I went back to a 2016 1040 form to figure out what they want. It has nothing to do with your W-2 income.

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

Enter here and on Form 1040 or 1040-SR line 8a.

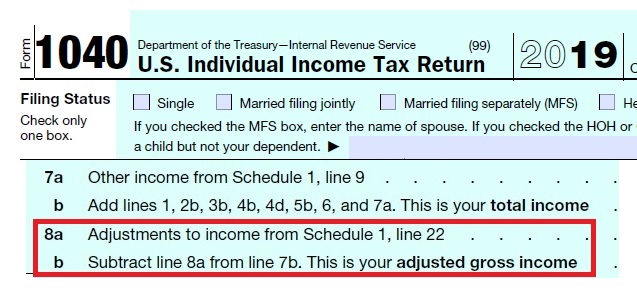

What is line 8a on 1040. The adjustments subtracted from total income on Form 1040 establish the adjusted gross income AGI. Enter this amount on line 1. The entire distribution is not taxable.

This amount would be put on Line 8a on the 1040. Subtract that amount from the amount on Form 1040 line 7. 70 95 150 245.

Use the first area for an address and the second area for the number of days. Have you considered ways to. You can find this information on.

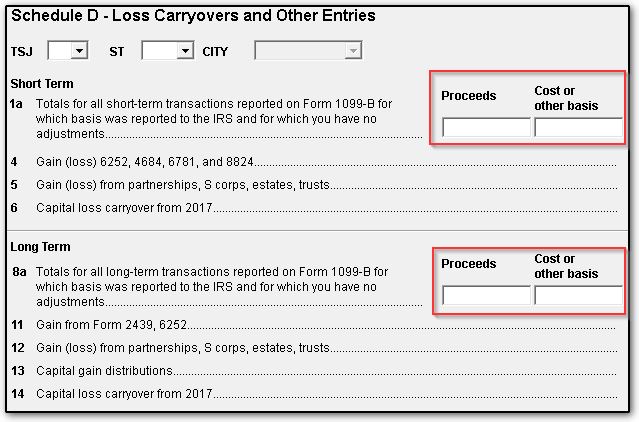

Line 8A - Net Long-Term Capital GainLoss - Amounts reported in Box 8A are not considered passive income. Line 9 asks you to add the values on lines 1 through 8. You can get this information of the Form 1099-INT that these institutions will send you.

The answer to the question is what is the limited amount for the property the 1098 is for that you will report on your Schedule A. 8b would be the line that would show your Tax exempt interest which for 2019 form would be line 2a. For Paperwork Reduction Act Notice see your tax return instructions.

Be sure to answer. Deduct your nonrefundable credits if any using the Ohio Schedule of. That amount from the amount on Form 1040 line 7 and enter the Amount received as a pension or annuity result in the first space of Step 5 line 2.

Lines 8a-d are where youll record any earnings from a job you already paid Social Security tax on like wages or salary. Taxable interest is the interest you receive from banks credit unions savings and loans brokerage houses etc. Income and Adjustment to Income Line for other income expanded.

Next youll gather all 1099-DIVs and other documents reporting dividends. Next look at line 11 of your Form 1040 or 1040-SR to find your AGI. What is the total taxable interest income shown on Line 8a of Form 1040.

Line 10 has two manual entry areas. Amounts entered on this line will automatically flow to Schedule D Form 1040 Line 12. Line 8 is for miscellaneous untaxed income you earned but did not report anywhere else on your tax return.

Enter Clergy on the dotted line next to Form 1040 line 66a. You can find this information on the Form W-2s your employer provided you. Line 11 is manual selection of Radio Button a b c or d.

Tax-exempt municipal bond interest is reported on Line 2a of Form 1040. Line 9 has two areas for manual entry tax homes and one date area. Line 8 covers any other income you had during the year.

