An IRS Form is commonly used to collect information from freelancers independent workers or workers who arent employed in a company but have completed work. Filling out a W-9 is a pretty standard procedure.

Answer 1 of 3.

W-9 form $600. This entry was posted in W9 on September 10 2021 by tamar. Also when you open a financial account overseas the financial institution might be required to ask you for your US Social. For example lets say I made two sales.

Form W-9 is most commonly used in a businesscontractor arrangement. If you are self-employed you can send the form to someone. If you are a US citizen and you win 600 or more in a calendar year on PlayEdge Games and we do not already have your IRS Form W-9 on file then you must fill out IRS Form W-9 and send it to us before we can deliver your redemptionWhen your prize winnings trigger this requirement we will hold the rewards for you in a pending state until we receive your Form W-9.

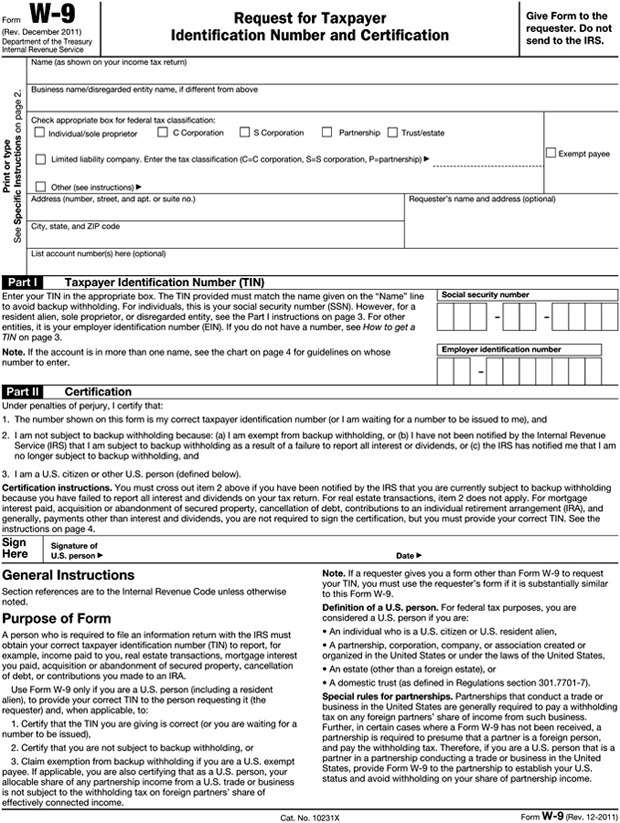

A W-9 form is an Internal Revenue Service IRS tax form that is used to confirm a persons name address and taxpayer identification number TIN for employment or other income-generating purposes. The IRS requires companies to file a Form 1099 to report payments to certain vendors in excess of 600. The W-9 form is an informational reporting tax form meaning that it provides information to the IRS about taxable entities.

When a business pays a contractor in excess of 600 during a tax year the business is required to file Form 1099-MISC. Gambling and lottery dont qualify though. When a company asks you to fill out a W-9 it is almost a virtual certainty they will need this form back before theyll pay you a penny.

Nonresident alien who becomes a resident alien. State Of Ohio Fillable W9the paper Form W-9 to write in online and print out a paper copy. The 600 Rule.

