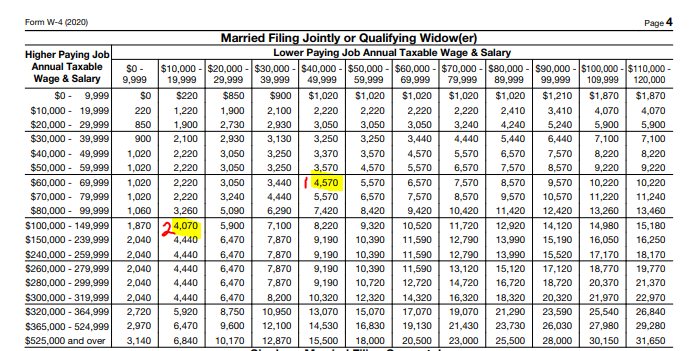

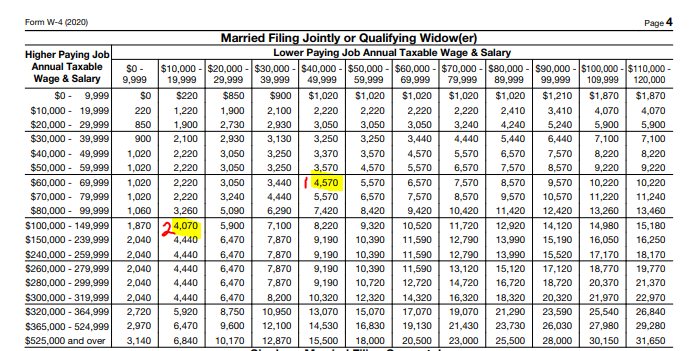

The fewer allowances claimed the larger withholding amount which may result in a refund. If youre filling out a Form W-4 you probably just started a new job.

To avoid any tax penalties you need to fill out this form and submit it to your HR department.

W4 form claim 99. Or maybe you recently got married or had a baby. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for. Can I claim 99 allowances.

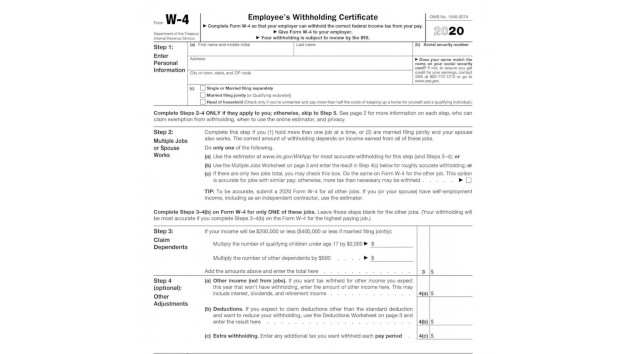

Just like the 2019 W4 form the new W4 form should be completed by all employees new and existing who wish to update their withholding. However - as I mentioned above - if the payment you are concern about is a bonus or other supplemental wages - W4 form will not affect your withholding on that payment. 2020 W-4 Sample - Claiming Exemptpdf.

The form asks for your Social Security number occupation and other information. Should I claim 1 or 0 on my W 4 tax form. To qualify for 99 allowances - you should have allowable deductions on 370099366300 And yes - you may change W4 form after one payment by submitting another W4 form.