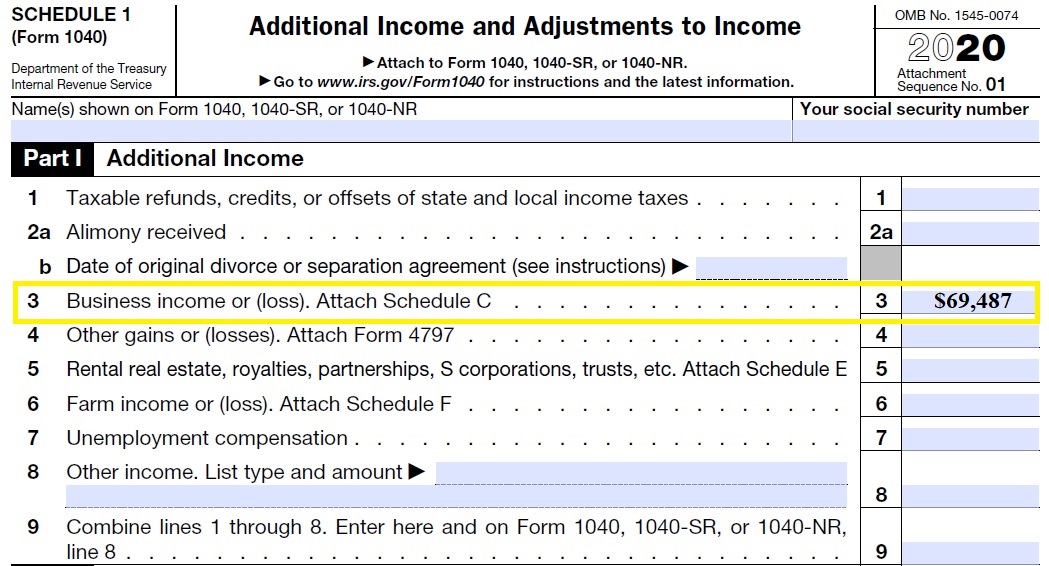

Line 8a is manual selection of YesNo Radio Buttons. This lesson covers the Adjustments to Income section of Form 1040 Schedule 1. 71479F Schedule 1 Form 1040 or 1040-SR 2019.

Line 8 is split out into lines 8a. On money you have deposited with them. Line 8a is where you put the amount you are eligible to claim in the Earned Income Tax Credit.

From previous comments seems like different years and different 1040s have different lines for what they want from us. The sum is your total income also known as your gross income. Calculate your nonbusiness income tax liability Ohio IT 1040 line 8a and your business income tax liability Ohio IT 1040 line 8b.

You misinterpreted the intent of Line 8a. Taxpayers can subtract certain expenses payments contributions fees etc. Determine how much of the amount on Form 1040 line 7 was also reported on Schedule SE line 2.

Add lines 10 through 21. Line 8b has two manual entry areas. These are your adjustments to income.

Add these amounts to calculate your income tax liability before credits Ohio IT 1040 line 8c. Taxable interest goes on Schedule B of Form 1040. Interest Income is the most common box filled out for individuals.

Half of the distribution is taxable. Amounts entered on this line will automatically flow to Schedule D Form 1040 Line 12. Be sure to answer Yes to question 3 in Step 5.

Line 8a Form 1098 is the Address or description of property securing mortgage. Enter the result in the first space of Step 5 line 2. If you did have other income you will also need to attach Schedule 1.

Then on line 10a the taxpayer is asked to subtract the amount from Schedule 1 line 22 Adjustments to Income. From their total income. Schedule 1 Form 1040 Additional.

On page one of IRS Form 1040 line 8 the taxpayer is asked to add the amount from Schedule 1 line 9 Additional Income. If you receive a 1099-INT or a 1099-OID at the end of the year then you probably have some taxable interest. Private activity bond interest is reported on Line 2g of Form 6251 as an adjustment for calculating the alternative minimum tax.

Added line 23 for Archer MSA deduction Lines 24a to 24k and 24z added for Other Adjustments. Line 8b is for the nontaxable combat pay election applicable to military filers only. You would then enter the total from Schedule B on line 2b of your Form 1040.

Line 37 is your Adjusted Gross Income which for 2019 is line 8b. The IRS has a chart that helps you figure this out. Interest income can really increase your tax bottom line.

