If you are a resident - you should use W-9 form to provide your correct TIN SSN to the requester. Unlike either the form W-4 or W-9 which are provided by US.

What is a W-9 for.

W-9 form vs w-8ben. Which obligates Canadian Financial Institutions to provide this information. The difference between W-8 and W-9 forms lies in the fact that the W-9 tax form is only required to be used by companies or. Sure I can address tax issues here.

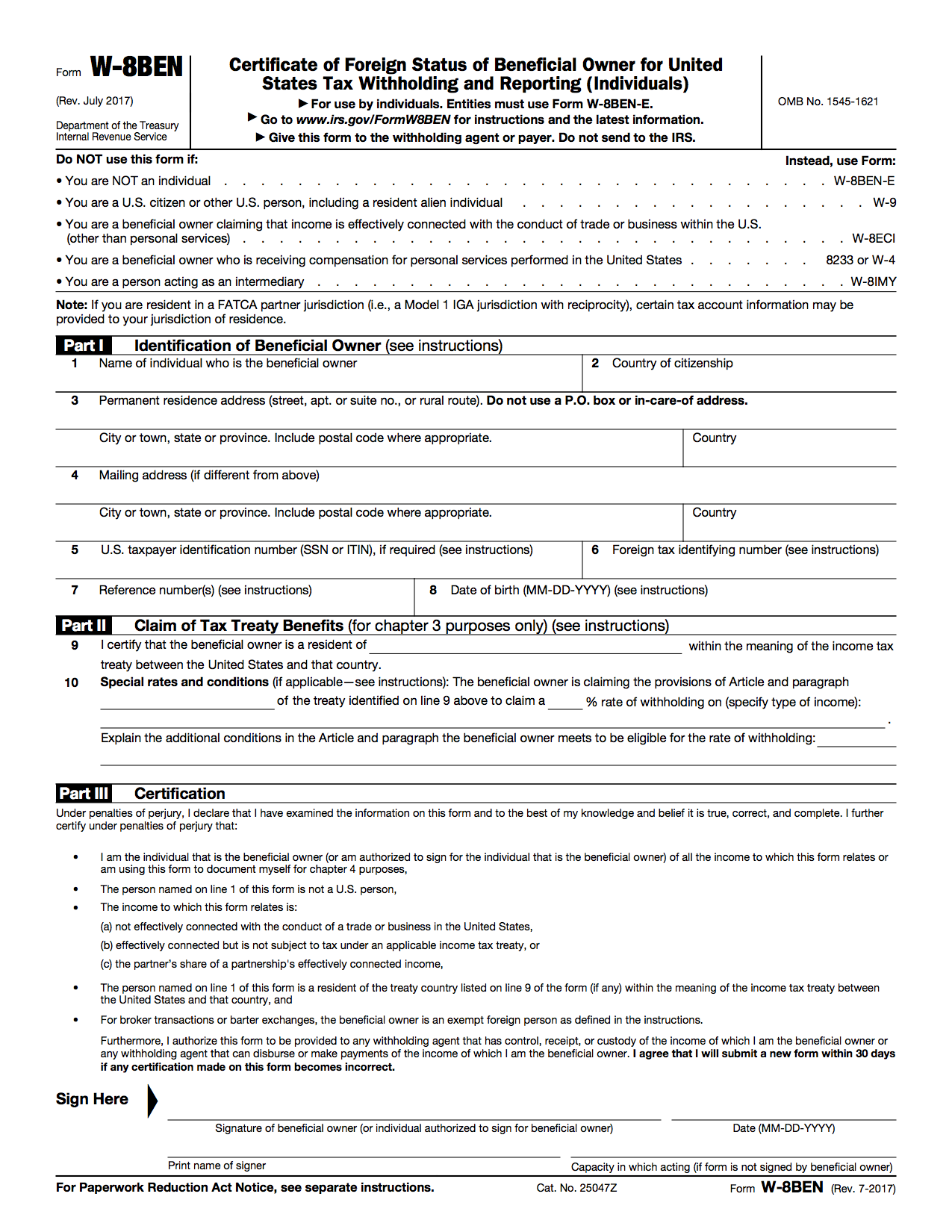

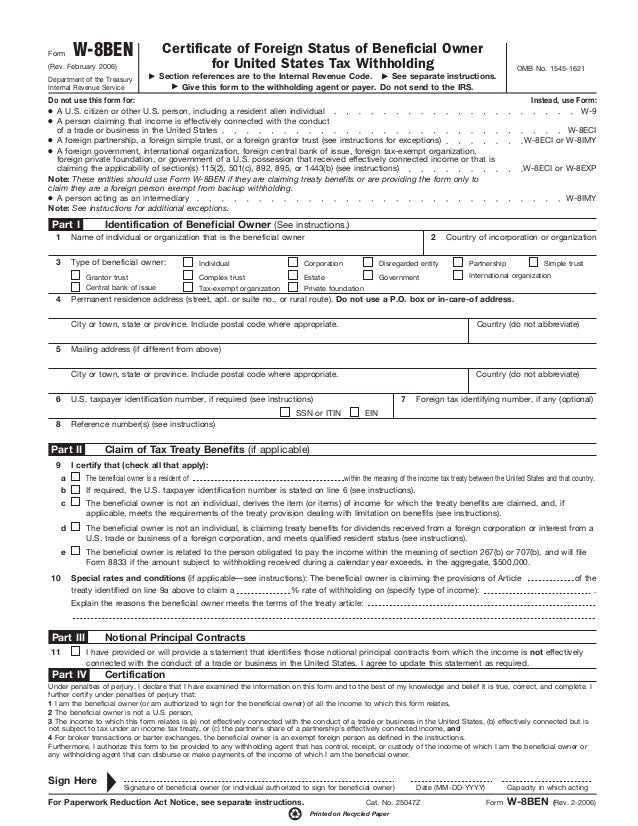

An alien who is a bona fide resident of Puerto Rico Guam the Commonwealth of the Northern Mariana Islands the US. Contrary to the intricacies of W-8 forms W-9 forms are straightforward. A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States.

On the site with all the document click on Begin immediately along with complete for the editor. It is required because of an intergovernmental agreement between Canada and the US. If youre a legal citizen of the United States at no point will you have to worry about filling out the form.

