Thus if the W-2 information is entered correctly into an individuals tax return no special treatment of the 403b deferral is required. The plan is considered an elective deferral meaning you do not report the deposits into the plan as.

Understanding Your W 2 Controller S Office

To calculate total elective deferrals reported on Form 8880 Line 2.

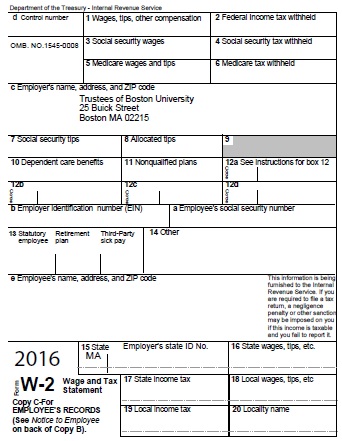

403 b w2 form. IRS Pub p571 states that deductionscontributions for 403 b retirement plans are not reported for income tax purposes but are shown on the W-2 in block 12 with an E code. 403 b contributions on W-2 Form. To help you understand your Form W2 weve outlined each of the W-2 boxes and the corresponding W2 box codes below.

The IRS regulates the operation of 403 b plans which must conform to certain contribution and participation rules in order to maintain tax-deferred status. By bobfree Sat Apr 07 2007 630 pm. Box 1 Shows your wages tips prizes and other compensation for the year.

If an amount is excluded from your income it is not included in your total wages on your Form W-2. UltraTax CS uses amounts entered on Screen W2 Box 12 Code E in the following locations. The employer may also contribute to the plan for employees.

The W2 boxes and codes show the wages youve earned and any taxes paid through withholding. For those UNMC employees who took part in the 403b Supplemental Retirement Account SRA in 2002 the recently mailed W2 tax forms are missing required data. Since the type of income paid to employees must be reported along with the amount W2 12 Codes help employees identify the different types of payments.

Allowable contributions to a 403b plan are either excluded or deducted from your income. Form W-2 Box 12 Code E - Section 403b contributions. The taxable year 2000 for each of five years to a 403 b plan.

A 403 b plan is a type of tax-deferred retirement plan that is similar to the 401 k plans offered by many employers. The form must be sent each year before January 31 to allow employees enough time to file income taxes ahead of the IRS deadline. 403 b reporting on W-2.

Who Files Form W-2. A 403b plan allows employees to contribute some of their salary to the plan. Employees save for retirement by contributing to individual accounts.

This means that you do not report the excluded amount on your tax return. Hannibal MO The church paid the pastor 20000 in wages and 10000 in housing allowance. Amounts entered on Screen W2 box 12 Code E reduce the overall annual.

If the IRS extends the deadline you can delay payment of taxes without incurring a penalty tax. Be maintained per a written plan that satisfies the requirements of IRC 403b in form and operation effective January 1 2009. For state tax returns the same process should apply.

This election provides a long -term employee with an additional excludable deferral totaling 15000 but which must be made over a period of five or more years. Any other contributions for example employer contributions or mandatory employee contributions under a governmental plan are not reported in Box 12. An employer is required to send Form W-2 to every employee of the company who earned a salary or other type of compensation.

Only contributions that are pre-tax deferrals and if permitted under the 403b plan Roth 403b contributions should be reported in Box 12 of the Form W-2. A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt organizations and certain ministers. This is a university-wide situation and affects employees participating in the 403b SRA plan at all four NU campuses and in central administration.

Most contributions to a 403 b plan are tax-deductible. The written plan must state the material terms and conditions for eligibility benefits limitations available contracts and the time and form of benefit distributions that apply to the plan. See the meaning of all the W-2 Box 12 codes below.

Box 12 code E would be contributions to your 403 b plan. Where do I find 403b contributions on W2. The 403 b elective deferrals salary reduction agreement means you have a retirement plan at work similar to 401k plans where employer takes money out of your paycheck before you receive it and deposits it into your 403 b retirement plan.

Regardless of whether the 1099-B form has or does not have the cost basis it is still important to report this on the tax return. On Form W2 the Box 12 Codes are certainly something that falls a little bit outside of this. 1000 was withheld from the pastors wages and put in a 403 b plan leaving salary of 19000.

Please advise us on how to complete the pastors W-2. Choose a 403 b Plan. Employers can also contribute to employees accounts.

Form W2 is filed by employers to report wages salaries and other compensation paid to employees. With all the details about the taxes on equity compensation and all about the form W2 you can go ahead and schedule to offer one of the stock option plans to your employees. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

The same is the case for Roth 403b contributions as well since the Form W-2 would properly report these contributions as include in taxable income. 2 Elective Deferrals under a 403b plan are also counted toward the contribution limit under section 457. See story for details.

Understanding Your W 2 Payroll Boston University

How To Read Your W 2 Justworks Help Center

How To Read Your W 2 University Of Colorado

Understanding Your Tax Forms 2017 Form W 2 Wage And Tax Statement

Clues A Form W 2 Provides About A 403 B Plan Voya Insights

How To Read Your W 2 Justworks Help Center

Are 403 B Contributions Tax Deductible Turbotax Tax Tips Videos

Is The Amount In Section Aa On The W 2 Form Consid

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

Form W 2 Explained William Mary

Post a Comment

Post a Comment