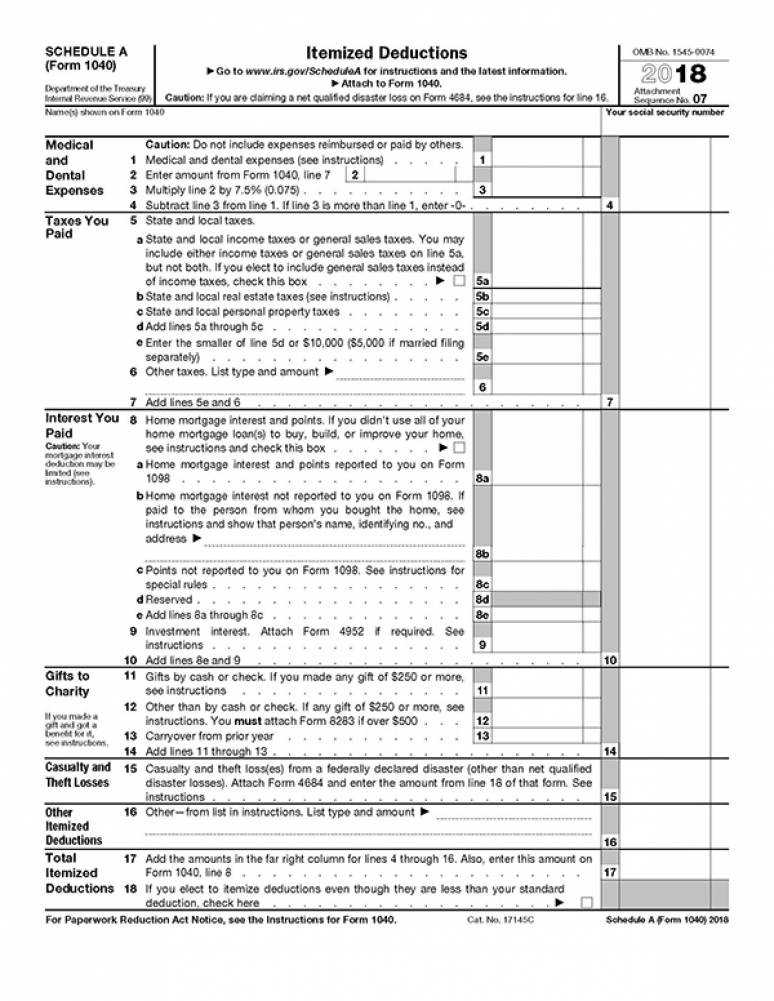

Total everything you spent on medical or dental expenses during the tax year that wasnt reimbursed by insurance. On the dotted line next to Form 1040 Church employeesDetermine how much of the amount on Form 1040 line 7 was also reported on Schedule SE line 5a. This includes everything not included in the previous lines.

Lines 1 through 4 in the first section are dedicated to medical and dental expenses. On Form 1099-INT Box 1. The balance remaining is entered on your Schedule B and on your Form 1040 in line 8a.

Some items in the Adjustments to Income section are out of scope. How does the code Q on Quincys Form 1099-R from Essex Bank affect the return. Youre legally liable for the repayment of the mortgage.

Line 8 has been expanded to lines 8a to 8p and 8z Added line 9 for total other income Added new lines in Part II. Lines 8a-c let you deduct any home mortgage interest you paid on your primary or secondary residence this year which youll also report on Form 1098 as long as.

What Were Your Total Untaxed Portions Of Ira Distributions Federal Student Aid

Expense Report Sample Template

Schedule D Lines 1a And 8a Scheduled

Get To Know The New Tax Code While Filling Out This Year S 1040 The New York Times

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Form 1040 U S Individual Tax Return Irs Tax Forms Tax Forms Tax Return

Adjusted Gross Income Form 1040 Decoded Physician Finance Basics

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Get To Know The New Tax Code While Filling Out This Year S 1040 The New York Times

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Fillable Form 1040 2020 In 2021 Income Tax Return Irs Tax Forms Certificate Of Participation Template

Post a Comment

Post a Comment