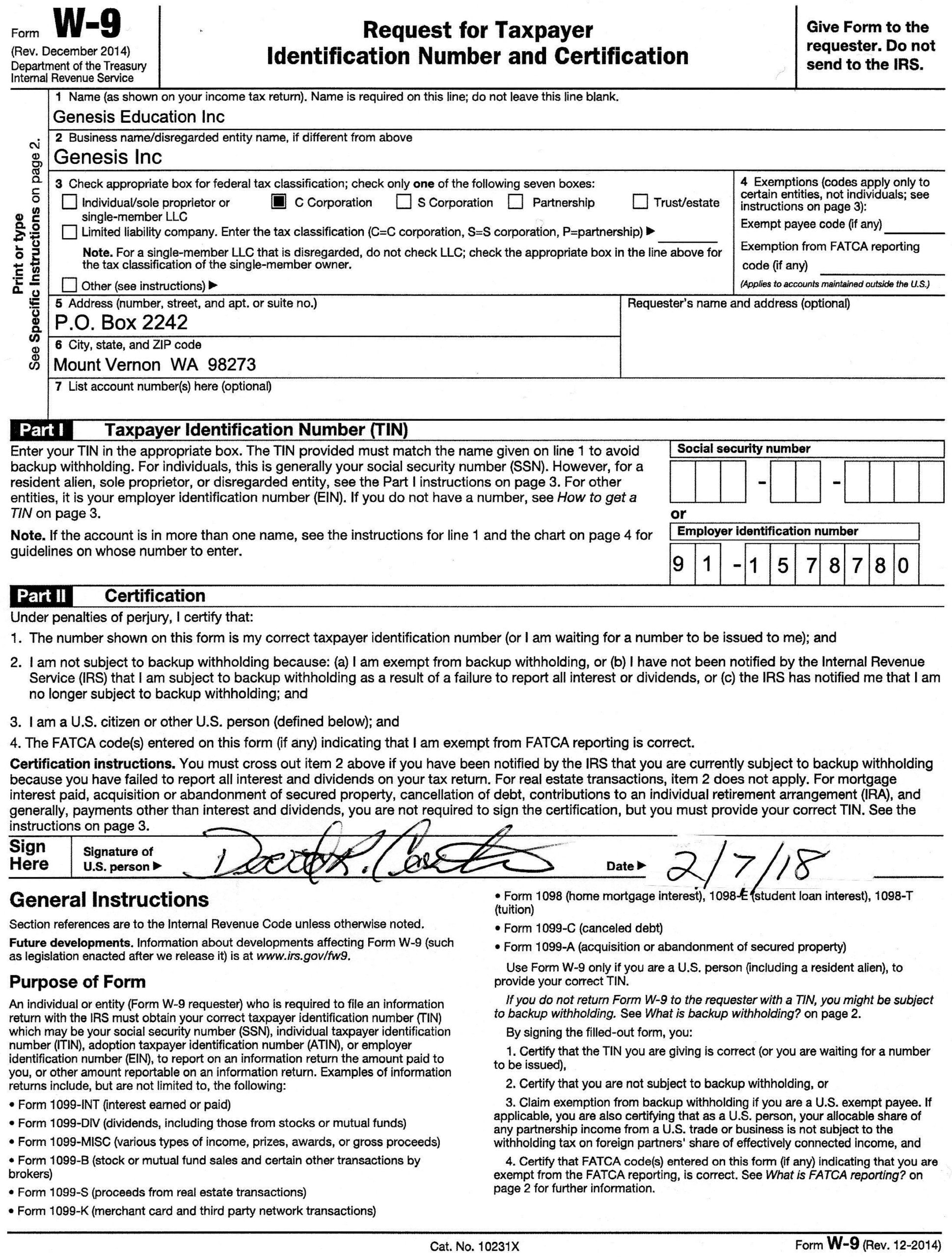

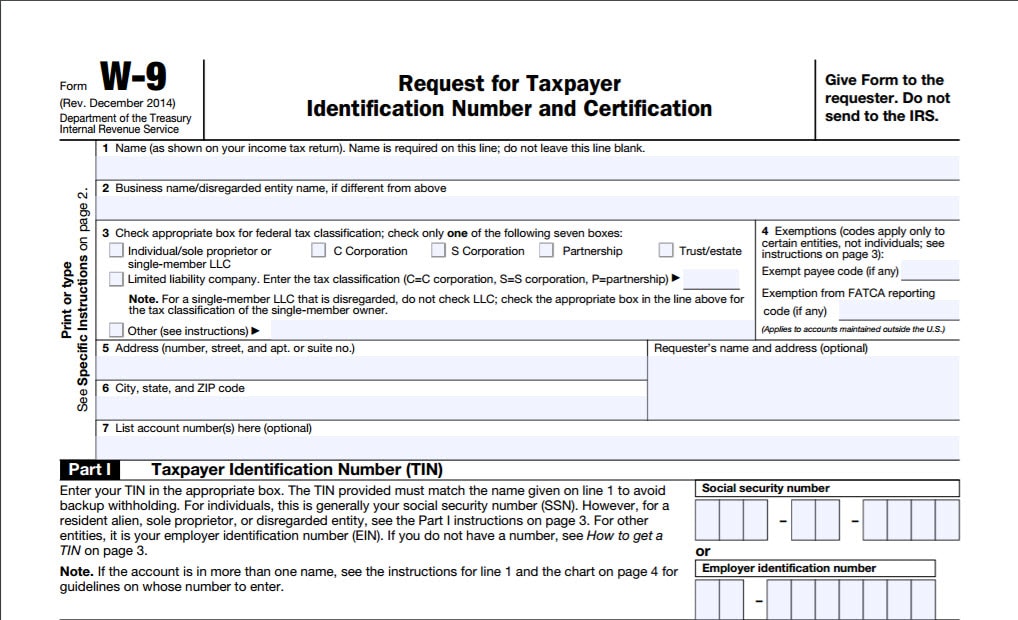

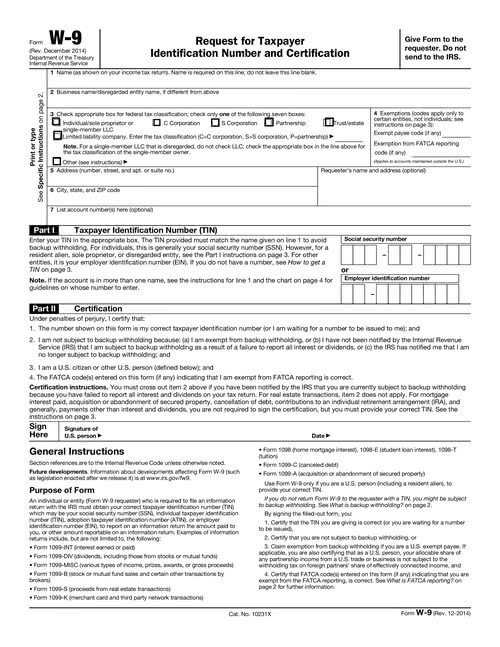

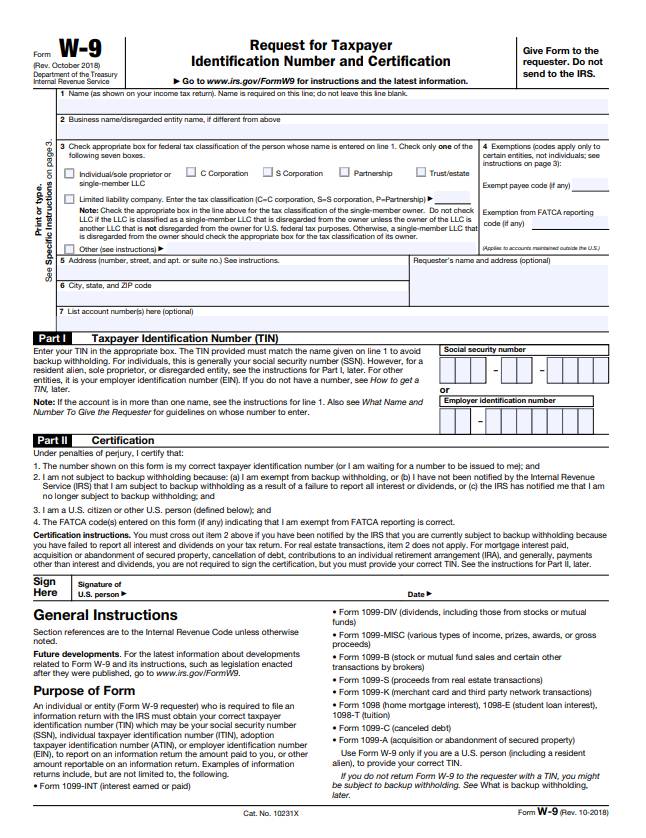

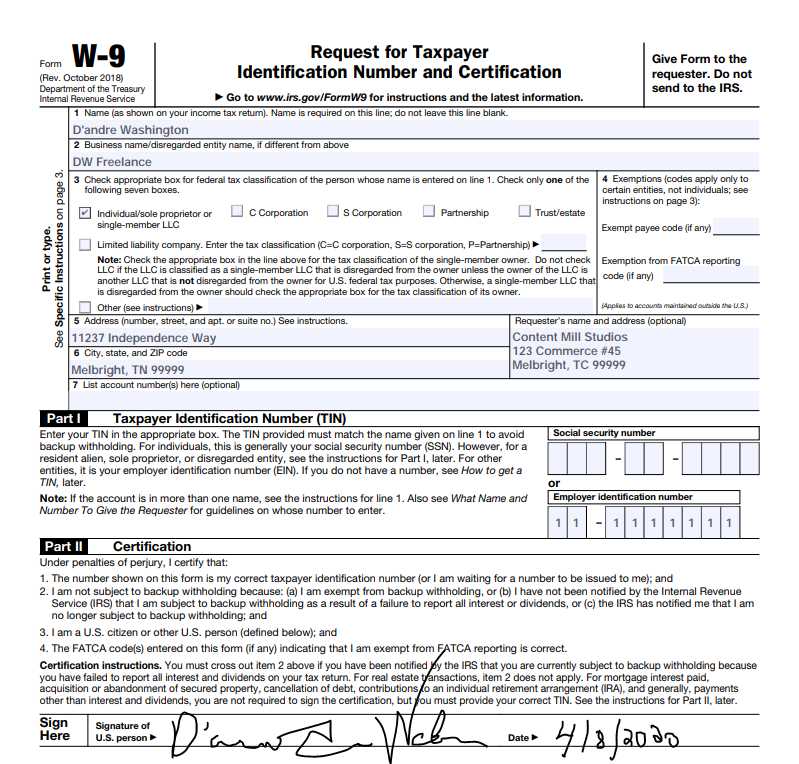

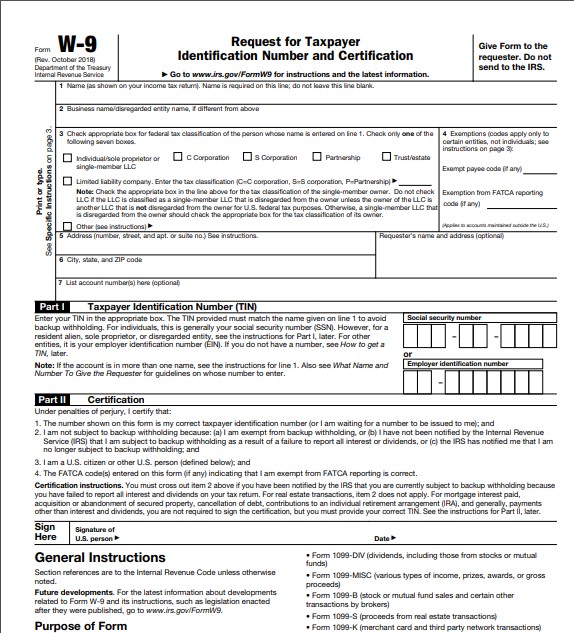

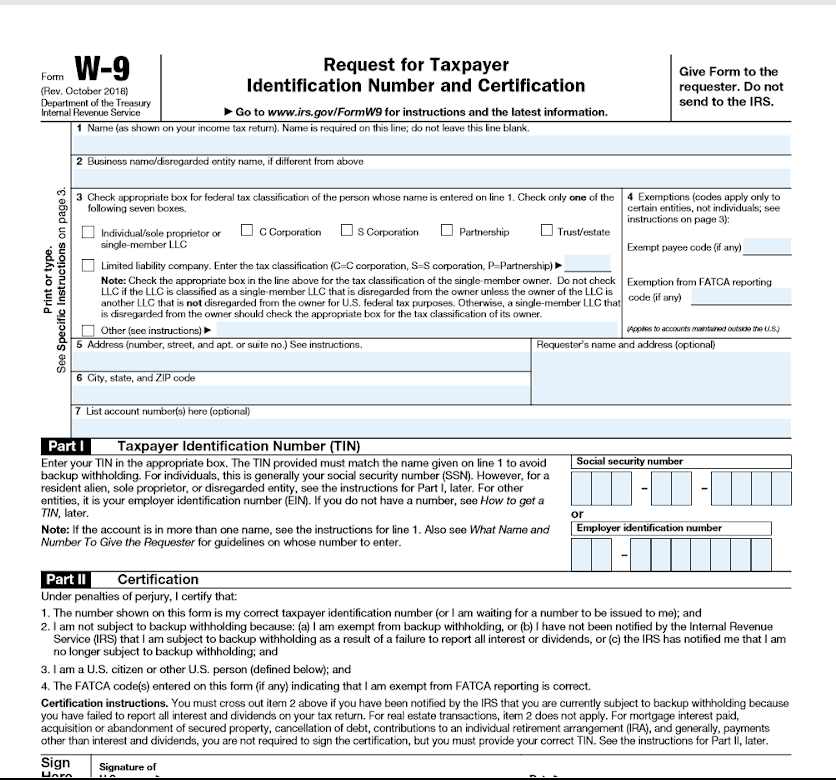