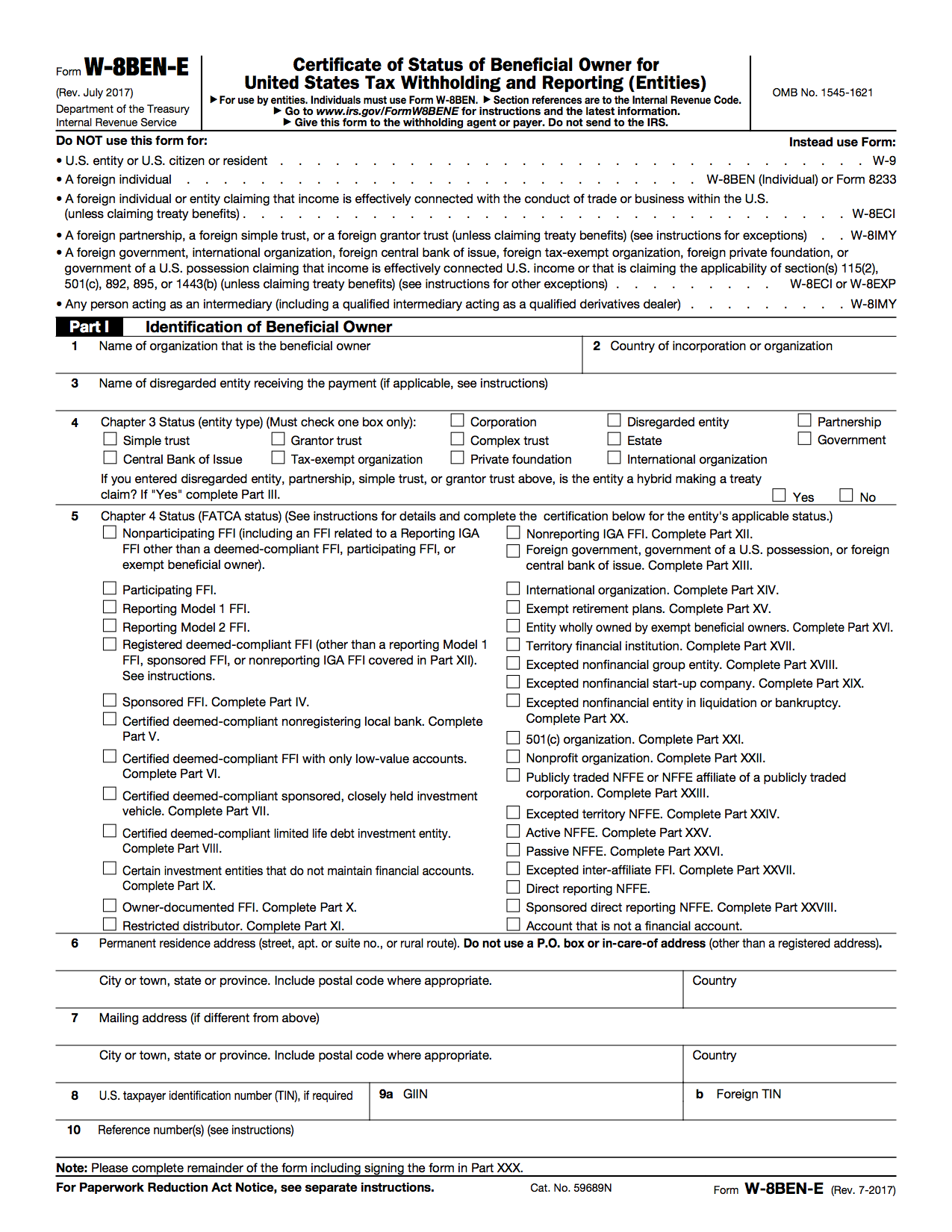

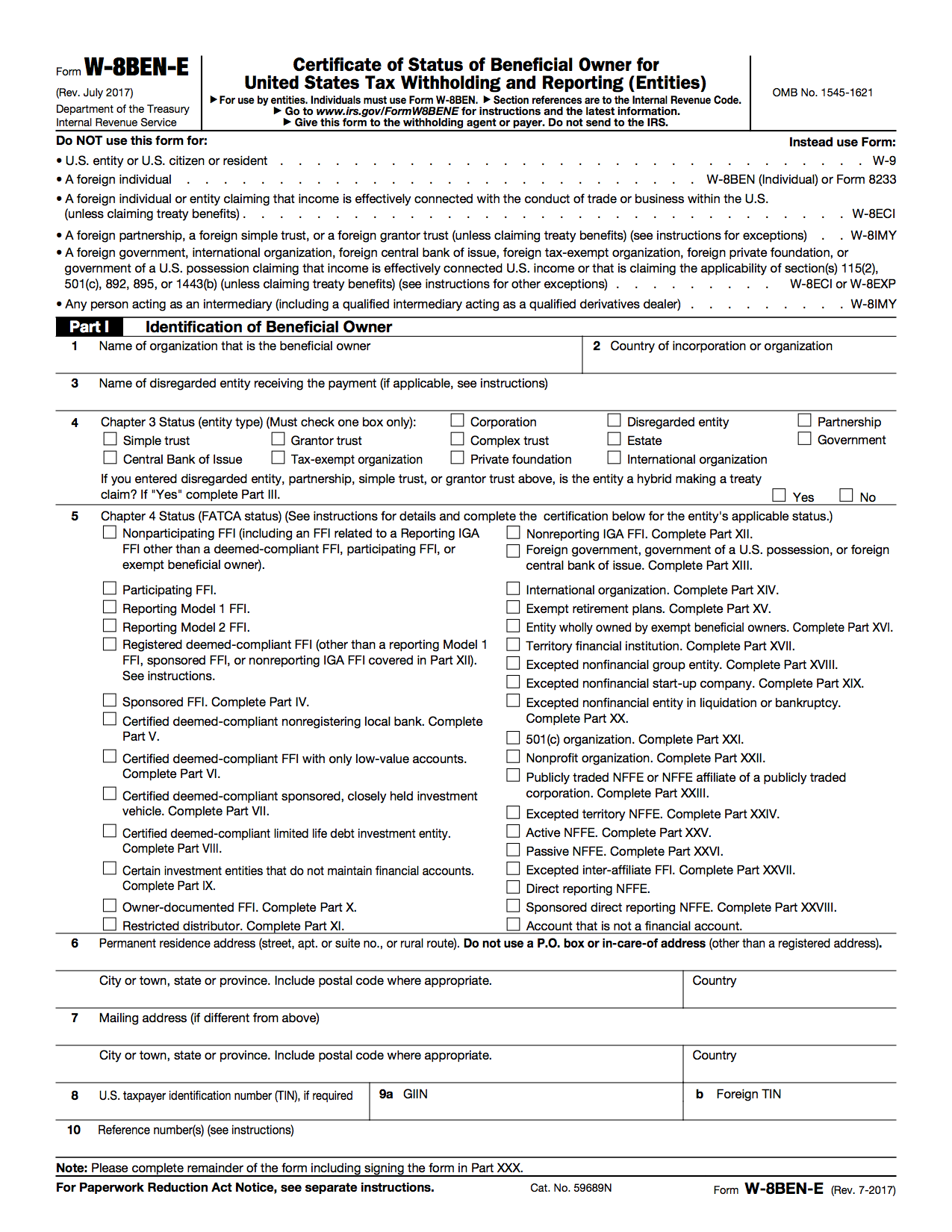

You would use the W-8 Ben for an individual situation. If you and your spouse are still nonresidents for tax purposes then you will provide a W-8BEN to your US employers clients when asked for a information form W-9. Further while form W-8BEN-E is for foreign entities W-8BEN is specifically for individuals.

