Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file. PayPal officially announced that it will be making its foray into the world of crypto by allowing its customers to buy sell and spend cryptocurrencies within the PayPal app also rolling out to Venmo in the first half of 2021.

Robinhood Requesting Form W9 R Tax

Now Could anyone please enlighten me as to which form should I use to file my taxes.

W9 form robinhood. They said my TIN did not match my name and provided both both were correct and matched. Form W9 is intended for US persons as explained in question 2. If you are requested to complete and sign the wrong form for your status inform the form.

Also I think its somewhat important to describe my situation. Retirement accounts subject to FBAR reporting. Commission-free Stock Trading Investing App Robinhood.

Within the next few days you will receive the form via an email from dsedocusign with the subject line Please DocuSign W-9 to Continue Using Robinhood. That the individual in question is the beneficial owner of the income connected to Form W-8BEN. That the individual is a foreign person technically a non-resident alien and not a US.

We recently received a B-Notice from the Internal Revenue Service IRS regarding your Robinhood Securities account which means that your Tax ID or other identification doesnt match what the IRS has on file. Answer 1 of 2. To satisfy the IRS requirement you will need to complete a W-9 form.

Most of the time. What happens if Im asked to complete Form W9 and Im not a US person. The Tax Implications Of PayPals Foray Into Crypto.

W9 Form Robinhood A W9 form can be used to allow you to supply a person or a an institution that you are a member of with taxpayer Identification number TIN. I certify that each QDD identified in Part I of this form or on a withholding statement. The only option available to change is I am not subject to backup withholding.

The brokerage account in the US may have specific requirements if your address is no longer in the US. A response would be very very helpful. Invest in BTC cryptocurrency with Robinhood in the easiest and fastest way.

The IRS requires you to certify your SSN or TIN to verify your US. On an F-1 being in the country under 5 years you ordinarily would not be a resident of the United States just remember to file IRS form 8843. Taxpayer meets FATCA threshold then those accounts must be also reported on form 8938.

3 Qualified Derivatives Dealers 16a. Similarly Norwegian individual retirement accounts are exempt from FATCA on the Norwegian side. But in most cases they would be able to update the account and keep it operational.

Form W-9 asks for the independent contractors name business name if different business entity sole proprietorship partnership C corporation S corporation. If youve been notified that the taxpayer information we have on file for you is incomplete or inaccurate youll need to complete the Substitute Form W-9 to certify your SSN or TIN. Last tax season they did not request one and I closed my Robinhood account a few months ago.

Hi Robinhood has asked me to confirm my tax status to ensure my W9 information is correct. There are two angles to this. No matter how you view the announcement this is a net-positive.

The W-9 form allows businesses to collect personal information from independent contractors such as name address and tax identification number. Upon receipt of a B-Notice from the IRS. Treasury they are on-US.

That the individual is eligible for a reduced rate of tax withholding or is exempt entirely due to. However for the US. I am on the process of getting a Green Card it isnt approved yet I do have a.

This permits them to report information including income received IRA contributions and your capital gains earnings to the IRS. At tax time companies use this to fill out a 1099 form which reports how much they paid the contractor. Robinhood requesting form W9 Im new to buying and selling stocks and recently I decided to buy some stocks on Robinhood.

Im planning to call Robinhood to confirm this is legit but wanted to check on here as well. The equivalent form that applies to non-US persons is W8-BEN for individuals and W8-BEN-E for entities. 2 - B-Notice - The IRS identifies that the name and tax identification number TIN combination reported on a Form 1099 is not correct for a specific account and sends the payer a B-Notice.

You can review the form adopt a signature and complete the signing process without having a DocuSign account. So you should file form Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax. Just got a letter from Apex clearing requesting a completed W9.

The purpose of the form is to establish. Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS. Information Needed on Form W-9.

Here is the email. From Oct 2008 however I am on H1B status. To prevent 24 IRS backup withholding and account restrictions please complete the following before December 6th.

Im going to college Im dependent on my parents tax return files also irl I dont have any taxpayer information or account setup to my name. Buy Bitcoin with 1 - BTC 4240381 Jan 18 2022. While Robinhoods app may glitter its lack of automated tax-saving options may cause you to lose out on a lot of gold.

