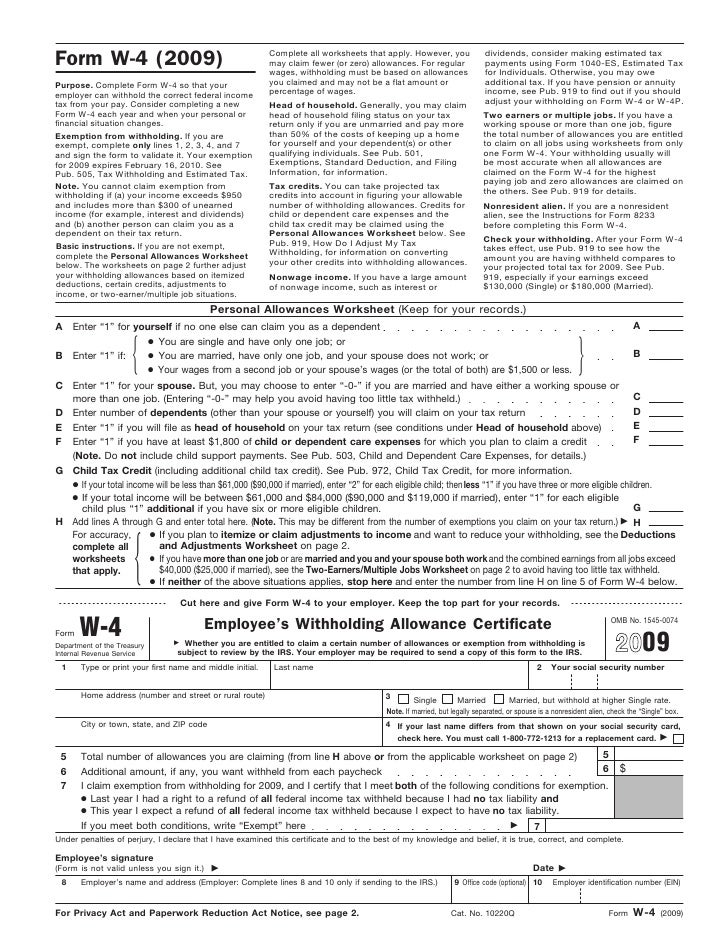

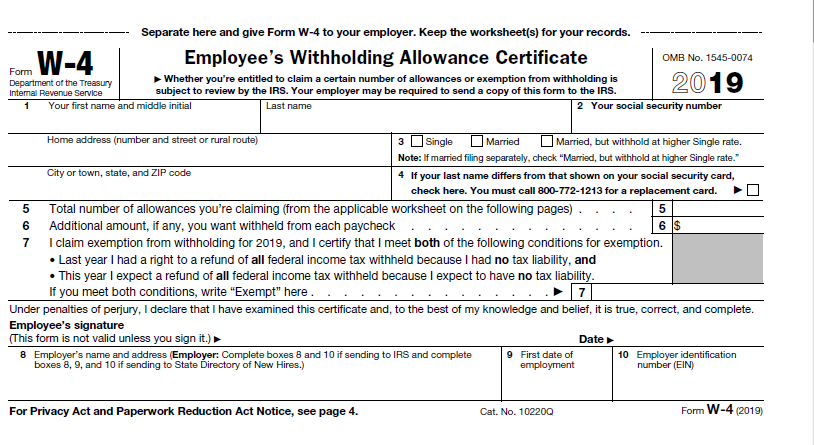

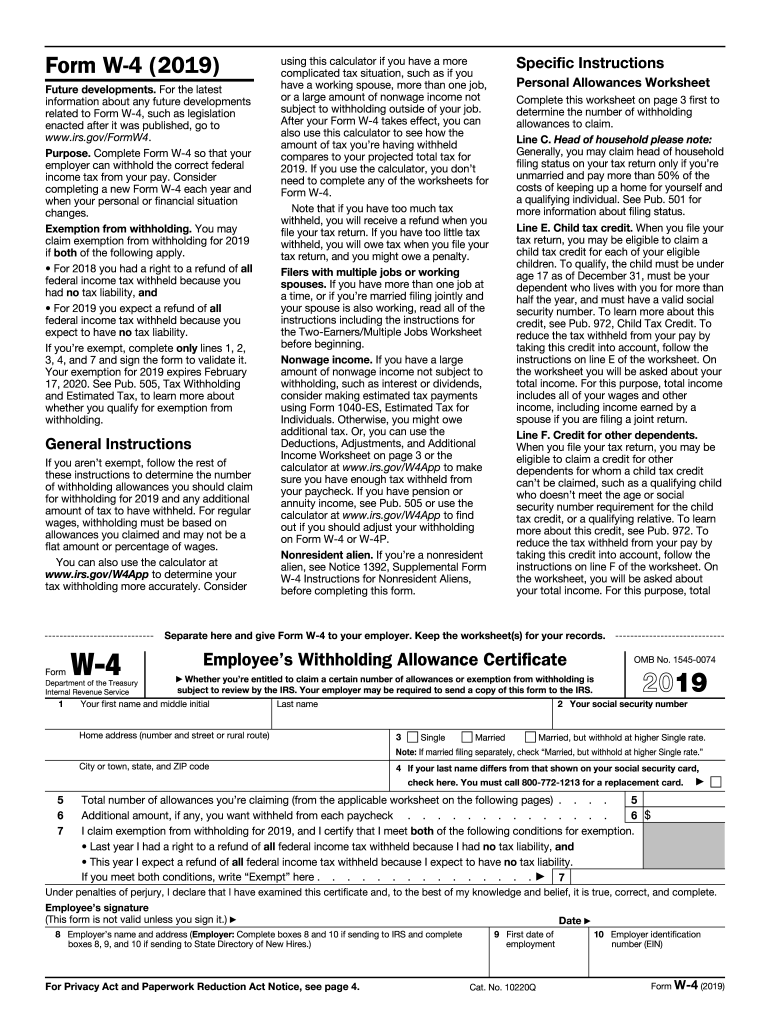

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W-4 and your spouse should enter zero -0- on lines 5 and 6 of his or her Form W-4.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

W4 form california. Forms W-4 filed for all other jobs. While a W4 tax form tells the employer how much money should be set aside for local state and federal taxes the W2 form tells employees how much money they earned taxes to be paid and where other deductions went health insurance union dues Medicaid etc. Youll be asked to fill one out when you start a new job.

Give Form W-4 to your employer. Need to adjust both your federal and state withholding allowances go to the Internal Revenue Service IRS website and get Form W-4 Employees Withholding Allowance Certificate. Your withholding is subject to review by the IRS.

