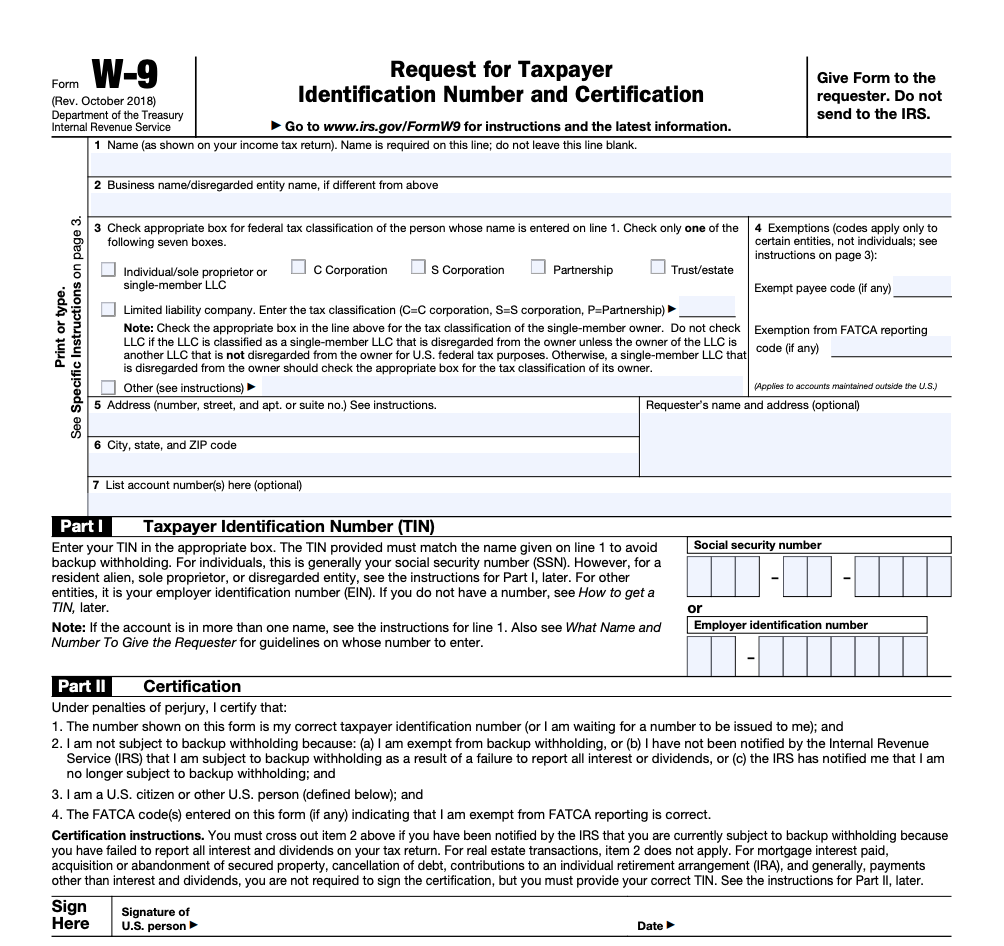

Then the client uses that info to fill out a Form 1099. In addition to the taxpayers identifying information Form W-9 asks that the contractor state whether they operate as a sole proprietorship a corporation a partnership or a.

Pin On 1000 Examples Online Form Templates

A W-4 tax form is an IRS form that you use to indicate how much an employer should withhold.

W-4 form (or w-9 for contractors). The document is essentially the equivalent of Form W-4 but for independent contractors. Form W-9 collects certain required information - for a companys records- of the persons paid by the payer but are not employees. W-4 form employees withholding allowance certificate If you work in the United States you are required by federal law to pay federal income tax.

Form W-9 is similar to the W-4 form an employer would ask an employee to complete full of information one would need to calculate tax withholding from their paychecks. When is a W-9 Form Necessary. Companies use W-9s to file Form 1099-NEC or Form 1099-MISC both of which notify the IRS how much theyve paid to non-employees during a tax year.