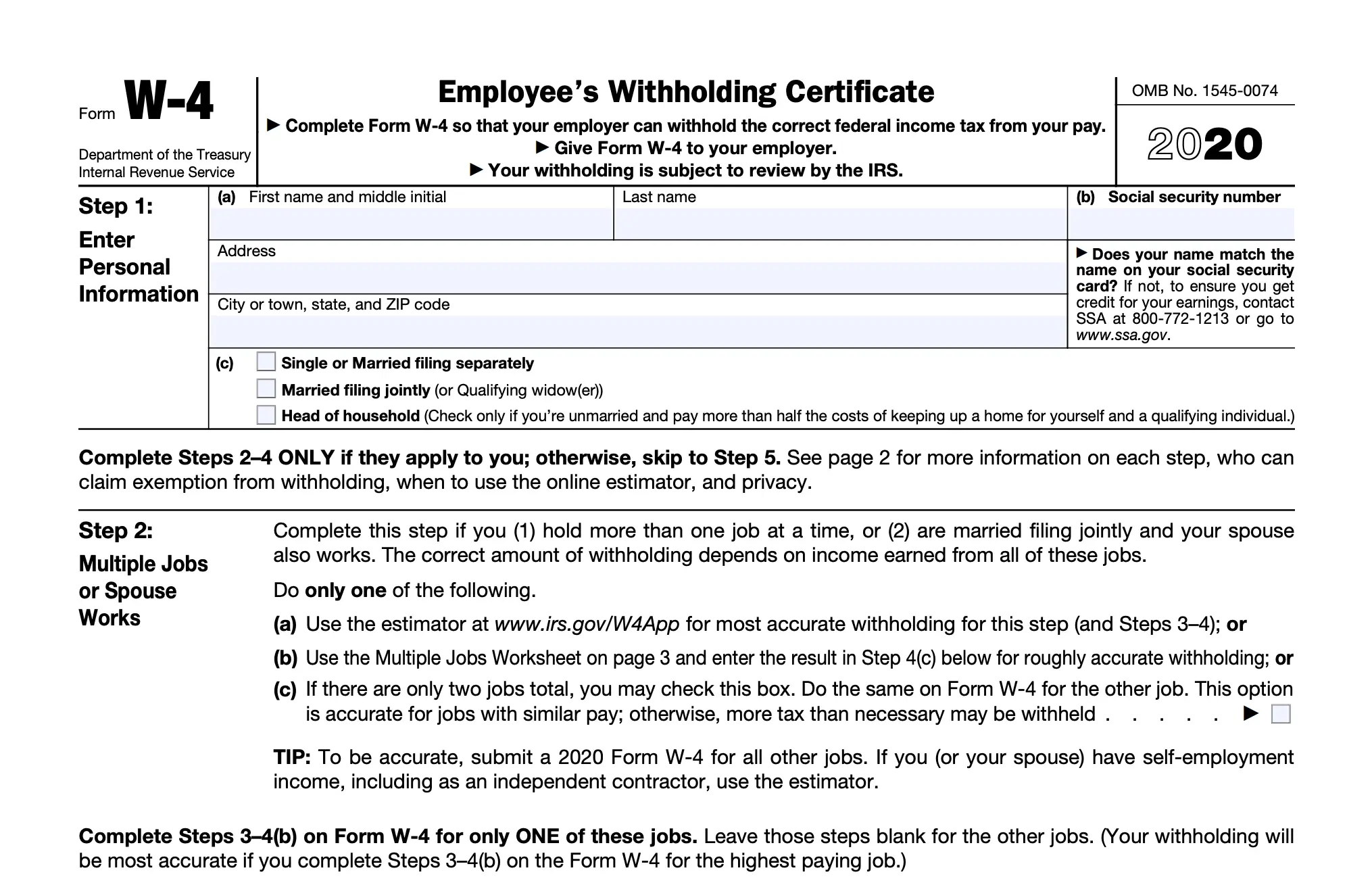

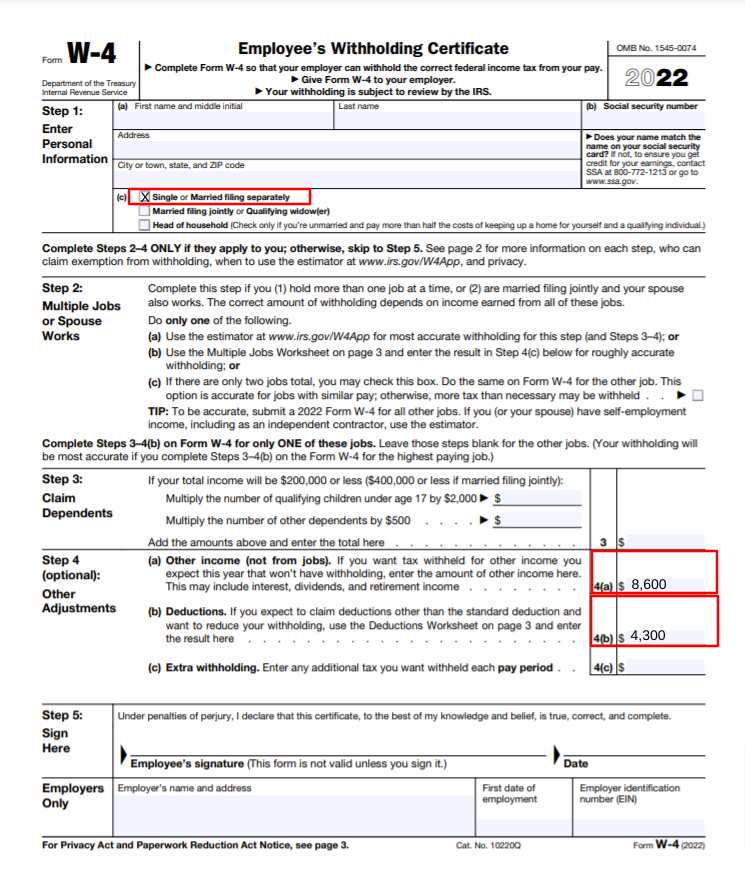

Your withholding is subject to review by the IRS. The form was redesigned for 2020 which is why it looks different if youve filled one out before then. If you are an exempt employee the IRS requires that you claim your exemption on your W-4 form.

