out by self-employed workers for companies they are providing services for. The W9 is required to give the business the necessary information needed to complete a Form 1099 to report.

Form W-9 simply provides the landlord with your correct taxpayer identification number so that they can properly complete the Form 1099 required for interest earned on your security deposit. A property manager must obtain a Form W-9 from the landlord and file Form 1099 to report rent paid in excess of 600 during the tax year. The W-9 is an official form furnished by the IRS for employers or other entities to verify the name address and tax identification number of an individual receiving income.

While W-9s arent filed with the IRS they should be collected by clients or companies that hire independent contractors or freelancers. If you do not return Form W-9 to the requester with a TIN you might be subject to backup withholding. Person including a resident alien to provide your correct TIN.

What is backup withholding later. A 1099 is the form that independent contractors and others may receive at the end of the year similar to a W-2. Certify that you are not subject to backup withholding or 3.

Ending the lease without cause. W9 Form For Landlords Rentals. Contributions you made to an IRA.

W-9s are also used for earnings received by financial. A W-9 is a form that a vendor someone being paid gives to the payer so that they payer knows whether or not they need to issue a 1099 at the end of the year. The information taken from a W-9 form is often used to generate a 1099 tax.

Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example. Assuming you live in a building with six or more units or in any building if your landlord voluntarily chooses to hold deposits in interest bearing accounts such accounting. Form W-9 SP Solicitud y Certificacion del Numero de Identificacion del Contribuyente 1018 11072018 Inst W-9 SP Instrucciones para el Solicitante del Formulario W-9SP Solicitud y Certificacion del Numero de Identificacion del Contribuyente 1118 11212018 Form W-9S.

Most often when youre a self-employed contractor you send it to someone so. The W9 is a standard tax form landlords need in order to properly deal with your security deposit though many of them dont bother with it says Sam Himmelstein a lawyer who represents residential and commercial tenants and tenant associations. Selling the rental property.

Landlord W9 For Rent Assistance RentalsRentals Details. It requires your tax ID number which is your social security number if the properties are held in your personal name.

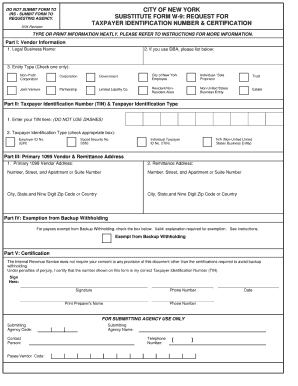

2017 2022 Form Va Substitute W 9 Fill Online Printable Fillable Blank Pdffiller

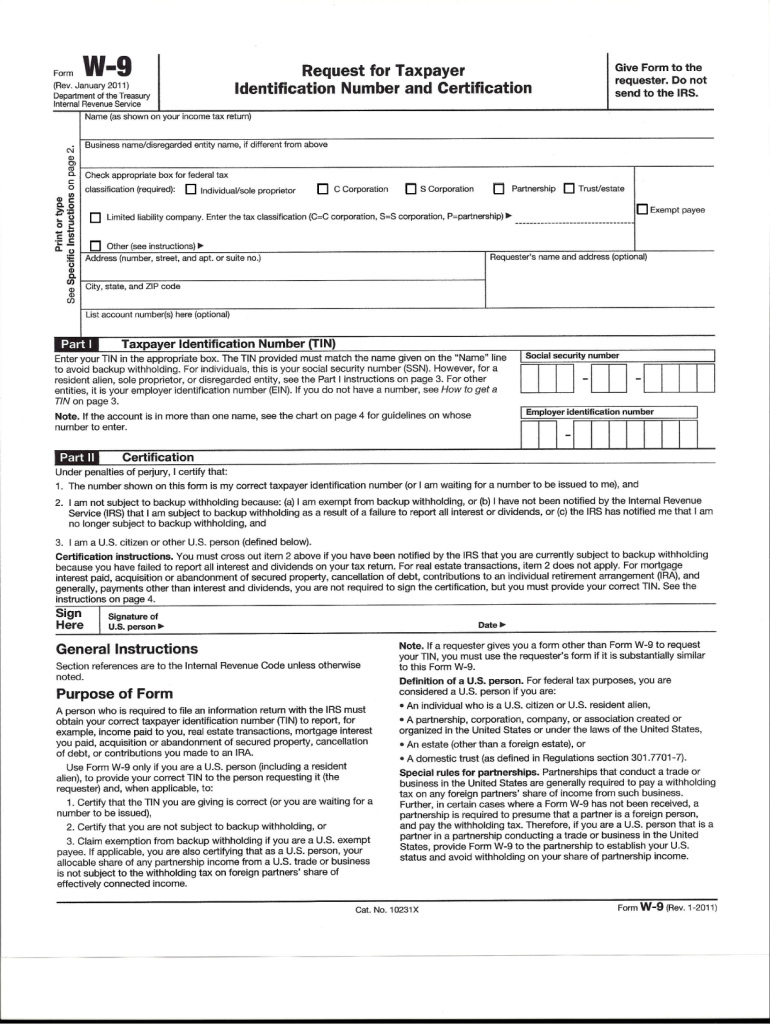

W9 Fill Online Printable Fillable Blank Pdffiller

W 9 Form Questions For Landlords

W 9 Tax Form 2018 2021 Fill Out Online Download Free Pdf

W9 Word Doc Fill Online Printable Fillable Blank Pdffiller

W 9 Tax Form 2018 2021 Fill Out Online Download Free Pdf

It S That Time Of Year Again W9 Best Practices Part I Apm Help Bookkeeping

Request For Taxpayer Identification Number W 9 Form Delaware Business Incorporators Inc

Ex 10 1 2 A14 9393 1ex10d1 Htm Ex 10 1 Exhibit 10 1 Office Lease Agreement Between Ns Wells Acquisition Llc A Delaware Limited Liability Company Landlord And Karyopharm Therapeutics Inc A Delaware Corporation

Wi W 9 Form Fill Out And Sign Printable Pdf Template Signnow

Irs Form W 9 Fill Out Printable Pdf Forms Online

2017 Form Irs W 9 Fill Online Printable Fillable Blank Pdffiller

Post a Comment

Post a Comment