Robinhood will also notify customers if there is an issue with their certification that requires attention. Tax in India -. 9 months on OPT 3 months H1Bwhat form to fill 1 Answers Good Evening I was on H1B since Oct 2007 through Oct 2008.

What Is A W 9 Form 2020 Robinhood

Robinhood Referrals Program Review 2020 Www Affopps Com

Robinhood Confirm Your Tax Status R Daca

Got My Class Action Lawsuit Paper Work For Robin Hood Today 65 Million Seems Like A Slap On The Wrist All Proceeds Will Be Used To Buy More Gme R Superstonk

How Do You Pay Taxes On Robinhood Stocks Picnic S Blog

Robinhood Referrals Program Review 2020 Www Affopps Com

What Is A W 9 Form 2020 Robinhood

Can Person On H1b Use Robinhood Blind

How To Read Your 1099 Robinhood

Got My Class Action Lawsuit Paper Work For Robin Hood Today 65 Million Seems Like A Slap On The Wrist All Proceeds Will Be Used To Buy More Gme R Superstonk

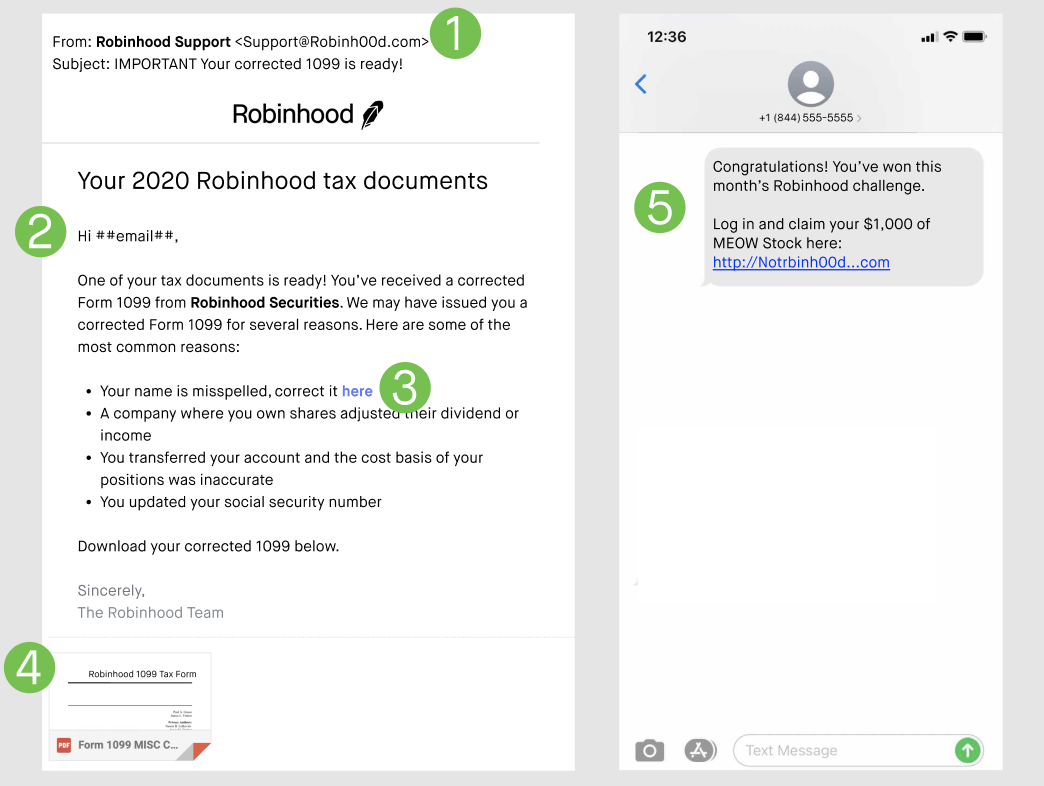

How To Identify Report Scams Robinhood

Don T Touch Robinhood S Latest Scam Email R Gmejungle

Post a Comment

Post a Comment