1099-q trustee to trustee transfer. Why was Form 1099-Q issued to me instead of the beneficiarystudent.

Guide To Irs Form 1099 Q Payments From Qualified Education Programs Turbotax Tax Tips Videos

Do not file Form 1099-Q for a change in the name of the designated beneficiary on a QTP account if the new beneficiary is a member of the former beneficiarys family.

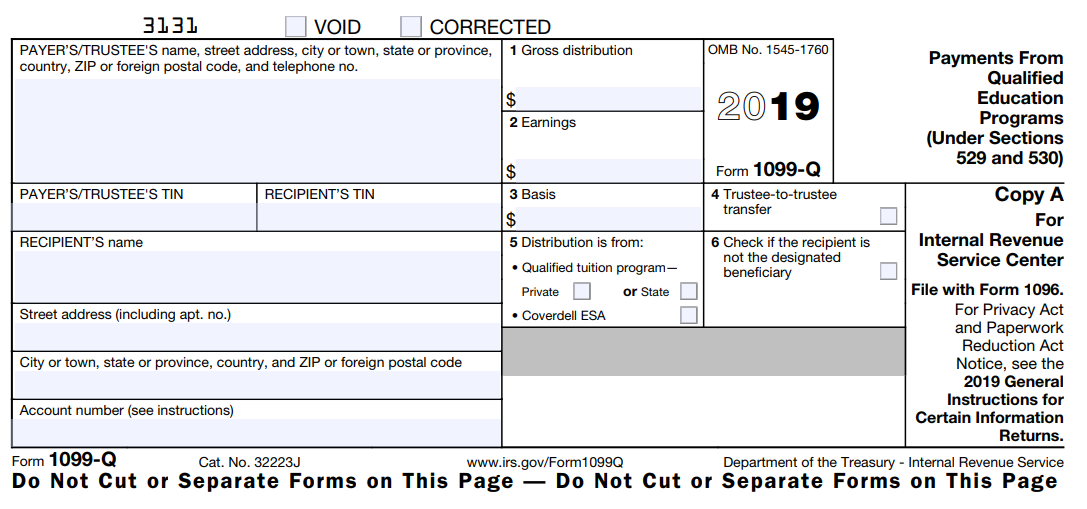

1099 q form 2019. You have successfully completed this document. Available for PC iOS and Android. Coverdell education savings account ESA must file Form 1099-Q to report distributions made from Coverdell ESAs.

Why did I receive a Form 1099-Q. Do i need to report 1099-q. You can review the Form 1099-R instructions at.

Download forms on your personal computer or mobile device. 1099-q trustee to trustee transfer. Approve documents with a lawful electronic signature and share them by way of email fax or print them out.

Fillable Form 1099-Q is filed by individuals who receive distributions from a Coverdell Education Savings Account or 529 plan. The 1099-Qs show the Gross distrib. Httpswwwirsgovpubirs-pdfi1099rpdf FREQUENTLY ASKED QUESTIONS 1.

Available for PC iOS and Android. Complete forms electronically utilizing PDF or Word format. Made a distribution from a qualified tuition program QTP.

1099-q recipient is not the designated beneficiary. Form 1099-Q is provided if a distribution was taken from your 529 account during 2020. Who reports 1099-q parent or student.

Who reports 1099-q parent or student. To enter Form 1099-Q data in your TaxAct return. Easily fill out PDF blank edit and sign them.

Save documents on your personal computer or mobile device. Complete IRS 1099-Q 2019-2021 online with US Legal Forms. Payments from Qualified Education Programs Under Sections 529 and 530 Info Copy Only 2018.

Questions regarding your Form 1099-R or 1099-Q please contact your financial advisor or a professional tax advisor. November 2019 For calendar year. A taxpayer transfers the funds in his 2 sons 529 accounts from one financial institution to another in which he opens 2 529 accounts.

For a Coverdell ESA the new beneficiary must be a member. File with Form 1096. Fill out securely sign print or email your 2019 Form 1099-Q.

From within your TaxAct return Online or Desktop click Federal. It identifies the amount made from the account in gross distributions over the year being reported. How to create an eSignature for the 2015 1099 q.

