There is a W8 BEN for non-US income and W8 ECI for US effectively connected income. So I understand I need to fill W-8ECI.

Facebook Tax Information Fill Up 2021 123 Tech Info

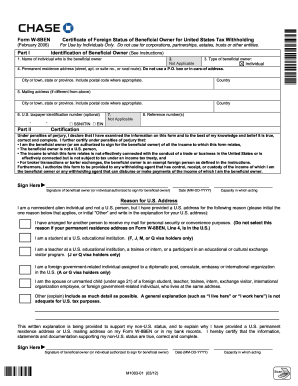

US tax law requires Bootstrap Themes to collect tax information from our sellers.

W9 form vs w8. W9 form is a question that most businesses should have answered especially because it can save yo. If you are a resident - you should use W-9 form to provide your correct TIN SSN to the requester. A W9 form is provided to employees from an employer to verify the identity of the employee for tax purposes.

You complete the appropriate form based on the nature of income you are receiving. The W8 and the BEN W8 are a set of American tax forms which certify your tax status in relation to the American authorities the IRS. Heres a sight to behold.

There is only one Form W-9 but five different types of W-8. FATCA agreement forms W-9 W-8 BEN W-8 BEN-E. W-8BenE W8 is for non-US residents Entities.

If you are non-resident - use the form W-8BEN. Which Is The BEST For US CompanyThe W8 vs. Form W9 is intended for US persons as explained in question 2.

There is a W8 BEN for non-US income and W8 ECI for US effectively connected income. If you are a corporation enter the country of incorporation. W-9 A Form W-9 is a document issued by the United States Internal Revenue Service IRS for certain taxation purposes.

Let me know if you need any help. W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes certifying that they qualify for a lower. US tax residents should fill out a W9.

Comparison Between W2 W4 and W9 Form. Which form you have to complete and upload depends on where you are a tax resident. Unlike a W8 form it plays no role in applying for tax exemption or rate reduction status.

Failure to complete this form may result in a 30 withholding on income paid to you from sources within. Form W9 is only for US individuals. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US.

I read from W-9 explanation that. Entity that has a foreign owner must use the appropriate Form W-8. Non-US tax residents should complete a W-8BEN.

Typically when a contractor gets a Form 1099 from a client some of those blue boxes are going to be filled inwith the contractors name address the TIN they entered on Form W-9 and other info. So if youre wondering whether you should complete and file a W8 or W9 form it simply comes down to your residency status. You only need a w8 if services were provided on the US.

Or by foreign business entities who make income in the US. The equivalent form that applies to non-US persons is W8-BEN for individuals and W8-BEN-E for entities. Form W-8BEN is the correct form.

If you bought something from overseas and it was imported no. The UK Deloitte office basically explained capital gains but arent answering about my tax status W9 vs. A Form 1099 thats totally blank.

If youre a contractor and you get a Form 1099 keep a copy for your files. Wayne Spivak President CFO July 19 2013. Let the US residents figure the W9 form procedure by themselves.

If I just sell whilst under W9 status and transfer the money back to the UK will this all just get evened out next year when I do both a UK and USA tax return via deloitte or am I in danger of breaking some IRS rules if I do that. One may have to create or request a taxpayer identification number in order to fill out the form. W9 is different from a W4 because a W4 is telling the employer how many exemptions one may have.

My friend did W9 and realized at tax filing time it was incorrect wasnt a big deal though. If you hired a consultant and they did work in the US you need a W8 only Id they claim no taxes because they are from a treaty country. If you are a non-US individual then you need to be completing a W8.

W8 Vs W9 Form. These tax forms are only used by foreign persons or entities certifying their. The W9 form is required to be submitted by US residents and asks for more specific details.