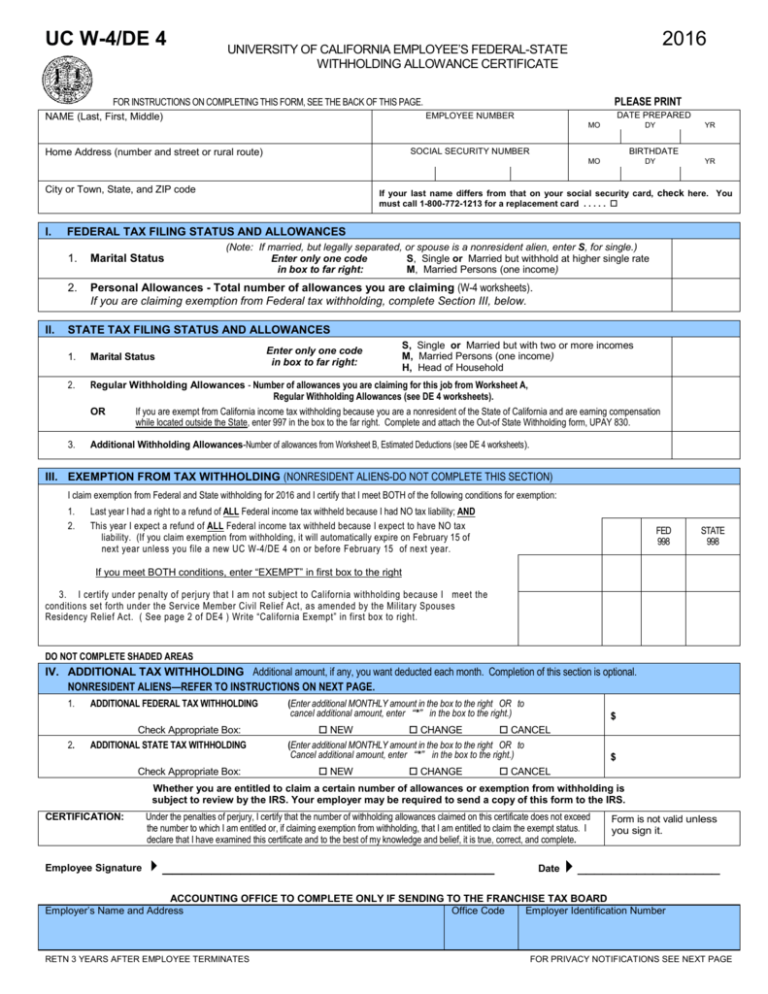

Use our W-4 calculator see how to fill out a 2022 Form W-4 to change withholdings. Form W-4 tells your employer how much tax to withhold from your paycheck. You must file the state form Employees Withholding Allowance Certificate DE 4 to determine the appropriate California Personal Income Tax PIT withholding.

December 2020 Department of the Treasury Internal Revenue Service. Leave those steps blank for the other jobs. Form W-4 otherwise known as the Employees Withholding Allowance Certificate is an Internal Revenue Service IRS tax form completed by an employee in the United States to indicate his or her tax situation exemptions status etc to the employerThe W-4 form tells the employer the correct amount of federal tax to withhold from an employees paycheck.

After you determine the forms needed. Previously an employer could mandate use of state Form DE 4 only when employees wished to. If you or your spouse have self-employment income including as an independent contractor use the estimator.

Complete Steps 34b on Form W-4 for only ONE of these jobs. California employees are now required to submit both a federal Form W-4 Employees Withholding Certificate and state Form DE 4 Employees Withholding Allowance Certificate when beginning new employment or changing their state withholding allowances. Use the calculators to determine the number of.

Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. While both the W4 and W2 are concerned with payroll their roles are completely different. Leave those steps blank for the other jobs.

Complete Steps 34b on Form W-4 for only ONE of these jobs. In addition to the federal income tax withholding form W4 each employee needs to fill out a California State income tax withholding form DE-4. IRS Form W-4 tells your employer how much federal income tax to withhold from your paycheck.

Employees have to fill the form out by themselves each year and let the employer know when the financial situation changes and a new W 4 blank form has to be filled. Employers must request the federal tax form W4 from their employees every year or at the time of hiring a new employee. Your withholding will be most accurate if you complete Steps 34b on the Form W-4 for the highest paying job Step If your income will be 200000 or less 400000 or less if.

To be accurate submit a 2022 Form W-4 for all other jobs. For instance if an employee has a child during the current. This form has essentially the same information on it but makes sure you have the correct notations for looking up how much needs to be withheld from each such as singlemarried with dual.

You can also submit a new W-4 to your HR or payroll department when you have a life event that affects your taxes eg getting married or divorced or having a baby or if you paid too little or too much in taxes. If you do not provide your employer with a withholding certificate. Form W-4 from the Internal Revenue Service IRS will be used for federal income tax withholding only.

Form W 4 Personal Allowances Worksheet

California State Form W 4 Download

Uc W 4 De 4 University Of California Office Of The President

Fill And Sign W4 Form Online For Free Digisigner

W4 Form California Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Meet The New W 4 Form What Employers Need To Know

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

2019 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Post a Comment

Post a Comment