The form makes sure your employer can withhold the correct amount of federal income tax from your pay. Generally the more allowances you claim the less tax will be withheld from each paycheck. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck.

The 2021 W4 Form needs to be filled out by all new employees and existing employees who want to update their withholding. Give Form W-4 to your employer. And less withholding from where.

If you are happy with your withholding and you already submitted a W4 to your employer during a previous year you do. This new rule applies whether you claim 1 or 0 on a W-4 form or anything in-between. This sample document provides instructions on how to complete 2020 W-4 federal tax withholding certificate if an employee has evaluated their tax situation and determined that claiming exempt is appropriate for their situation.

How to Claim Exempt. They almost certainly wont do that. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for.

If you do not have such deductions - you should not claim 99 allowances on your W-4 form - but the number of allowances should correspond with your expected deductions. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for. You technically can claim 99 allowances BUT you definitely shouldnt.

The fewer allowances claimed the larger withholding amount which may result in a refund. What is W4 form and why was it redesigned. But you claim 9 on your W4.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. The W4 W-4 form also called the Employees Withholding Allowance Certificate is a form that your employer uses to make sure that they are withholding the correct amount of taxes from your paycheck. You can also use the online version of the W-4 to fill out this form.

Employers use the W-4 to calculate. The W4 form no longer asks about allowances. You might be wondering what it means to claim a 0 or 1 on a W-4 but its important to note that in 2021 you dont use the W-4 form to claim withholding allowances.

The IRS wont know how many dependents you claim on your W4 unless they request it from your employer. Thats because you bought a great big house with a fat mortgage with a lot of interest expense. History of W-4 Before 2021.

Claim 99 or exempt and change it back after and youll be fine. Regular salary Yes - the W-4 form affect withholding from your regular wages - not supplemental wages. Generally the more allowances you claim the less tax will be withheld from each paycheck.

Issued by the Internal Revenue Service Form W-4 includes three types of information your employer will use to determine your withholding. December 2020 Department of the Treasury Internal Revenue Service. The W4 ensures your employer can withhold the right amount of.

Generally the more allowances you claim the less tax will be withheld from each paycheck. The fewer allowances claimed the larger withholding amount which may result in a refund. The fewer allowances claimed the larger withholding amount which may result in a refund.

It has changed. Your withholding is subject to review by the IRS. A W-4 form formally titled Employees Withholding Certificate is an IRS form employees use to tell employers how much tax to withhold from each paycheck.

How many withholding allowances you claim each allowance reduces the amount withheld Whether you want an additional amount withheld. Youre probably wondering why your employer or anyone would want to do this at all. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for.

How many allowances to claim on Form W-4. Whether to withhold at the single rate or at the lower married rate. Enter Personal Information a.

When you file your return you still get a refund because of all that interest but not because of another 5 kids. Generally the more allowances you claim the less tax will be withheld from each paycheck. One may claim exempt from 2020 federal tax.

According to the IRS 10 million people underpaid their taxes in 2015 and ended up having to pay a hefty fine they have to pay what they owed plus interest and a fine. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. This post will explore what the 2020 W4 form is and how to fill it correctly.

Give Form W-4 to your employer.

Answers To Common Irs W 4 Form Questions

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

Should I Claim 99 Deductions Youtube

Can Someone Claim 99 Exemptions On Your W 4 Quora

2021 W4 Form How To Fill Out A W4 What You Need To Know

2022 New W 4 Form No Allowances Plus Computational Bridge

What Is A W4 Form And How Does It Work Form W 4 For Employers

Form W 4 2012 Tax Forms Fillable Forms How To Get Money

Everything You Need To Know About The New W 4 Tax Form Mycentraloregon Com

Unf Controller Mywings W4 Tax Form

2021 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

Everything You Need To Know About The New W 4 Tax Formmyclallamcounty Com Myclallamcounty Com

Post a Comment

Post a Comment