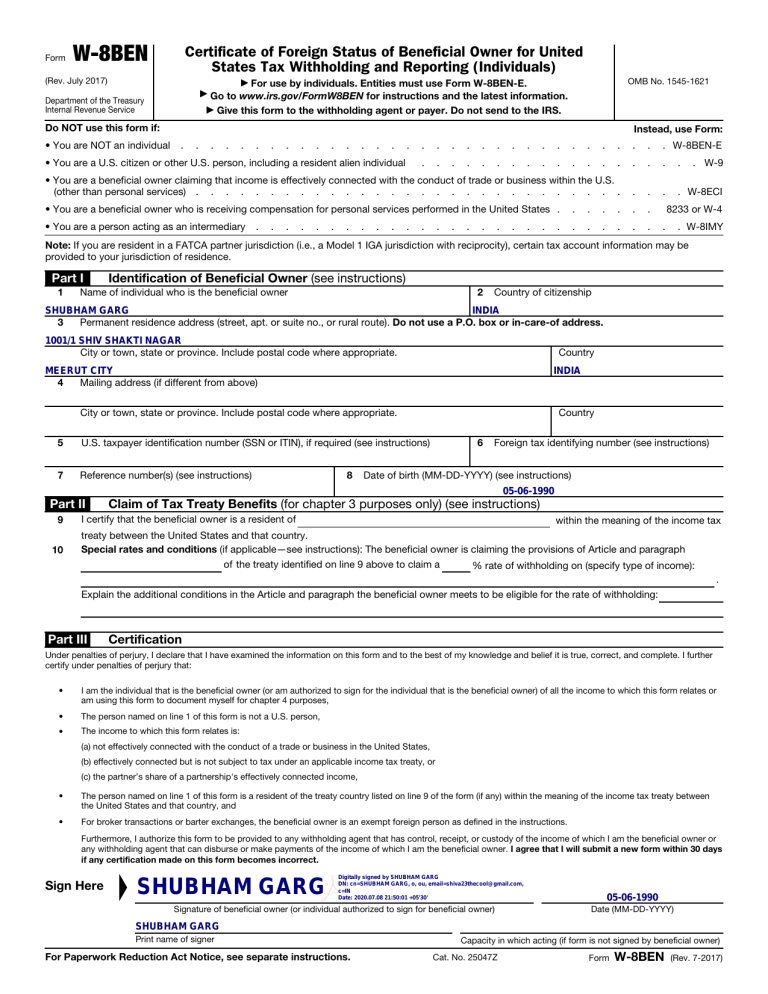

The difference between W-8 and W-9 forms lies in the fact that the W-9 tax form is only required to be used by companies or associations that are created organized and primarily in the US operating under United States laws. The W8 BEN form is required for non-US residents and you just need to fill in your Name Location Country and your signature. If youre a legal citizen of the United States at no point will you have to worry about filling out the form.

If you are a non-US individual then you need to be completing a W8. Form W-9 is to be filled out by US workers that have a SSN or TIN while W-8 forms are filled out by foreign individuals and non-resident aliens who receive income from US sources. Non-US organizations should complete a W-8BEN-E.

W-8Ben W8Ben is for non-US residents Individuals. The W8 is a form that must be filled out people or businesses who arent domiciled in the United States but have received income or payments in the USA. The major difference between the W2 W4 and W4 2019 is that W4 is an input document whereas W2 is an output document.

For non-US residents who earned money from US based online affiliate programs you will be asked to submit a W8Ben form. If you are requested to complete and sign. Submit Form W-8BEN-E to the withholding agent or payer such as financial institution or real-estate holding partnership if you are a foreign non-US entity and you are the beneficial owner of an amount subject to withholding.

Form W9 is only for US individuals. You complete the appropriate form based on the nature of income you are receiving. Im on F1 OPT and did this last year.

But when I start to do it it asks me. Please be aware that as a foreign person - you are a subject of 30 income tax withholding on dividends and capital gain unless you timely provide the form W-8BEN. What happens if Im asked to complete Form W9 and Im not a US person.

If you are filing for another type of entity enter the country under whose laws the.

