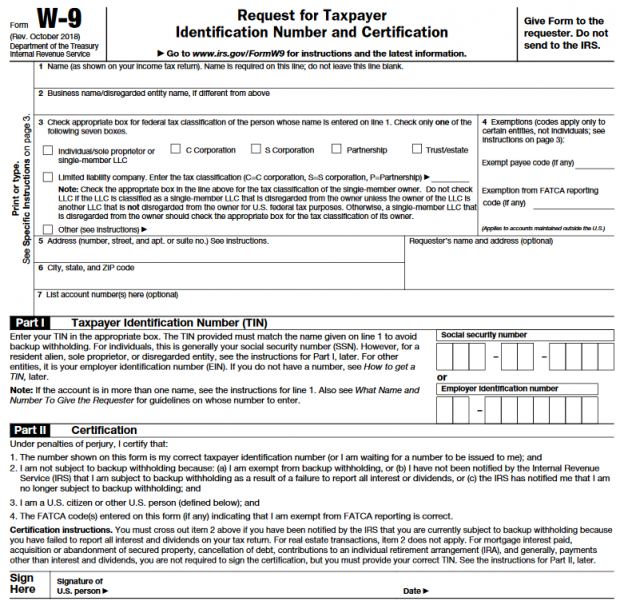

How to complete the W9 form print online. Filling out W-9s The TIN is entered on part one of the form and it must be the correct TIN.

W9 Form 2020 W 9 Forms With Printable W 9 Form Blank In 2021 Irs Forms Calendar Template Calendar

Submit the completed W-9 to the person who requested it from you.

How do i create a w9 in quickbooks. Create a Custom Field. Check only one box on line 3 of the W-9. Have them send you an invoice when theyre ready to be paid and send them a check.

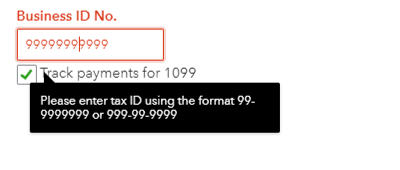

Who needs to provide a W9 form. Please make sure that you follow the format indicated for tax ID Click Save. Point to the Vendors menu and select Enter Bills Select the name of your independent contractor from the drop-down box next to the Vendor field.

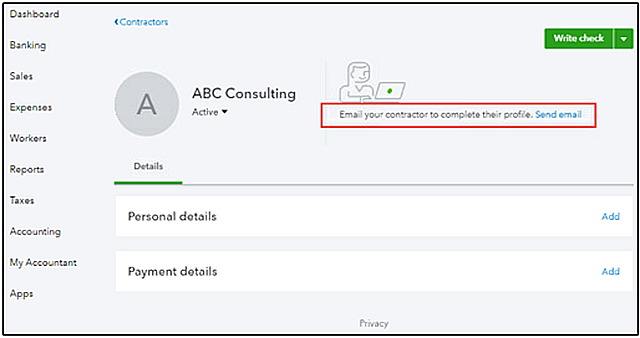

You can now create utilize and memorize a Vendor W-9 Information Report. Next Click Add Contractor. Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS.

Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file. Is a W9 form mandatory. What is expense reimbursement revenue.

Save this form in your files. Log into QuickBooks Online. Click the vendors name and next hit Edit.

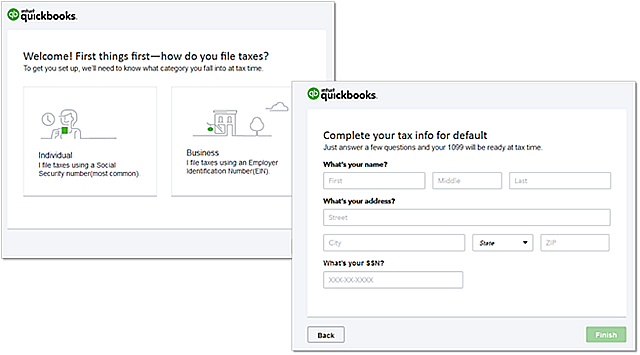

Who is required to provide a W9. To create the report. Click the Add button next to the People Products and Bank Accounts sections to add the information to your account.

If youre filing a W-9 for your company verify your firms business structure C corporation LLC etc and complete line 3. Click on the Tax Settings tab and enter the contractors tax identification number or Social Security number if the vendor is a sole proprietor. Click add field and select vendor Info.