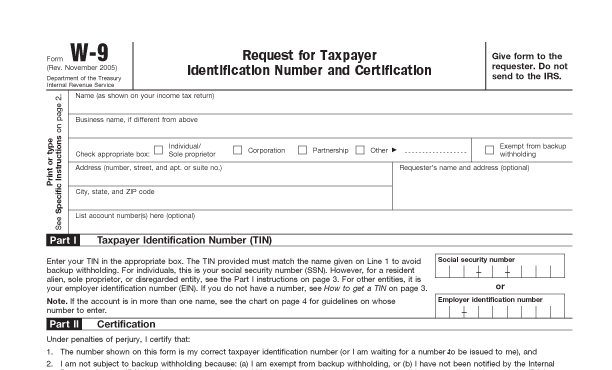

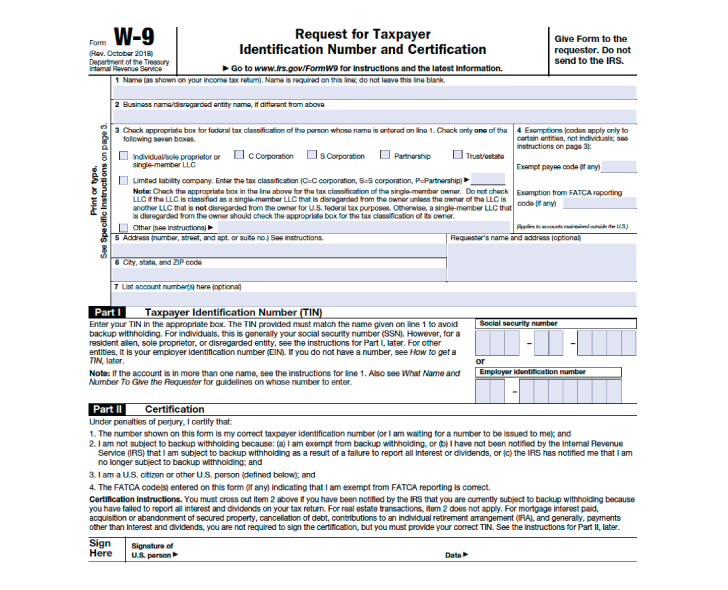

Businesses must have independent contractors complete Form W-9 Request for Taxpayer Identification Number and Certification before beginning work. The W-9 form provides key data clients need if youre an independent contractor. A W-9 form is completed by independent contractors and freelancers as a means of gathering information for the Internal Revenue Service.

Beginning in 2020 the information on the W-9 is used to complete a 1099-NEC form reporting non-employee income for a tax year like a W-2 form for employees. Form W-9 is an IRS form that is filled out by self-employed workers for companies they are providing services for. You must get a W-4 form for non-employees independent contractors freelancers and others before the person is hired and before the work begins.

If you or your spouse have self-employment income including as an independent contractor use the estimator. W9 is the form filled by third party companies such as independent contractors who provide services to companies upon the request from the respective company. Sometimes it can be difficult to know what forms are needed when hiring a new person for your business.

Below are some categories under the CommonLaw Test that may be considered when determining a. In turn employers use a contractors W-9 to complete a 1099 detailing the workers income. After the end of the year the payer sends a Form 1099 to the persons paid.

When a business pays a contractor in excess of 600 during a tax year the business is required to file Form 1099-MISC. To be accurate submit a 2022 Form W-4 for all other jobs. At the end of the year employees receive a W-2 tax form recording their earnings.

Its generally only used by legal employees of a company while contractors use a separate form called a W-9 that specifies basic information like name and Social Security number. A W-9 is sent by a client to a contractor to collect their contact information and tax number. W4 or 1099 Employee or Independent Contractor In determining a workers status the primary inquiry is whether the worker is an employee or an independent contractor.

Form W-9 is most commonly used in a businesscontractor arrangement. IRS Tax Forms in the W-8 Series W-8BEN W-8BEN-E W-8ECI W-8EXP W-8IMY International vendors must submit a US withholding certificate W-8 series of forms with an Employer Identification Number EIN Individual Taxpayer Identification Number ITIN or Social Security Number SSN in order to claim an exemption from or reduction in. The contractors job is to fill it out with tax info for.

W4 is a form that has to be completed by the employee. The W-9 differs from a W-4 Formwhich is more commonly supplied by employees to direct employersin that the W-9 does not inherently arrange for the withholding of any taxes due. There are 18 different 1099 forms each one relating to the nature of the income.

Independent contractors fill out the W-9 to confirm their tax responsibilities and provide information to their employer s. To be accurate submit a 2021 Form W-4 for all other jobs. Form W-9 is sent to the company that requested it not to the IRS.

Businesses can use Form W-9 to request information from contractors they hire. Leave those steps blank for the other jobs. Complete Steps 34b on Form W-4 for only ONE of these jobs.

Tax forms for independent contractors. W-4 forms are directly tied to federal taxes withheld by an employer usually set in place when you start a new job and receive your first paycheck. Forms W-8 Series and W-9.

When comparing a W-9 Form and a W-4 Form the W-4 process is reserved for employed persons only. If you are hiring a new employee you must have that person fill out a W-4 form. Generally independent contractors and freelancers yes they are self-employed are required to fill out and submit the Form W-9 to the payer.

Leave those steps blank for the other jobs. Employer is the responsible party for the completion of the W2. You must use either one of two forms a W-4 or a W-9 depending on whether you are hiring a new employee or an independent contractor.

Unless you are hired as an independent contractor your employer will use information you provide to fill out the W-4 form and withhold the correct amount of income tax from your pay. If you or your spouse have self-employment income including as an independent contractor use the estimator. Complete Steps 34b on Form W-4 for only ONE of these jobs.

Its the clients duty as someone who is contracting work to send the contractor Form W-9 before the end of the financial year. Just be sure youre not really an employee who should fill out a W-4.

W9 Form When And Why To Use It Harvard Business Services

W4 Form Florida The Reason Why Everyone Love W4 Form Florida Irs Forms Power Of Attorney Form Tax Forms

W4 Vs W2 Vs W9 Vs 1099 Tax Forms What Are The Differences

W4 Form Florida The Reason Why Everyone Love W4 Form Florida Irs Forms Power Of Attorney Form Tax Forms

Difference Between W2 W4 And W9 Forms Compliance Prime Blog

W9 Tax Form 2020 Printable Template Printable Free Calendar Template Calendar Template

What Is Irs Form W 9 Turbotax Tax Tips Videos

W 9 Form What Is It And How Do You Fill It Out Smartasset

Pin On 1000 Examples Online Form Templates

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Learn How To Fill Out A W 9 Form Correctly And Completely

W 9 Form What Is It And How Do You Fill It Out Smartasset

W4 Vs W2 Vs W9 Vs 1099 Tax Forms What Are The Differences

Post a Comment

Post a Comment