W 8 Form Printable Fill Out And Sign Printable Pdf Template Signnow

W8 Ben For International Clients

Blank W8 Fill Online Printable Fillable Blank Pdffiller

Canva On Twitter Adva82259269 Hi There We Are An Australian Incorporated Company Foreign Entity And As Such We Do Not Have W8 Forms Since We Do Not Have A Us Tax Id

23 Printable W 8 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

What Risk Would I Take By Filling Out A W8 Or W9 For A Firm That Asks For One Personal Finance Money Stack Exchange

W 8 Or W 9 Form Not Sure What You Need Let Us Help You

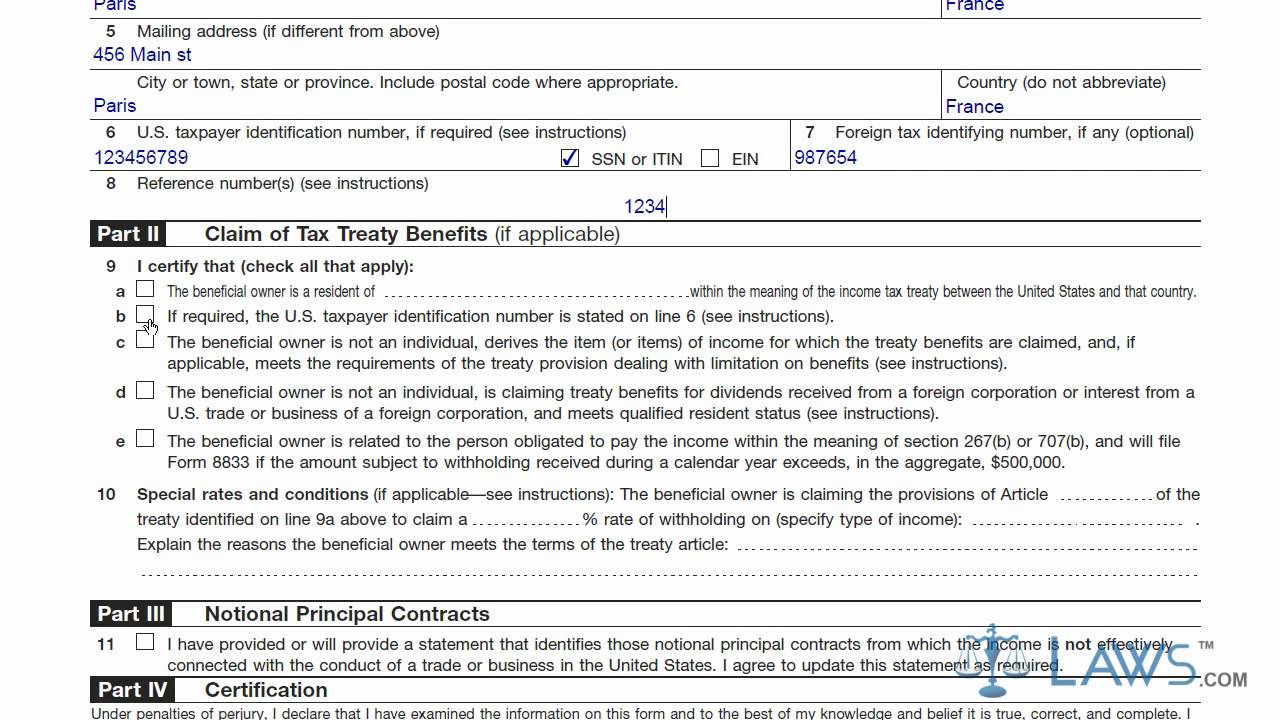

Learn How To Fill The W 8 Form Certificate Of Foreign Status Of Beneficial Owner For United States Youtube

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions 8 Things You Should Do In Form W8 Instructions Employment Application Irs Forms Job Application Template

W 8 And W 9 Instructions University Of Missouri System

Post a Comment

Post a Comment