You need to complete form 1410 Statutory declaration for family violence claim and also read Family. This means that professionals in all areas of work typically submit the same 1040 form.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

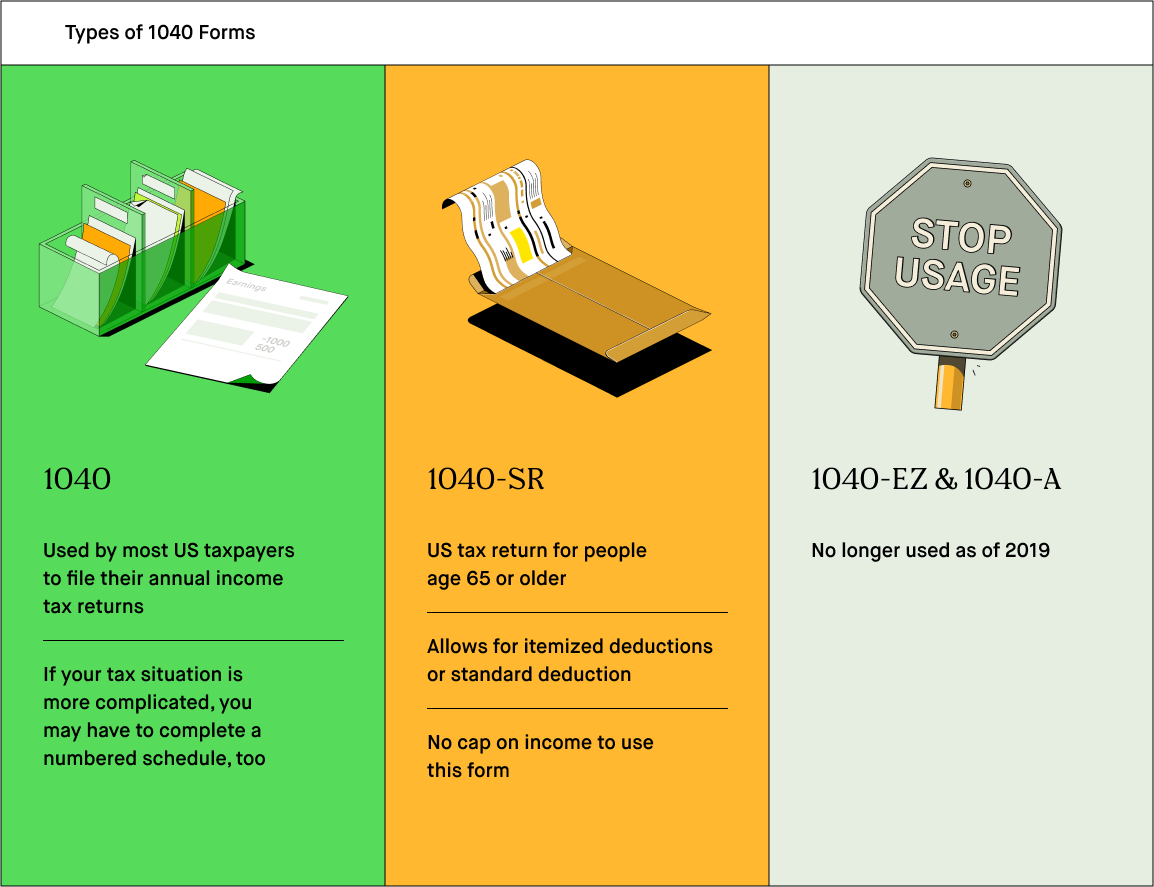

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Meaning and Symbolism of Angel Number 1040 Clearly angel number 1040 represents amazing potential regarding the self and regarding certain systems of values well-established.

1040 form meaning. You can also claim certain deductions and credits right on Form 1040 such as the recovery rebate credit which you claim if you didnt receive your 2021 coronavirus stimulus checks. One where income and family information is reported and one where allowable deductions credits and other considerations are applied to tax liability. Within Form 1040X youll only have to update the numbers and details that need to be changed.