Make sure that you enter correct details and numbers throughout suitable areas. That the individual is eligible for a reduced rate of tax withholding or is exempt entirely due to an income tax treaty between his home country and the United States. A W-9 form is needed by independent contractors to submit to the IRS in the United States.

Use your indications to submit established track record areas. If you are in the USA then you dont need an ECI because all of your income while you. October 2021 Department of the Treasury Internal Revenue Service Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals For use by individuals.

See The Importance of a Certificate of Loss of Nationality CLN and FATCA Foreign Account Tax Compliance Act. Persons are generally not going to have a US. How to complete any Form W-8ECI online.

Most non-US financial institutions are using the Form W-8BEN to identify and document their non-US account holders. Persons should use Form W-8BEN. Presence test for the calendar year is a resident alien and must submit a Form W-9.

And you would use the W-8 Ben E for a company situation. The W-8BEN tax form serves to. Authenticate that a sole proprietor or individual is a foreigner who is subservient to the 30 tax rate on indigenous income earned by foreign organizations.

Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US. If youre a US citizengreen card holder - you should always fill W9. Let me know if you need any help.

US account holders must fill out Form W-9 certifying that they are US persons and thus indicating their US status to the institution. What is a W-9 tax form. However the W-8 Forms provide the foreign person the ability to enter their foreign TIN.

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the US whereas W-8BEN-E is used by foreign entities who receive this. Please be aware that as a foreign person - you are a subject of 30 income tax withholding on dividends and capital gain unless you timely provide the form W-8BEN. Resident employees or independent contractors form W-8BEN-E is specifically for foreign entities.

Though the actual completion of the form center on how the US international tax provision taxes the foreign person or company o. Or by foreign business entities who make income in the US. Person provides the Form directly to the company that is requesting the information.

Answer 1 of 12. Persons file Forms W-9 W-4 and others. Virgin Islands or American Samoa is a nonresident alien individual that should fill out a W-8BEN not a W-9.

They are used to provide a companys federal Taxpayer Identification Number TIN to an entity that makes taxable payments to said company. There are also other less common versions of W-8s as well for other specific situations. Forms W-8 Series and W-9 IRS Tax Forms in the W-8 Series W-8BEN W-8BEN-E W-8ECI W-8EXP W-8IMY International vendors must submit a US withholding certificate W-8 series of forms with an Employer Identification Number EIN Individual Taxpayer Identification Number ITIN or Social Security Number SSN in order to claim an exemption from or reduction in.

These tax forms are only used by foreign persons or entities certifying their. If you are a Hover customer from the United States and are purchasing domains or email for your company through us your accounting department may have told you that you need a W-8BEN and a W-9 form before you can do business with us. The foreign person does not send the Form W-8BEN or Form W-8BEN-E to the IRS.

US tax residents should fill out a W9. You can get Forms W-7 and SS-4 from the IRS by visiting wwwirsgov or by calling 1-800-TAX-FORM 1-800-829-3676. The main differences between a W-8BEN and W-8BEN-E forms.

Add your own info and speak to data. Non-US tax residents should complete a W-8BEN. Which form you have to complete and upload depends on where you are a tax resident.

If you are non-resident - use the form W-8BEN. Go to wwwirsgovFormW8BEN for instructions and the latest information. The form W-8BEN is for non-US sole proprietors and individuals whereas the form W-8BEN-E is for non-US entities like corporations or organizations.

You might be required to file form W8-ECI instead of W8-BEN depending on circumstances. If you are asked to complete Form W-9 but do not have a TIN write Applied For in the space for the TIN sign and date the form and give it to the requester. IRS Forms W-8 W-9 W-8BEN-E W-7 W-8IMY W-4 W-8ECI W-8EXP are a confusing alphabet soup of IRS forms.

Entities must use Form W-8BEN-E. Non-US organizations should complete a W-8BEN-E. If not you need to consider whether youre considered resident for tax purposes in the US and whether youre going to be present in the US to do the job.

A completed W-8BEN form confirms that. They have become more difficult to understand now because of the intricacies of the law of FATCA.

How To Fill In W 8ben W 8ben E Form Deel

Cara Mengisi Form Tax W 8ben Di Situs Microstock Update 2017 Sangdesstock

Tax Form W8ben University Of Washington

Pin By Fatkul Mubin On News And Story In 2021 Adsense Youtube Info

Easy Way To Fill W 8ben W9 Autofills Blanks E Sign Download Print

How To Fill In W 8ben W 8ben E Form Deel

Canadian Doesn T Need To Provide W 9 To United States W9 Form Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

W 8ben E Form Images Nomor Siapa

Downloadable Invoice Template Word New Ms Word Invoice Template Download Unique Word Invoice Template Free Di 2020

Cara Isi Form Tax W 8ben Di Shutterstock Lagsung Jadi

Post a Comment

Post a Comment