What expenses are. All my information AND the information of the vendor are already in Quickbooks. Your address is posted to lines 5 and 6.

Are meal reimbursements taxable. Once the correct Payer has been selected you can either Select your Recipients using the Check Boxes to the left of their name and then click the Bulk W9 Request button at. Have them send you a W9 and set them up as a vendor in QB.

Check Vendor eligible for 1099 Verify the tax. Your signature certifies that the information you provide is correct. In QuickBooks Online go to Payroll then Contractors.

The benefit to filling that out is that ifwhen you file your 1099s through Quickbooks Online Quickbooks will send an electronic copy of the 1099 directly through email to your vendor in addition to mailing a paper copy. Select the Details tab to see the contractors personal info. The advanced tools of the editor will direct you through the editable PDF template.

How do I enter a w9 in QuickBooks. Go to the Vendors menu and then select Vendors. Save this form in your files.

The Business ID No field is where you will enter. For each vendor there should be a download w9 or send w9 button. What if a contractor does not provide W9.

From the Reports menu List Vendor Phone List. Double check all the fillable fields to ensure complete accuracy. Prior to issuing a payment to any vendor you should first request they complete and return to you a Form W9.

Name on your tax return. Utilize a check mark to indicate the answer wherever needed. Enter the field name as Tax Entity Type W-9 and select the drop-down list option as the type.

If you pay them more than 600 for the year they need to receive a 1099-NEC. Click the gear icon and select custom fields under the lists column. You must confirm the three statements directly above the signature line.

Click the Customize Report button upper left corner on the Display tab - click into the Columns box and check the following options. I can second this. How do I account for reimbursed expenses in QuickBooks.

These are the options for which box you should check on line 3. Once you are logged into your Quickbooks Online file in the left panel click on Workers and then Contractors. When youre finished or if you want to skip this step and add the information as youre working click Start Working Information in this article applies to QuickBooks 2013.

Depending on your circumstance select the most appropriate federal tax classification on line 3 for the name entered on line 1. Select the contractors name. On lines 1 and 2 you enter either your name or your companys name.

Eventually you will make it down to the Business ID No and a check box for Track Payments for 1099. Once inside the Manage Recipient screen if you have more than one Payer click the Drop-down button at the top and select the payer that has the recipients you wish to send the requests to. Enter the persons name and email address.

Several types of individuals and businesses can fill out Form W-9. Leave BLANK in cases of rare exceptions for specific LLC or Corporations would this be filled out. Enter your full name including middle name or the name of your separate business entity if you created an LLC or Corporation.

Part two requires you to certify the information you provided is correct. How do I file a w9 on my taxes. Enter your official contact and identification details.

Is a refund considered revenue. Enter your official contact and identification details. To start the form utilize the Fill Sign Online button or tick the preview image of the document.

Utilize the Sign Tool to add and create your electronic signature to signNow the Online W. Create a bill to represent the work done by the independent contractor for your business. Next set up the vendor in QuickBooks Vendors Vendor Center.

This feels like something that should be an obvious and easy addition. What happens if I dont give a W9. Enter the Company Complete name Business ID NoTax ID No and address.

Method 1Method 1 of 1Pay an Independent Contractor in Quickbooks. Leave the box unchecked for use on other expense forms and leave the box for inactive checked. The check the box that says Email this contractor to complete their profile The Contractor will receive an email asking them to fill out the Form W9.

Can Intuit Please Fix The Broken W 9 Request Feature Clearly Not Working Vendor Account Creation Has Errors All Around Please Put In A Ticket With An Eta

New Qbo Contractor W 9 Self Set Up Insightfulaccountant Com

1099 W 9 Wtf How To Track File The Correct Forms For Independent Contractors Creative Entrepreneurs Things To Come 1096 Form

New Qbo Contractor W 9 Self Set Up Insightfulaccountant Com

I Got W 9 From A Contractor How Do I Upload It Instead Of Having Them Do So

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

New Qbo Contractor W 9 Self Set Up Insightfulaccountant Com

Is There A Way I Can Enter W9 Information On A Contractor Instead Of Sending Them The Information Email

How To Prepare A W9 Tax Form Youtube

I Have A W9 From My Contractor How Can I Upload I

Irs Form W 9 Is A Valuable Tool For Your Business

How Can I Send A 2nd Reminder For A W9

Operating A Business Employer Identification Number Hobbies That Make Money Hobbies Quote

Post a Comment

Post a Comment