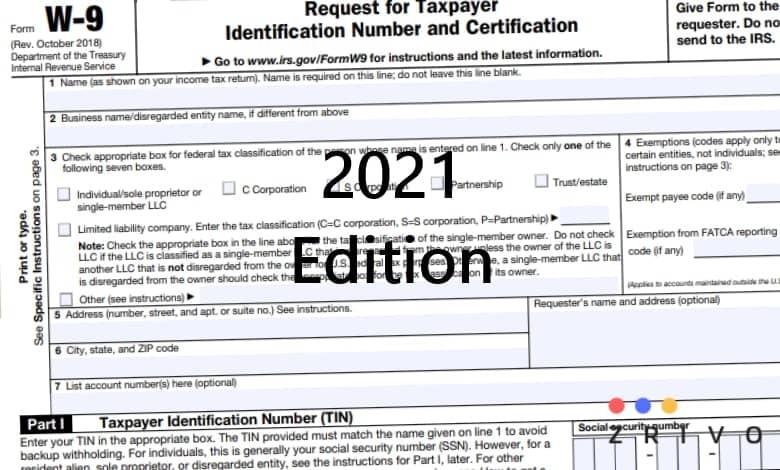

Blank Fillable W 9 Form IRS Form W-9 Request For Taxpayer Identification Number And Certification is a one-page IRS tax legal document that businesses or individuals use to give the accurate taxpayer ID number to consumers individuals banks or financial institutions. Businesses in the United States are instructed by the IRS to request the W-9 be completed by any service provider theyre paying US 600 or more to during the tax year. Companies that pay contract workers or freelancers a minimum of 600 for each work done require a W-9 form.

The Form W-9 you send us simply provides the tax-payer information we will need from you such as social security number to. Does the 600 limit for the W-9 form completion include raw sales amounts or just the profit you get from each sale. If you earn more than 600 you must submit a W-9 Form.