For Privacy Act and Paperwork Reduction Act Notice see the. Payments From Qualified Education Programs Under Sections 529 and 530 Copy A. Who reports 1099-q parent or student.

Form 1099-Q - Taxable Amount of Earnings. A trustee of a Coverdell education savings account ESA must file Form 1099-Q to report distributions made from Coverdell ESAs. Distributions from qualified education programs are reported on Form 1099-Q.

Save or instantly send your ready documents. If someone has contributed money to a 529 plan or a Coverdell Education Savings Account Coverdell ESA and designates you as the beneficiary you will receive an IRS Form 1099-Q when you start tapping into those funds. Complete documents electronically utilizing PDF or Word format.

The Most Secure Digital Platform to Get Legally Binding Electronically Signed Documents in Just a Few Seconds. Make them reusable by making templates include and fill out fillable fields. He receives 2 1099-Qs.

Approve documents by using a legal digital signature and share them by way of email fax or print them out. Make them reusable by creating templates include and complete fillable fields. Note that there are other 1099scheck this post - Form 1099 MISC Rules RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of600 or more for services performed for a trade or business by people not treated as employeesRent or prizes and awards that are not for service 600 or more and royalties 10 or moreany.

1099-q recipient is not the designated beneficiary. Payments from Qualified Education Programs Under Sections 529 and 530 Info Copy Only 2019. How to create an e.

For an individual 529 account the IRS requires we issue. Do not file Form 1099-Q for a change in the name of the designated beneficiary on a QTP account if the new beneficiary is a member of the former beneficiarys family. Department of the Treasury - Internal Revenue Service OMB No.

1099-q recipient is not the designated beneficiary. Do i need to report 1099-q. 1099-q trustee to trustee transfer.

The taxable amount of any distributed earnings is calculated automatically in TaxAct. Form 1099-Q Payments From Qualified Education Programs 2019. Instructions for Form 1099-Q Payments from Qualified Education Programs.

About Form 1099-Q Payments from Qualified Education Programs Under Sections 529 and 530 Are an officer or an employee or the designee of an officer or employee having control of a program established by a state or eligible educational institution. The form is issued whether or not you used the distribution to pay for qualified education expenses. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

When you receive the 1099-Q each year it may be necessary to include some of the amounts it reports on your tax return. For Internal Revenue Service Center. Do i need to report 1099-q.

Fill Out Securely Sign Print or Email Your 1099 Q 2018-2020 Form Instantly with SignNow. Payments From Qualified Education Programs Under Sections 529 and 530 instantly with SignNow. You will recieve an email notification when the document has been completed by all parties.

This document is locked as it has been sent for signing. Other parties need to complete fields in the document. Why might I be receiving multiple Forms 1099-R for one type of account.

Start a Free Trial Now to Save Yourself Time and Money. How to create an e.

Irs Form 1099 R Box 7 Distribution Codes Ascensus

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

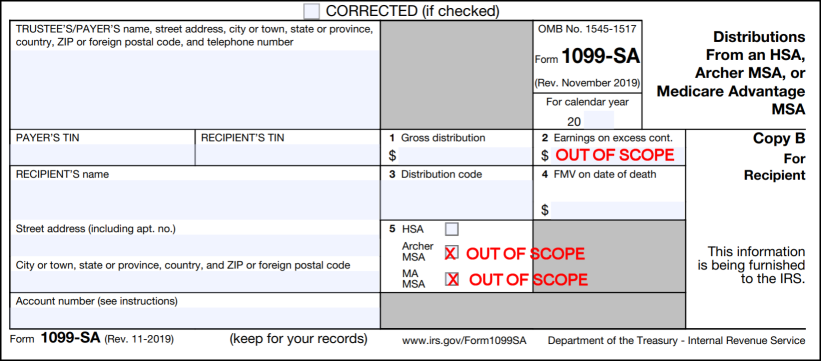

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)

Form 1099 Q Payments From Qualified Education Programs Definition

What Is Irs Form 1099 Q Zipbooks

1099 Q 2019 Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)

Form 1099 Q Payments From Qualified Education Programs Definition

Form 1099 Misc Requirements Deadlines And Penalties Efile360

2019 2022 Form Irs 1099 Q Fill Online Printable Fillable Blank Pdffiller

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Post a Comment

Post a Comment