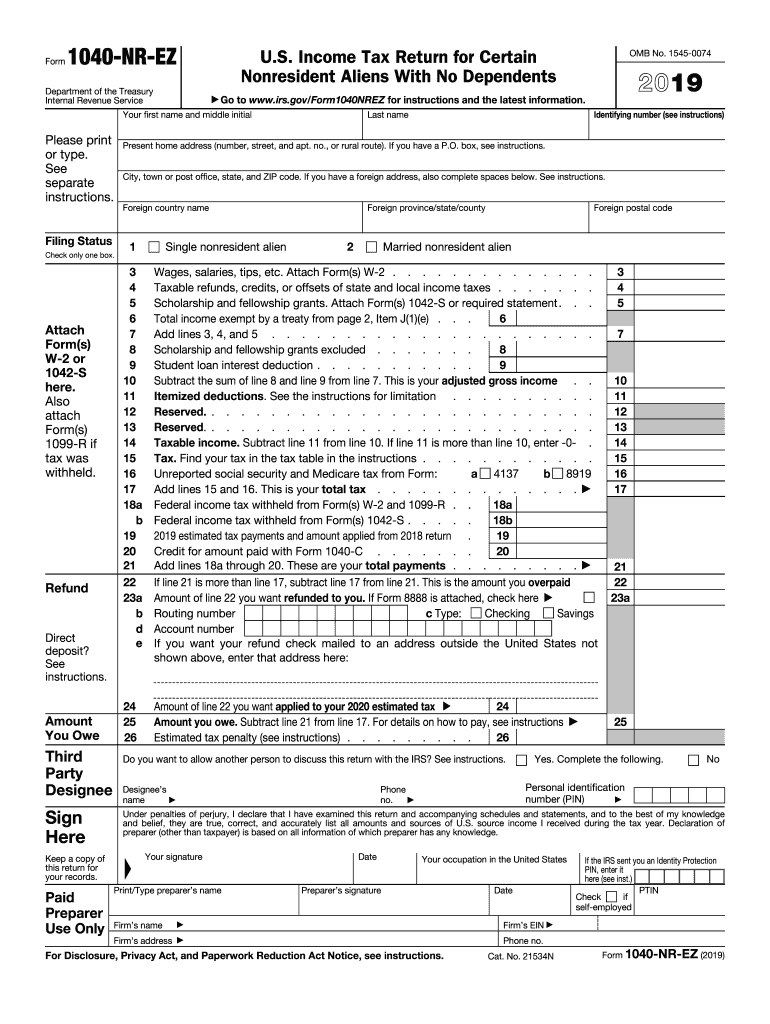

The form consists of two major sections. US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. Specifically you can use it to make corrections to IRS Forms 1040 1040A 1040NR and 1040NR-EZ.

One of the clearest differences between a 1040 form and a 1099 form is the number of types each form has. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax. Here are a few general guidelines on which form to use.

AGI includes more than wages earned. US taxation The main form for US individual income tax filing. The 1040A covers several additional items not addressed by the EZ.

About Form 1040 Internal Revenue Service Apr 18 2019 - Form 1040 is used by US. A form 1040 is a basic US Federal income tax form. Individual Income Tax Return As of 2019 there is only one version of the Form 1040 which means all tax filers must use it.

The Form 1040 is a two-page form thats greatly simplified from years past because of the 2017 tax reform. For example if mortgage interest medical and other expenses are itemized and deducted from income Schedule A is attached to Form 1040. It calculates the amount of tax you owe or the refund you receive.

Its used to report your gross incomethe money you made over the past yearand how much of that income is taxable after tax credits and deductions. The basic form that is used by taxpayers to file their income tax returns. One of the most common US tax documents a form 1040 is filled out by many Americans each year.

What is Form 1040. Individual tax return form that taxpayers use to file their annual income tax returns with the IRS. And finally the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

In fact since the visionary number was the base of this message this means that you have potentials actually to re-establish systems of value even on a bigger scale. If you need to make adjustments to your tax return you dont have to completely start over. Form 1040 is the standard Internal Revenue Service IRS form that individual taxpayers use to file their annual income tax returns.

Form 1040 Defined. 1040EZ Single or Married Filing Joint Under age 65 No dependents. The full name the IRS gives to Form 1040 is Form 1040.

Individual Income Tax Return is the only form used for personal individual federal income tax returns filed with the IRS. More What Is an Amended Return. Angel Number 1040 comes to reveal to you that everything in the higher planes including its process of awakening and improvement.

The form itself is short but many taxpayers must use additional forms to calculate how things like dividend income and capital gains are taxed on the 1040. Form 1040 is the standard US. Schedules may be attached to the form.

Angel number 1040 represents the part of the spiritual theory that must be studied and combined with the practice of the teachings making you evolve and expand your perception of the spiritual and material reality. What does 1040 mean. For Tax Year 2018 you will no longer use Form 1040-A or Form.

However most taxpayers also need to fill out and attach other forms. Once you file it Form 1040X becomes your new tax return. The 1040 form calculates income deductions and credits and ultimately arrives at how much if any tax the filer owes for the year.

The response indicates the adjusted gross income AGI reported on your parents 2019 income tax return. A form that an individual files with the IRSto calculate and pay taxes based what heshe believes hisher ultimate tax liabilitywill be. As of the 2018 tax year Form 1040 US.

If your parents filed a joint federal tax return the AGI can be found on line 8b of the IRS Form 1040. Form 1040 is how individuals file a federal income tax return with the IRS. In other words one uses Form 1040-ES to estimate taxes and pay them usually on a quarterlybasis.

The form is on one double-sided piece of paper. For example it can include alimony Social Security and business income. Forms Instructions Internal Revenue Service Form 1040.

Simplest IRS form is the Form 1040EZ. Form 1040 Statutory declaration relating to domestic violence. The IRS 1040 form is one of the official documents that US.

From Longman Dictionary of Contemporary English Form 1040 Form 1040 fɔːm ˌten ˈfɔːti ˌfɔːrm- -ˈfɔːrti noun countable a form which people in the US use to give information to the IRS Internal Revenue Service so that their income tax can be calculated. In prior years it had been one of three forms 1040 the Long Form 1040A the Short Form and 1040EZ - see below for explanations of each used for such returns. Taxpayers to file an annual income tax return.

Because a 1040 form can show the information from all other tax forms a taxpayer might need to fill out theres only one type of 1040 form. If you are making your first request to be considered under the family violence provisions on or after 24 November 2012 do not complete this form. The form contains sections that require taxpayers to disclose.

Taxpayers use to file their annual income tax return.

Irs Updates Form 1040 For 2019 Bright Tax Taxes For Expats

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Forms 1040 And 1040nr Ez Which Form To File 2022

/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

/ScreenShot2021-02-11at1.09.54PM-a0f5478dda0b440f99a2d4d10e61321e.png)

Form 1040 V Payment Voucher Definition

Form 1040 U S Individual Tax Return Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

The 2018 Form 1040 How It Looks What It Means For You The Pastor S Wallet

How To Fill Out Your Form 1040 2020 Smartasset

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

What Was Your Income Tax For 2019 Federal Student Aid

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

Post a Comment

Post a Comment