You may send the form to someone in the event that you are independent worker. The form simply reports the amount of income you earned. Form W9 is an Internal Revenue Service form for vendors to fill out and provide to the trades or businesses that pay them.

The IRS requires us to submit a Form 1099 to the IRS whenever your winnings exceed 600 or more in a calendar year. In general W-9s are required only for business-to-business relationships where more than 600 is paid in the calendar year. If you are a contractor consultant or freelancer and you want to get paid more than 600 by one particular client in a tax year then you are required to file Form W-9 so that you can get a Form 1099-MISC.

W-9 forms are for self-employed workers like freelancers independent contractors and consultants. Those who should fill out a W 9 are those who are working as independent contractors or freelancers because the W-9 is the form used by the IRS to help gather information about such workers. Form W-9 ensures that the company will have enough information to make a Form 1099 filing if necessary.

This form is required to report your income to the IRS. Who Has to Fill It Out. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce.

You need to use it if you have earned over 600 in that year without being hired as an employee. Businesses can use Form W-9 to request information from contractors they hire. After they are completed your vendors freelancers and contractors W-9 forms do not expire.

Blank 2022 Printable W 9 IRS Form W-9 Request For Taxpayer Identification Number And Certification is a one-page IRS tax legal document that businesses or individuals use to send out the accurate taxpayer ID number to customers individuals banks or financial institutions. If youre an independent contractor consultant or another type of self-employed worker the company youre providing a service for will ask you to complete Internal Revenue Service IRS Form W-9 if your total compensation for the year will exceed 600The company will use that form to complete its Form 1099-NEC which reports to the IRS the amount of. They will then be.

We never send any of your winnings to the IRS. The company has no way of knowing what the end of the year tally will be. Participating foreign financial institution to report all United States 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

A W-9 form is not required for all business transactions. 1st sale 20 10 shipping profit after merc fees lets say 18 2nd sale 10 10 shipping profit after fees lets say 8. Businesses in the United States are instructed by the IRS to request the W-9 be completed by any service provider theyre paying US 600 or more to during the tax year.

Instead use the appropriate Form W-8 or Form 8233 see Pub. Besides sometimes free W-9 tax form is requested to record other income-generating sources. Companies later fill out IRS information returns Form 1099-MISC and 1099-NEC with amounts of 600 or more that they pay certain types of suppliers during a calendar year a FATCA reporting checkbox and any backup withholding amounts.

To be safe some businesses will send out Form W-9 to every single one of their contractors to fill out ahead of time even if they dont expect them to perform 600 of work for them. If your employer sends you a W-9 instead of a W-4 the company has likely classified you as an independent contractor. First youll need to get tax form W9 downloadable if only your annual revenue from freelance work is at least 600.

Some accountants will even suggest collecting a W-9 before issuing any payments at all to encourage people to file up-front. For example if you go into a store and spend money you dont need to get a W-9 from the store to ensure they are paying their taxes. Selling real estate receiving profit from bonds and so forth.

Do I need to fill out a W 9 form every year.

W 9 Form 2021 Pdf Free W9 Tax Form 2022

W9 Tax Form Sample W9 Tax Form 2022

What Is Irs Form W 9 Turbotax Tax Tips Videos

W 9 Tax Form 2018 2021 Fill Out Online Download Free Pdf

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

What Is A W9 Form How To Fill It Out

What Is A W9 Form How To Fill It Out

2021 Blank W9 Form W9 Tax Form 2022

Irs W9 Form 2021 Printable W9 Form 2021 Printable

Blank W 9 Form Pdf Blank W9 Form 2022

W 9 Vs 1099 Irs Forms Differences And When To Use Them

W 9 Form What Is It And How Do You Fill It Out Smartasset

What Is A W 9 Tax Form H R Block

Post a Comment

Post a Comment